Good news, crypto crusaders! In the grand, glittering kingdom of finance, the high priests of BlackRock have declared that Bitcoin is about to blast off like a rocket on a sugar high. With the recent signing of the GENIUS Act, these financial gurus are singing a brand new tune: stablecoins aren’t just digital tokens—they’re the future of digital payments! 🤑💸

“Behold!” they cry, “the GENIUS Act, a legislative masterpiece that redefines stablecoins as payment methods rather than mere investment baubles!” No more interest payments, and only the federally blessed banks (and a chosen few nonbanks) can mint these digital dollars. It’s as if the monetary overlords have decreed a new monetary order in a world where money talks—and sometimes even sings! 👑

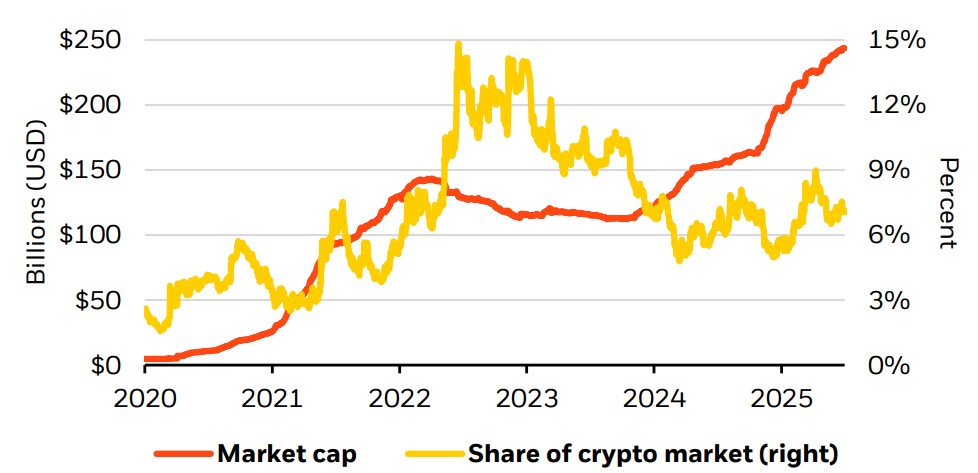

Currently, these digital darlings hold a modest 7% of the market (roughly $250 billion in the good old cash), but since 2020 they’ve been rocketing like a UFO on a caffeine buzz. Emerging markets might just get a free ride, while the big economies are forced to adapt to the no-interest rule. Meanwhile, the titans of stability—Tether (USDT) and Circle (USDC)—are hoarding over $120 billion in Treasury bills. In the grand cosmic ledger, that’s just a drop in the endless ocean of Uncle Sam’s debt. 🌊

BlackRock also hints that while the demand for Treasury bills might tick upward, the overall impact on yields could be as mild as a tickle on a sleeping giant. Why? Because it’s merely a shuffling of funds from one asset to another—not the creation of new demand. And let’s not forget Uncle Sam’s plan to issue more short-term debt to cover his never-ending deficits. It’s the financial equivalent of a reality TV show where nothing really changes—except maybe your bank balance. 📺

Meanwhile, beyond the borders of the US, other lands are stirring in the stablecoin cauldron. Hong Kong is cooking up new regulations to foster innovation, while Europe is flirting with the idea of a digital euro—complete with enough safeguards to protect their beloved banks. Should other nations allow interest-bearing stablecoins or dive headfirst into the CBDC pool, then the mighty US dollar might just have to reconsider its no-interest stance. After all, in the world of finance, change is the only constant—unless it’s your tax rate. 😂

In conclusion, as digital assets swagger into the mainstream, the blend of regulatory support and government backing suggests that Bitcoin and stablecoins are set to become the new rockstars of the financial world. BlackRock remains as optimistic about Bitcoin’s potential as a distinct return driver as a man who just won the lottery with his nose! So grab your popcorn (or your crypto wallet) and get ready for a show that promises more twists than a pretzel factory—because in the end, only the digitally savvy survive! 🍿🤪

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD ILS PREDICTION

- Brent Oil Forecast

- Solana Staking Soars! Is $60 Billion the Secret Sauce for Success?

- Silent Whales: Bitcoin’s Shadow War on Binance

- Paradex: When Glitches Meet Gold, and $650K Later…

- USD THB PREDICTION

- Ethereum’s Circus: $10B Reserve, Whales, and the Quest for $6K – Or Not

- Dash Crypto Implodes: Will It Crash Like a Mel Brooks Movie?

2025-07-30 09:06