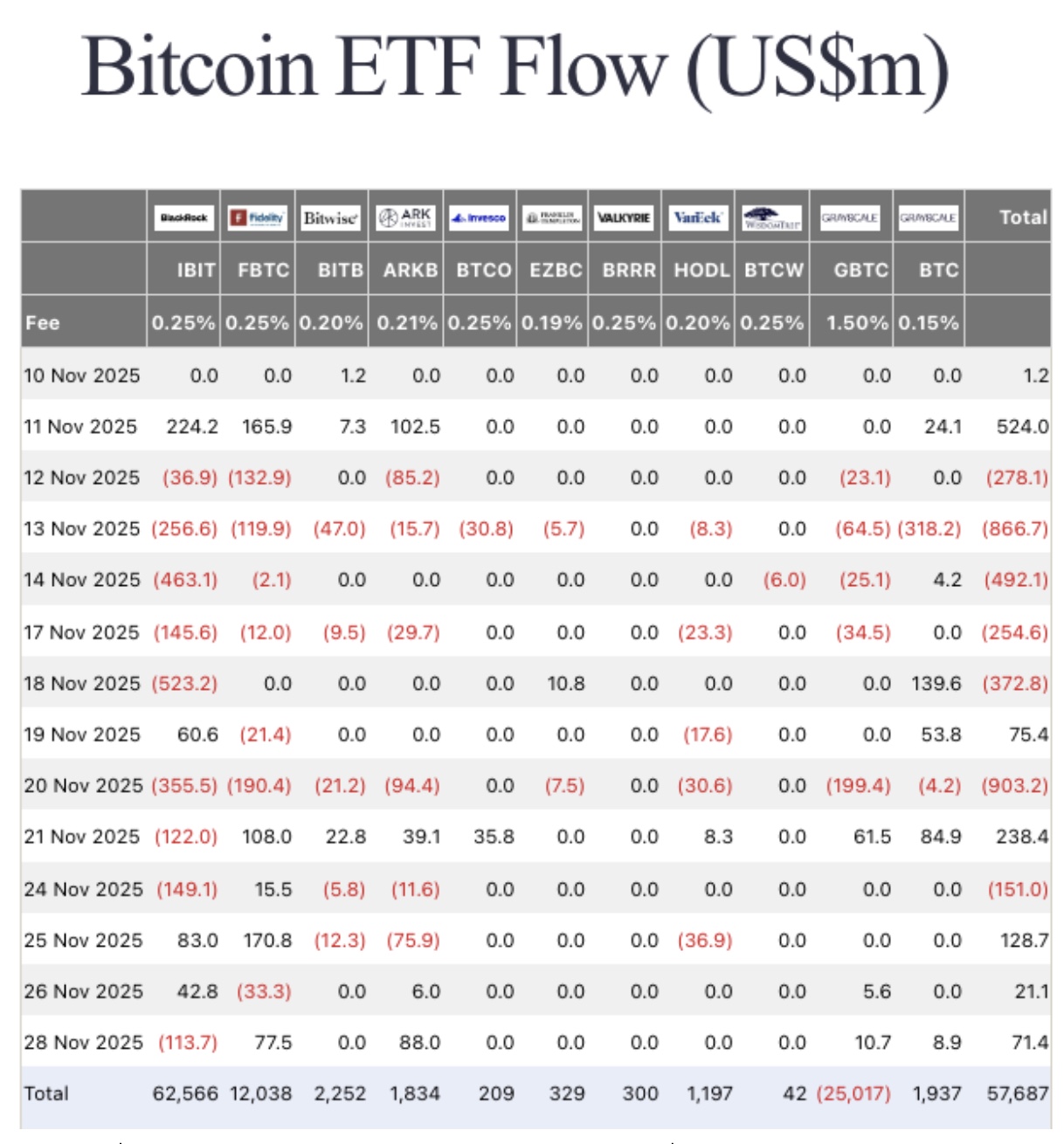

Ah, the capricious Bitcoin, that digital chimera, has once again performed its tiresome ballet, rebounding a staggering 17% from its pitiable lows near $82,000 on November 21 to a fleeting graze of $93,000 on November 28. 🕺💸 The Bitcoin ETFs, those modern-day sirens, lured in a combined $221 million in net inflows between Nov. 25 and Nov. 28. Yet, despite this modest triumph, the wretched BTC could not breach the $95,000 resistance, a barrier as impenetrable as a socialite’s disdain. 😒

