While the illustrious bitcoin ascends to celestial heights, the public, it seems, remains curiously indifferent, as Google Trends would have us believe.

$119K Bitcoin and a Yawn—What’s the Matter with the Masses?

On a fine Sunday, bitcoin (BTC), the darling of the crypto world, soared to the dizzying heights of $119,000, reaching a new all-time high of $119,444 on the esteemed Bitstamp exchange. Throughout the week, BTC has continued its meteoric rise, breaking through the $112,000 barrier and climbing ever higher. Yet, despite this spectacular performance, the public’s curiosity, as measured by Google search activity, remains as tepid as a lukewarm cup of tea.

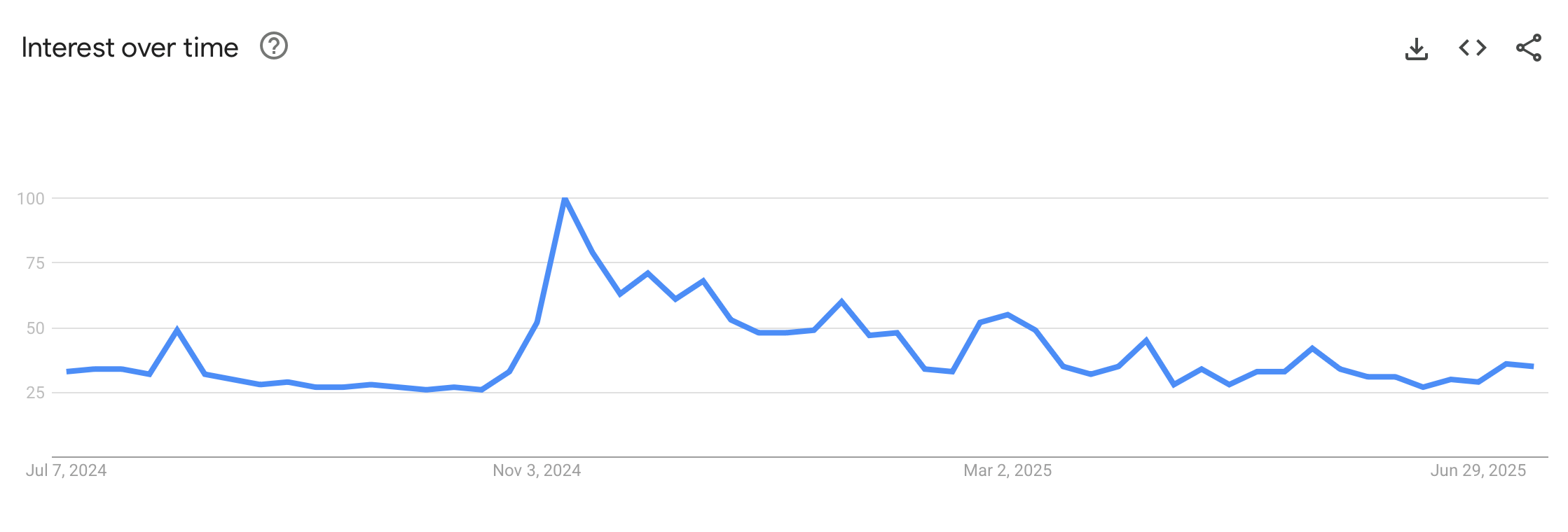

Google Trends, the oracle of public interest, paints a rather chilly picture. When one examines the keyword “bitcoin” over the past five years, the search term scores a mere 24 out of 100. A score of 100, you see, signifies the zenith of popularity, a moment when the world was utterly captivated. For “bitcoin,” that moment of glory was in May 2021. Over the past 12 months, the query registers a modest 35 out of 100, suggesting that the public’s interest, while growing, is doing so at a pace that would make a tortoise blush.

