Darling, the economic tango between the U.S. and China, coupled with the Federal Reserve’s latest rate cut, has rather conveniently smoothed over those pesky macroeconomic wrinkles. Quite the relief, isn’t it? Yet, Bitcoin, that tempestuous prima donna, is still deciding whether to pirouette above the 100-day MA or cling to the 200-day MA like a socialite to her martini. 🍸

Until this equilibrium shatters-and it will, my dear, it always does-the market remains in its tedious accumulation and consolidation phase. Expect volatility to compress like a corset before the next dramatic impulse move. 🌪️

Technical Analysis

By Shayan, the darling of data.

The Daily Chart

On the daily stage, Bitcoin has been flitting between the 100-day MA at $114K and the 200-day MA at $109K, creating a perfectly tedious equilibrium zone. The repeated rebounds from the 200-day MA suggest that the $108K-$109K area is still the darling of institutional demand, while the $114K-$116K range remains a no-fly zone for our bullish friends. 🛑

This tiresome balance between buyers and sellers is as predictable as a Coward play-charming, but oh-so-familiar. The current stabilization phase could be an accumulation pattern, as evidenced by the clustered price action between these two key averages. How utterly riveting. 😴

A confirmed daily close above the 100-day MA would likely spark a breakout toward $120K-$122K, while a breakdown below $108K could send us tumbling into the $102K-$104K demand zone once more. Thrilling, isn’t it? 🎢

The FOMC’s dovish pivot and the U.S.-China cooperation framework might just provide the wind beneath Bitcoin’s wings-if, of course, on-chain and volume metrics confirm accumulation. Fingers crossed, darling. 🤞

The 4-Hour Chart

The 4-hour timeframe only reinforces Bitcoin’s range-bound theatrics. The price has repeatedly bounced from the $108K-$109K support zone, forming higher lows and attempting to reclaim its short-term glory. However, the $115K-$116K resistance band remains an impenetrable ceiling, foiling every upward attempt. 🛑

This symmetrical consolidation within an ascending structure suggests that volatility is tightening like a pre-show curtain call. A bullish breakout above $116K could signal a structural shift toward $120K-$122K, while a failure to hold $108K would confirm a deeper retest of the $102K liquidity pocket. Oh, the drama! 🎭

Until one side of this range is breached, expect the market to oscillate like a pendulum-with low volatility preceding the next grand expansion. 🕰️

On-Chain Analysis

By Shayan, the maestro of metrics.

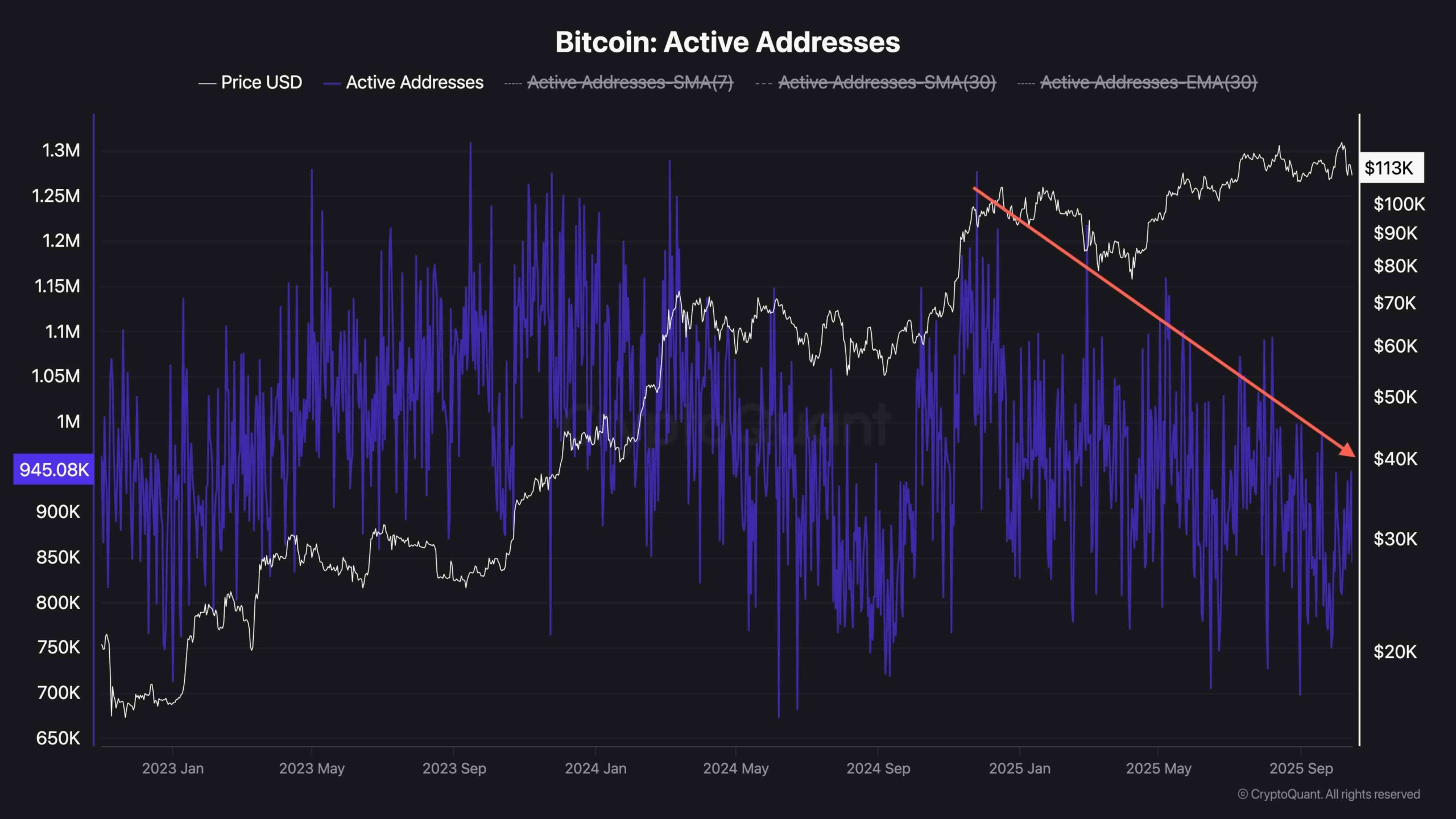

Bitcoin Active Addresses, my dear, offer a fascinating glimpse into market participation and network health. Over recent months, the number of active addresses has dwindled, even as Bitcoin’s price clings to its record highs. Historically, such a decline in on-chain activity often signals market fatigue or short-term distribution, particularly after extended rallies. 🏃♂️💨

However, the current level of activity, while subdued, remains above the 2024 accumulation baseline, indicating that the market is not yet in full capitulation mode. Phew! 😌

Periods of reduced address activity near key support levels have often preceded large-scale accumulation and trend reversals, as seen in late 2023 and mid-2024. If active address growth stabilizes while the price holds the $108K-$110K support range, it would strengthen the case for an accumulation-driven bottom formation. How utterly delightful! 🌟

With the macro environment favoring increased global liquidity and improving investor sentiment post-Fed rate cut, the stage could be set for a bullish encore. Bravo, Bitcoin, bravo! 👏

Read More

- BTC PREDICTION. BTC cryptocurrency

- XRP PREDICTION. XRP cryptocurrency

- FLR PREDICTION. FLR cryptocurrency

- PENGU PREDICTION. PENGU cryptocurrency

- GBP CAD PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- LSETH PREDICTION. LSETH cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- BNB PREDICTION. BNB cryptocurrency

2025-11-02 09:31