Ah, Bitcoin-the digital darling of the modern age, where bulls and bears wrestle like cats in a yarn shop. Right now, it’s stuck between bullish dreams of reclaiming $115K and bearish nightmares trying to shove it below $110K. The poor coin is as indecisive as a tourist at a buffet line, unsure whether to pile on the optimism or the pessimism. And lo, here comes the US Federal Reserve meeting, armed with potential interest rate cuts that could either flood the market with liquidity or leave Bitcoin gasping for air like a goldfish out of water. 🎢💰

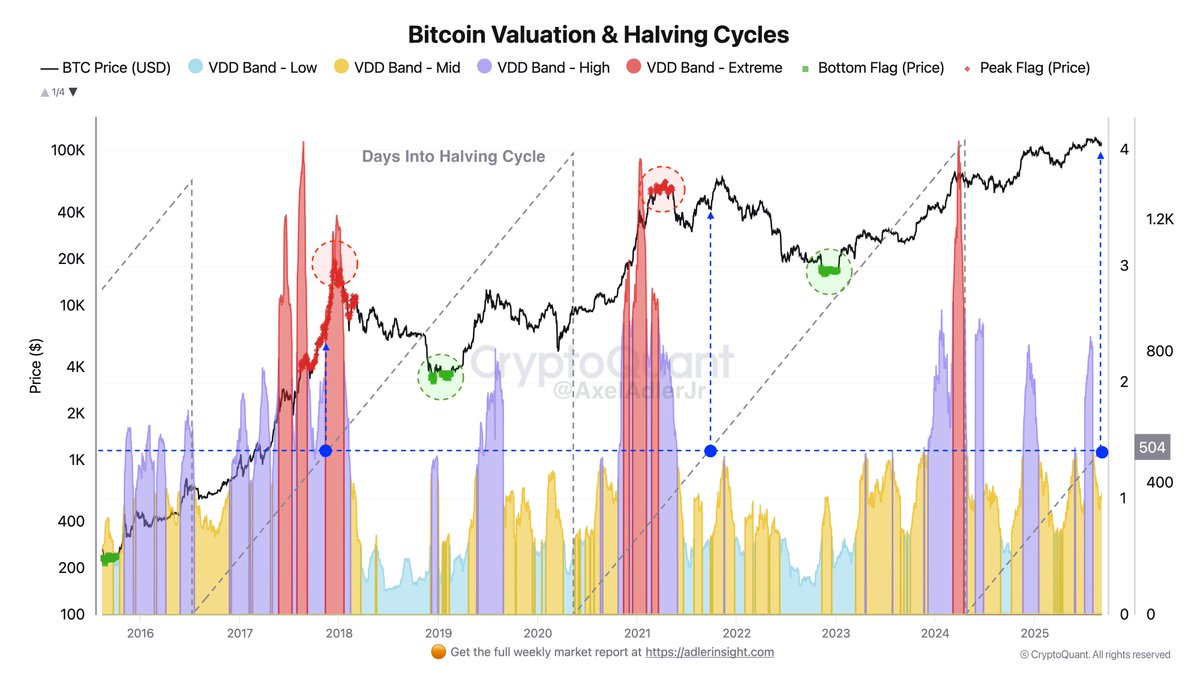

Enter Axel Adler, top analyst extraordinaire (or so his business card claims), who informs us that we’re smack-dab in Day 504 post-halving-a milestone he says signals a “mature phase” of this bull run. Mature? Sounds more like Bitcoin has hit middle age and started Googling “how to lose volatility fast.” Adler compares this cycle to its predecessors and notes that late-cycle behavior is rearing its head: heightened volatility, profit-taking, and-wait for it-institutional demand keeping things afloat. Institutions buying crypto? Who’d have thought they’d trade their cufflinks for blockchain ledgers? 🤵♂️📈

Redistribution Patterns That Make Sense? Say It Ain’t So!

Now, let me tell you about Value Days Destroyed (VDD), because nothing screams excitement like financial jargon. Back in March, when BTC flirted with $70,000, VDD spiked higher than a cat startled by cucumbers. Long-term holders were cashing out faster than a teenager spending allowance money. But then came two smaller waves near $98,000 and $117,000, proving that even millionaires can learn portion control. These batched sell-offs suggest something rare in crypto: sustainability. Imagine that-a bull market without everyone losing their shirts in one big panic sale. Institutional buyers are swooping in like bargain hunters at a Black Friday sale, absorbing supply and stretching the cycle longer than my patience during family dinners. 🛒📉

But hold your horses-or rather, hold your Bitcoins-for the grand finale isn’t written yet. Analysts await the elusive Peak Flag, a signal triggered when spot prices soar 11 times above the long-term holder realized price. If history repeats itself (and when does it not?), October-November 2025 might just be the stage for this dramatic climax. Of course, only time will tell if the stars align-or if Bitcoin trips over its shoelaces first. 🌟📉

