Bitcoin, with a sprightly step, maintains its position above the £113,000 threshold, though the market’s indecision remains as fickle as a debutante at her first ball. With the esteemed Federal Reserve set to unveil its next interest rate decision on Wednesday, traders and investors await its pronouncement with the fervor of a house party awaiting the arrival of the most eligible bachelor-a decision that might, if fortune smiles kindly, breathe new life into risk assets, including crypto, like a well-placed compliment.

The broader market, ever the cautious hostess, remains wary yet hopeful. Should the Fed adopt a dovish tone, it might doff its stern cap and declare, “My dear friends, the financial conditions have softened,” thus paving the way for a grander Bitcoin rally. Conversely, a neutral or hawkish stance may leave the market lingering in the drawing room, sipping tea and hoping for a more agreeable invitation to the dance floor.

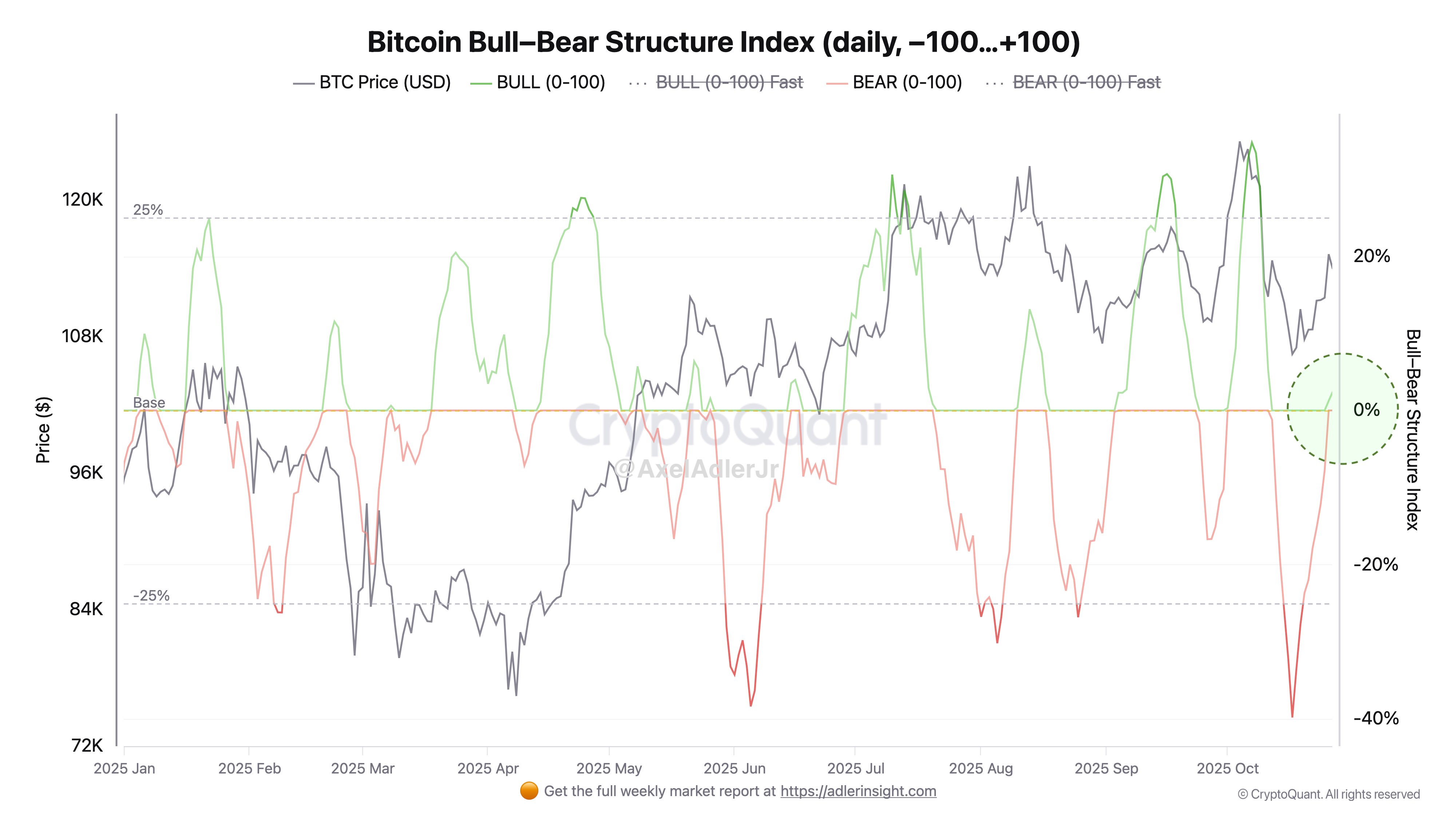

To the delight of many, esteemed analyst Axel Adler has observed a pivotal shift: the Bitcoin Bull-Bear Structure Index, after languishing in bear territory since October 12, has ascended above zero. This index, a barometer of bullish and bearish tempests measured by price action and on-chain data, suggests that momentum may now favor the bulls, much like a suitor finally securing a dance with the season’s most sought-after lady.

According to Mr. Adler, the Bitcoin Unified Sentiment Index-a composite of CoinGecko’s Up/Down votes and the Fear & Greed Index-has entered positive territory, signaling a shift in investor psychology akin to a sudden thaw in winter. When sentiment and on-chain data align, it often marks the beginning of renewed confidence, much like a gentleman and lady finding common ground over shared interests in botany and poetry.

This development arrives at a most critical juncture. The Federal Reserve’s decision could prove as influential as a well-timed letter in a romantic correspondence. A dovish move-perhaps a gentle reminder of past rates or a hint of cuts-might act as a tailwind, propelling Bitcoin toward higher altitudes. A cautious stance, however, may leave the market twirling in place, waiting for the next cue.