BlackRock, that leviathan of finance, spewed forth $117 million in outflows on Friday, a spectacle as jarring as a debutante at a punk rock concert. 🎩💨 Despite the net inflows, one cannot help but marvel at such audacity. | Source: FarsideInvestors

BlackRock’s exodus, a sum of $117 million, stands as a beacon of institutional whimsy. As the world’s largest asset manager, its every move is watched with the fervor of a society matron at a scandal. 🕵️♂️

Strategy Inc.’s Bitcoin purchases, or rather, the lack thereof, paint a picture of caution so profound it borders on the absurd. 🎭 From August 11 to November 17, 2025, the Michael Saylor-led firm acquired 8,178 BTC for $836 million, a spree now halted with all the drama of a canceled season finale. | Source: Bitbo.io

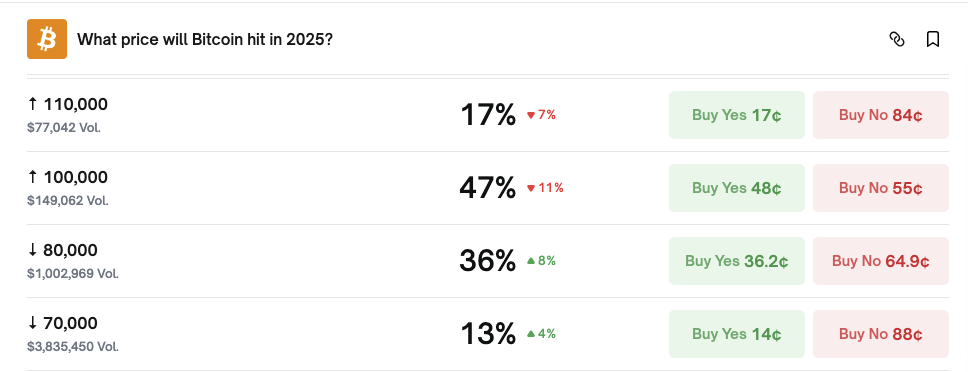

The prediction markets, those oracles of modern finance, have turned their fickle gaze upon Kalshi, now embroiled in a lawsuit as tawdry as a country house weekend. 😱 Traders, with all the optimism of a Waugh protagonist, are pricing lower odds of Bitcoin reclaiming $100,000 by year’s end, leaning instead toward a close below $80,000. How delightfully bleak. 🌧️

Kalshi’s odds on Bitcoin hitting $100,000 dropped 11%, a decline as precipitous as a fallen aristocrat’s fortunes. Meanwhile, the odds of a $110,000 breakout sank 7% to a mere 45%. How quaint. | Kalshi

Bitcoin’s technicals, those arcane scribbles, suggest a structure as fragile as a socialite’s ego. Pinned at $92,971, the BTCUSD chart reveals a Keltner Channel mid-band compression, a prelude to a breakout as inevitable as a scandal in high society. 📉

Momentum signals, those fickle harbingers, are improving but remain unconfirmed. The MACD line, that darling of technicians, has crossed into positive territory for the first time since early November, a bullish whisper in a sea of doubt. The Woodies CCI, another technical trinket, has reclaimed the 0-line, indicating renewed buyer participation. How charming. 🎢

A decisive close above $95,000 would re-establish bullish dominance, a triumph as fleeting as a summer romance. Yet, should BTC fail to hold $90,000, liquidation looms like a vengeful ex-lover. | Source: TradingView

In this farce of finance, one can only marvel at the absurdity. Will Bitcoin breach $100,000, or will it collapse in a heap of digital despair? Only time, that implacable judge, will tell. 🕰️💔

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD ILS PREDICTION

- Brent Oil Forecast

- USD THB PREDICTION

- Solana Staking Soars! Is $60 Billion the Secret Sauce for Success?

- Why Coinbase’s ‘Super App’ Might Be a Dud (But Buy $BEST Anyway!) 🤷♂️

- Silent Whales: Bitcoin’s Shadow War on Binance

- Dash Crypto Implodes: Will It Crash Like a Mel Brooks Movie?

- EUR NZD PREDICTION

2025-11-29 23:59