BTC Plays Tug-of-War with Resistance

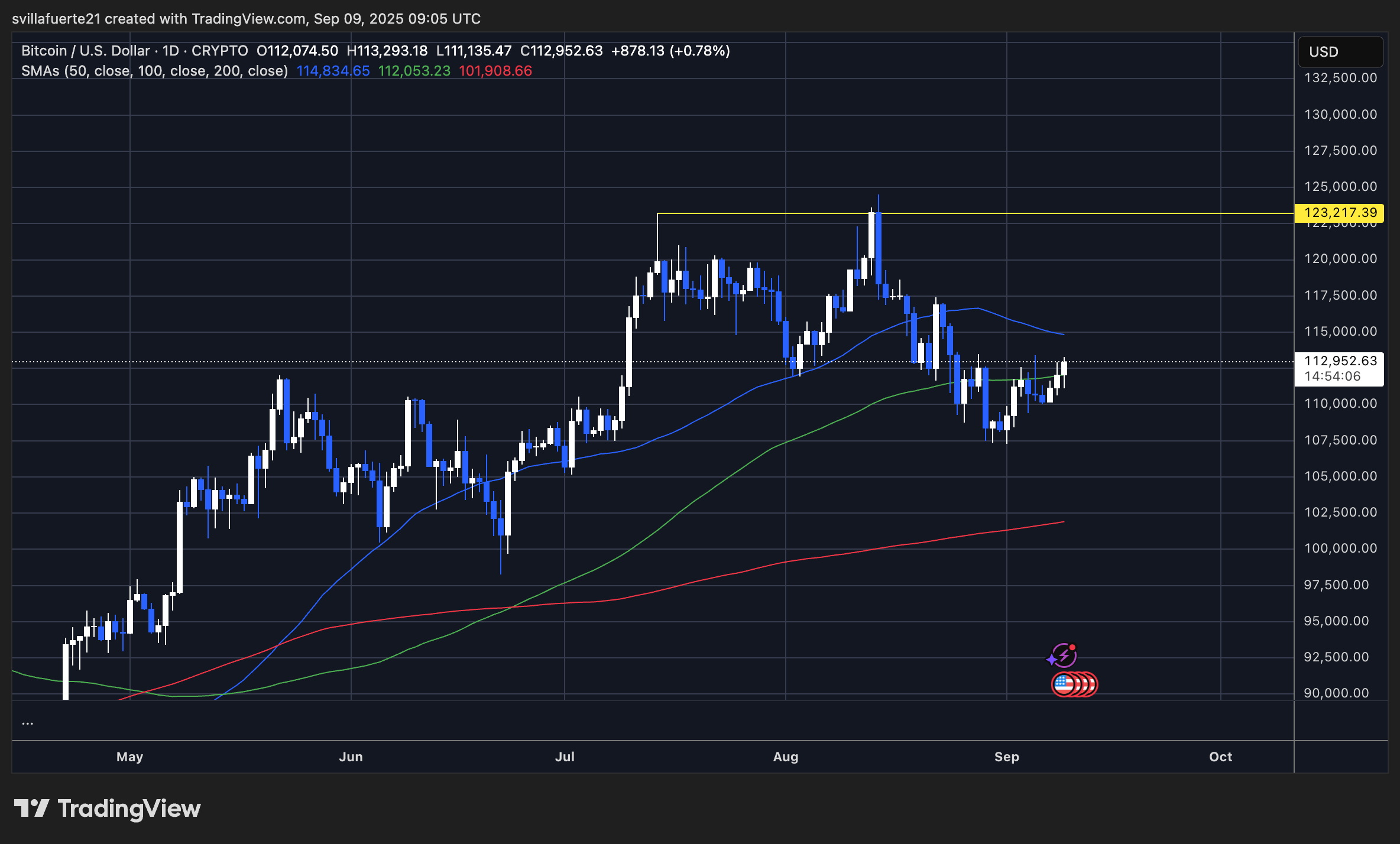

As I write this, Bitcoin sits pretty at $112,952, clinging to life above the $110K support zone like a kid refusing to let go of their favorite blanket. Bulls are trying to rally, but resistance lurks menacingly around $114K, guarded by the dreaded 100-day moving average. Break through that barrier, and maybe-just maybe-we’ll see some upward momentum. Fail, and well… choppy waters lie ahead. 🏴☠️🌊

The 50-day moving average? Oh, it’s playing hard to get, trending downward and acting as dynamic resistance. Meanwhile, the 200-day moving average hovers protectively around $101,900, ready to catch BTC if it takes a tumble. For now, BTC forms a short-term higher low, suggesting stabilization. But unless bulls push past $114K-$115K soon, Bitcoin risks slipping back into the same old sideways shuffle that makes traders pull their hair out. Volume confirmation on breakouts? Critical. Without it, we’re all just whistling in the dark. 🕵️♂️📉

In conclusion, dear reader, Bitcoin remains a rollercoaster ride wrapped in mystery, tied up with hope-and occasionally sprinkled with despair. Will it soar? Will it crash? Only time, and perhaps a few institutional whales, will decide. Until then, buckle up and enjoy the show! 🎢✨

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- USD CNY PREDICTION

- Brent Oil Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Dostoevsky Discovers Google: Crypto Wallets Face Absurd Bureaucratic Fate 😱

- Bitcoin’s Christmas Miracle? Analysts Bet Big Bucks Amid Crypto Chaos 🎅💰

- Bitcoin’s Big Breakout: Fed Cuts, Crypto Cash, and a Million BTC Heist 🚀

2025-09-09 14:13