Ah, Bitcoin-ever the perfect Roman candle, flickering uncertainly just above the modest ambition of eighty thousand dollars. Though it serenades us with hopeful rebounds from the depths of sub-$85K despair, the grand spectacle remains enthrallingly cautious, as if even the cryptocurrency gods are sipping afternoon tea, pondering whether to ascend or descend into legend-or merely to appease their own boredom.

BTC Technical Analysis

By Shayan

The Daily Chart

On the daily canvas, our dear Bitcoin is caught in a melodramatic ballet within a descending channel-an elegant dance of peaks and valleys that has persisted for months. The recent flirtation with $81K support is less a breakout and more a jest, with each upward step nimbly halted at around $95K-just shy of the lofty battlements and bearish order block that loom like the curtain on a tragic comedy.

It lounges below both the 100-day and 200-day moving averages, these cunning curves pointing impatiently downward at approximately $107K. The market’s sentiment? Still whispering, “Maybe, darling, maybe,” unless someone dares a bold daily close above $96K-then, perhaps, we’d have an act worth applauding, or at least a nod of neutral suspicion.

The 4-Hour Chart

Shift focus to the 4-hour tableau, where Bitcoin is unwittingly staging an ascending triangle-a romantic yet possibly fleeting structure between $80K and $95K. Nearly always, these structures resolve with a flourish upward, but only if volume and momentum decide to attend the ball. Right now, every aspiring breakout near $94K faces a stubborn rejection, like a guest turned away at a velvet rope.

The tension? Tightening. The moment? Approaching. A breakout past $95K, with enough volume, could send us soaring toward $100K-an idealistic utopia for traders with hearts. Meanwhile, the more pessimistic might favor a descent below the trendline, aiming to revisit the somber corridors of $85K or even slip back into the shadows of $80K-an encore of the earlier act.

On-Chain Analysis

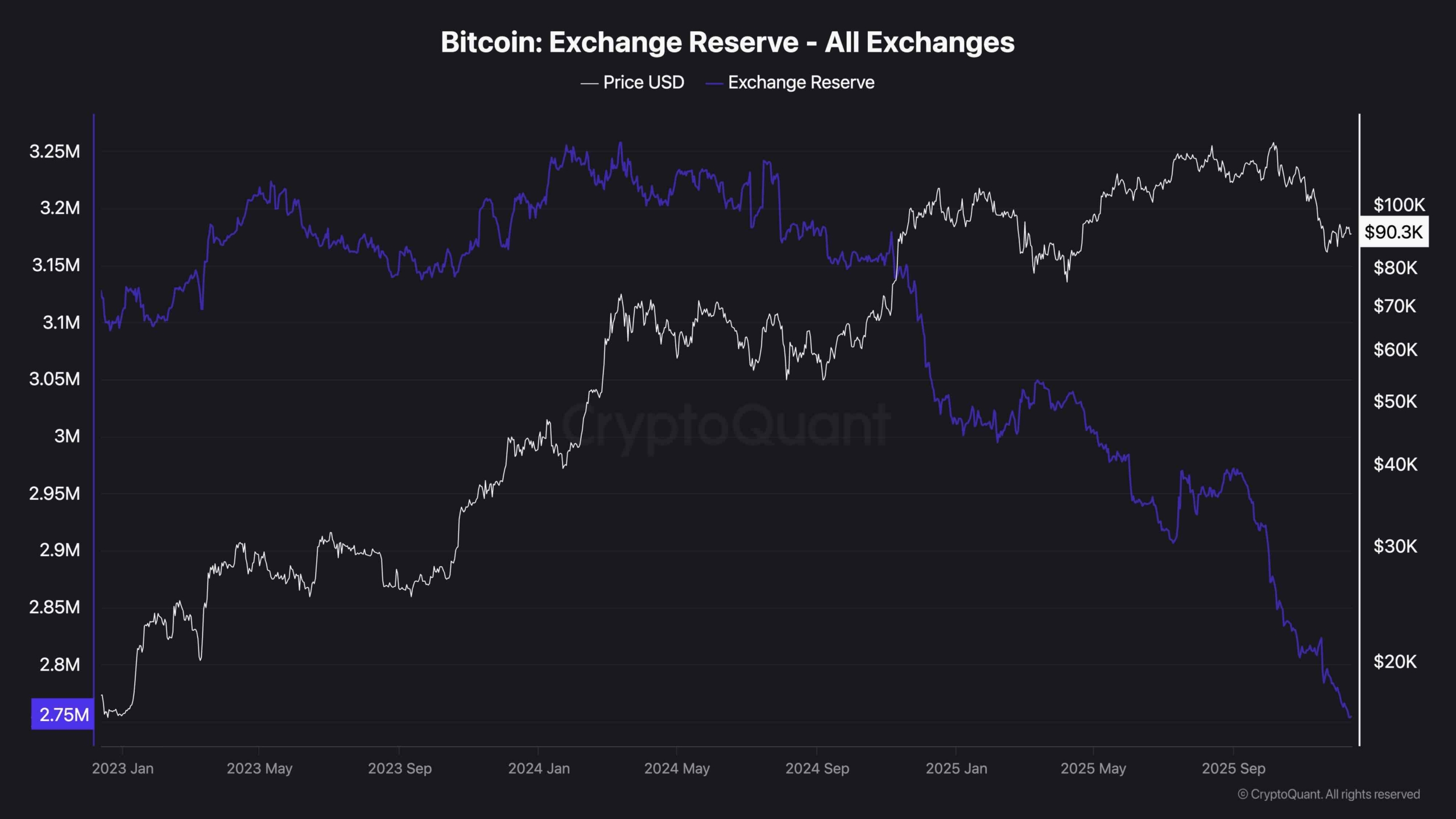

Bitcoin Exchange Reserve

The on-chain whispers are more intriguing: Bitcoin reserves on exchanges are plummeting-down to multi-year lows around 2.75 million BTC. A sign, perhaps, that long-term holders are playing romantic coy, hoarding their treasures and withholding supply like a miser clutching his gold at midnight.

Yet, paradoxically, this scarcity has done little to invigorate the price-demand remains subdued, as if everyone is waiting for a cosmic sign before rushing to buy. The divergence between dwindling reserves and stagnant prices suggests that institutional whispers and retail curiosity are still whispering rather than roaring. Capital sits on the sidelines, perhaps waiting for clearer macro skies, rather than fancying a rally powered merely by supply constraints.

And so, we wait-for a sign, a spark, or a cosmic nudge, all while Bitcoin elegantly teeters on the edge of another grand reveal. 🎭💰

Read More

- Gold Rate Forecast

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- XRP’s Little Dip: Oh, the Drama! 🎭

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- Silver Rate Forecast

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

2025-12-13 20:41