Macro Moves – Central banks whispering sweet nothings or maybe lowering rates. Risk assets like Bitcoin? They love that. That’s how we get to the moon, apparently.

Big Players – Whales throwing money into ETFs or just flaunting their holdings. Because nothing says “bull market” like a big fish swimming around.

Government Stuff – Friendly regulations or some positive rulings. Basically, if the government plays nice, Bitcoin might just do the happy dance.

Crypto Analyst Supports the Hype

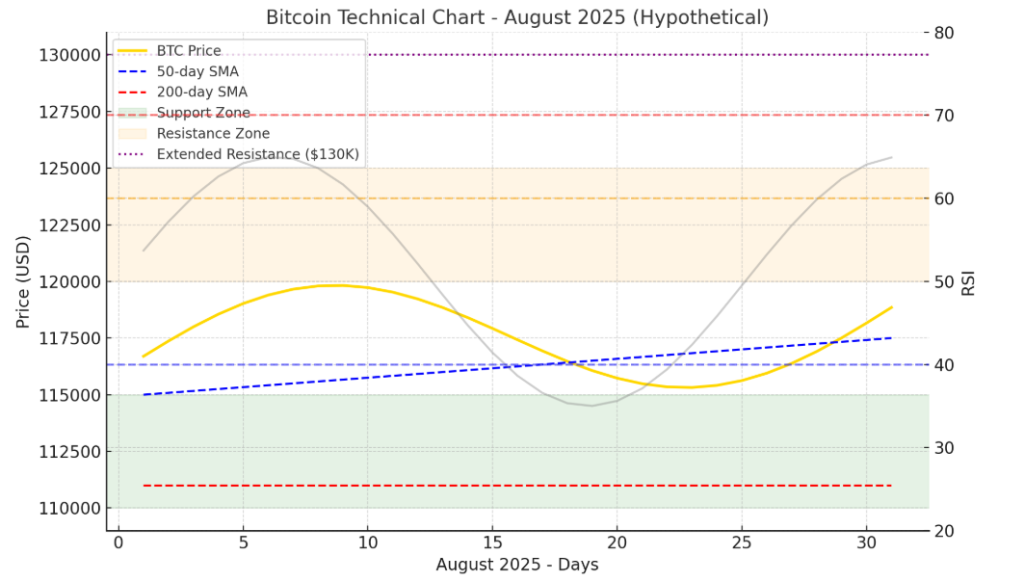

This Crypto Jelle guy (because obviously he’s the hero here) says Bitcoin’s crawling toward a “liquidation cluster” around $120K. Sounds fancy, right? Basically, it’s a trap for short sellers-when the price hits, they get squeezed, and the buying frenzy kicks in.

And if it breaks that resistance? Then it’s a straight shot to $130K. Easy as pie. Or so they say.

What if it all Falls Apart?

Seasonality. The thing no one really cares about until it hits. Historically, eight out of twelve Augusts end in the red (no surprise there). Average gain? A tiny 1.68%. Basically, Bitcoin’s summer fling usually ends in heartbreak.

If it can’t hold $115K, though, it could slip back to $110K. Nothing fun about that.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Binance’s USDT Gold Rush: When Crypto Meets TradFi’s Worst Nightmare 🚀

- USD IDR PREDICTION

- CNY RUB PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Dogecoin’s Dramatic Dance: Surges, Secrets & a Fed-Fueled Frenzy! 🚀🐶

- Wyoming’s Wild Crypto Ride: Stablecoins, Solana & School Funds! 🚀

- Zcash Plummets: ECC Splits, Bears Feast, and $300 Looms 🤑💥

2025-08-08 16:30