From a macro and technical standpoint, Bitcoin’s consolidation around the £113K-£115K zone suggests a poised dancer awaiting the conductor’s baton. With sentiment improving, on-chain activity stabilizing, and stablecoin liquidity near cycle highs, the stage is set for an impulsive leap upward-provided no unforeseen economic scandals disrupt the harmony.

As markets await the Fed’s tone and broader economic signals, this week may determine whether Bitcoin transitions from consolidation to expansion-or remains trapped in indecision, much like a heroine torn between two suitors.

Bitcoin currently trades near £114,400, displaying resilience akin to a well-bred horse refusing to be led astray. The chart reveals how BTC has reclaimed the 50-day moving average while finding support near the 200-day moving average-a technical setup as reassuring as a gentleman’s promise to attend a ball unaccompanied.

The £117,500 level (marked in yellow) remains the key resistance, a barrier as formidable as a well-guarded estate. A decisive breakout might confirm bullish momentum toward the £120K-£125K region, while short-term support lies near £111K, where price has rebounded like a determined suitor refusing to be turned away.

Traders await the Federal Reserve’s decision with the anticipation of a society matron awaiting the arrival of a titled gentleman. A dovish tone might trigger buying pressure, while a neutral or hawkish statement could prompt another short-term retreat, much like a dance partner suddenly losing interest in the quadrille.

Bitcoin’s structure remains constructive so long as it holds above the 200-day MA. Sustained strength above £115K could signal renewed bullish intent, much like a heroine finally accepting her true love’s proposal-indicating that accumulation phases may soon give way to a grand finale.

Read More

- Gold Rate Forecast

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- USD HKD PREDICTION

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- KakaoBank’s Bold Venture into Stablecoins: The Future of Digital Money or Just a Digital Distraction? 🚀💰

- Bitcoin’s Bailout: Schiff Say’s ‘Gold Alleys’ & CZ’s Snarky Comeback 😂

2025-10-29 02:54