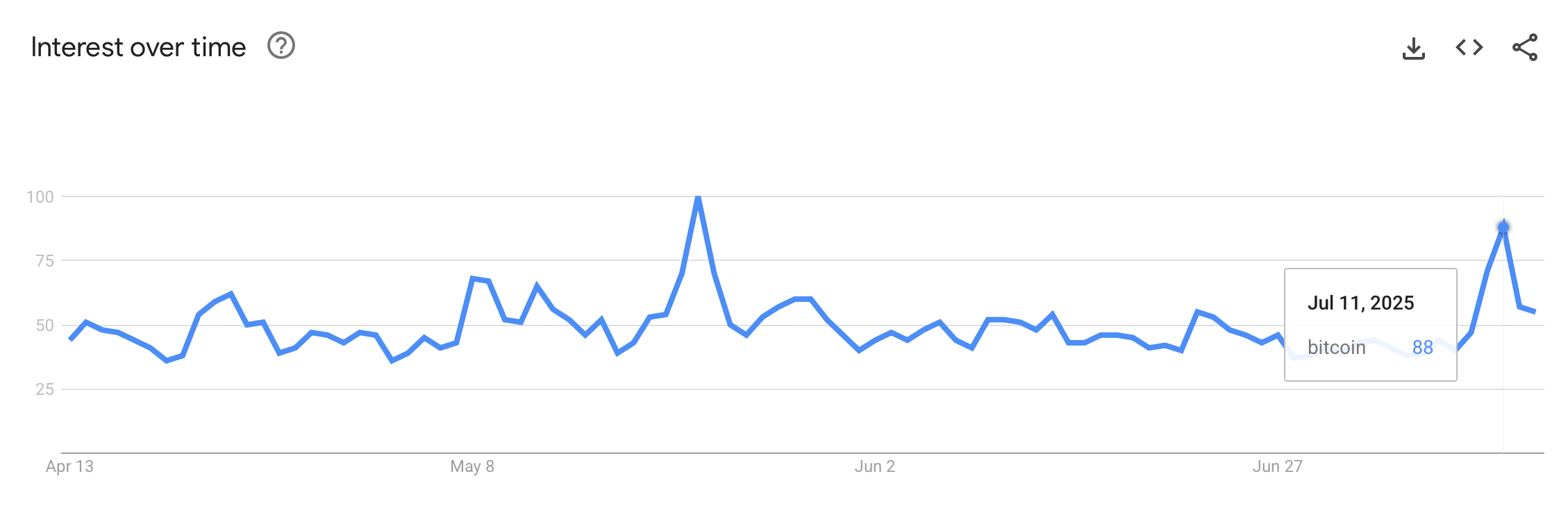

However, as we narrow our gaze to the 90-day span, a glimmer of hope emerges. Interest in bitcoin climbed to 88 on July 11, 2025, with the most recent peak of 100 occurring on May 22, 2025. As of today, July 13, the score has cooled to 55 out of 100. The countries showing the most enthusiasm for bitcoin are El Salvador, Switzerland, Nigeria, Austria, and the Netherlands. A veritable parade of nations, each with its own unique reasons for embracing the digital currency.

Some speculate that bitcoin’s astronomical price tag may be deterring potential newcomers. With headlines trumpeting six-figure valuations, it’s easy to understand why many might feel they’ve missed the boat or that owning bitcoin requires a fortune. The sticker shock alone could explain the lackluster search interest, despite the asset’s explosive price action.

But fear not, dear reader, for this perception is as misguided as a donkey in a ballet. Bitcoin is divisible down to eight decimal places, meaning one can purchase a fraction of a coin without breaking the bank. This divisibility allows anyone, from the humblest peasant to the wealthiest noble, to partake in the grand experiment of decentralized finance. Bitcoin is not just for the whales; it’s for anyone seeking an alternative to the traditional financial (TradFi) systems and a hedge against the erosion of fiat currency.

Bitcoin’s price may be rewriting the record books, but the relatively muted search data suggests a market moving with a more measured, if not more sophisticated, conviction. Whether this signals a shift toward broader adoption or simply a quieter phase in bitcoin’s evolution, only time will tell. For now, it seems that price alone is no longer the sole driver of public interest. 🤔

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- EUR NZD PREDICTION

- USD THB PREDICTION

- Memecoins Mania: How Traders Are Betting on Rate Cuts and Altcoin ETFs!

- SEC Throws Open the Crypto ETF Gates-Finally, No More Waiting Forever!

- The Great Bitcoin Revival: How $108K Became the New $0

- Fed’s $55B Injection: Will XRP Hit $3? 🚀

2025-07-13 23:57