Bitcoin, that most fashionable of cryptocurrencies, continues to pirouette just below its all-time high of $112K, deftly maintaining its poise above the critical support at $105K. Despite the bears’ relentless attempts to push the price lower, the market remains in a state of delightful uncertainty, a condition that, in the grand scheme of things, seems to favor the bulls as long as the support levels remain unbroken.

Meanwhile, the world of macroeconomics is undergoing a transformation as rapid as a change of costume. The US Congress, in a display of legislative elegance, has passed President Donald Trump’s “big, beautiful” economic package, just in time for the self-imposed July 4 deadline. This new phase of fiscal stimulus, marked by tax cuts and aggressive spending, is a spectacle in itself, and when combined with strong job reports, it suggests that inflation may soon accelerate. Historically, such conditions have been a boon for Bitcoin, a currency that thrives as a hedge against the devaluation of fiat currencies.

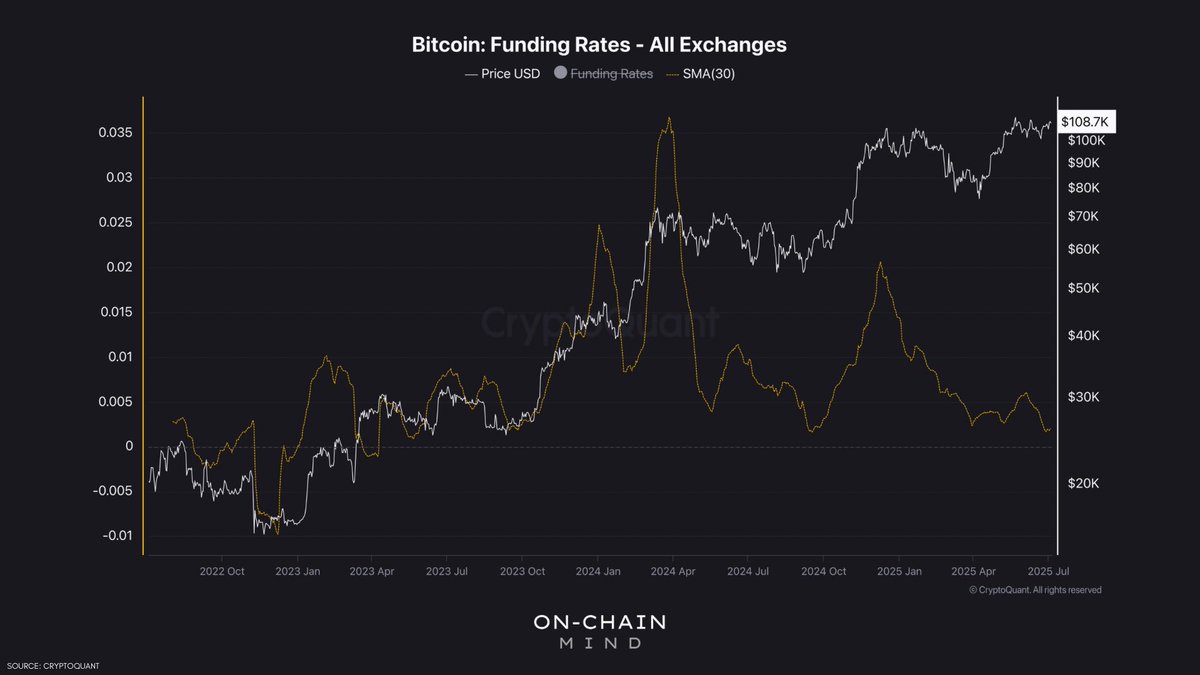

On the market sentiment front, the funding rates offer a particularly intriguing clue. According to the esteemed analyst On-Chain Mind, the 30-day average of Bitcoin perpetual funding rates is currently at a rather modest level. This lack of excessive greed is typically a harbinger of a favorable setup for a bullish continuation. Indeed, periods of low funding rates have often preceded significant upward moves, especially when bolstered by strong macroeconomic tailwinds. With economic pressures mounting and Bitcoin still in a bullish structure, the coming days could very well witness the next major move for the world’s largest cryptocurrency.

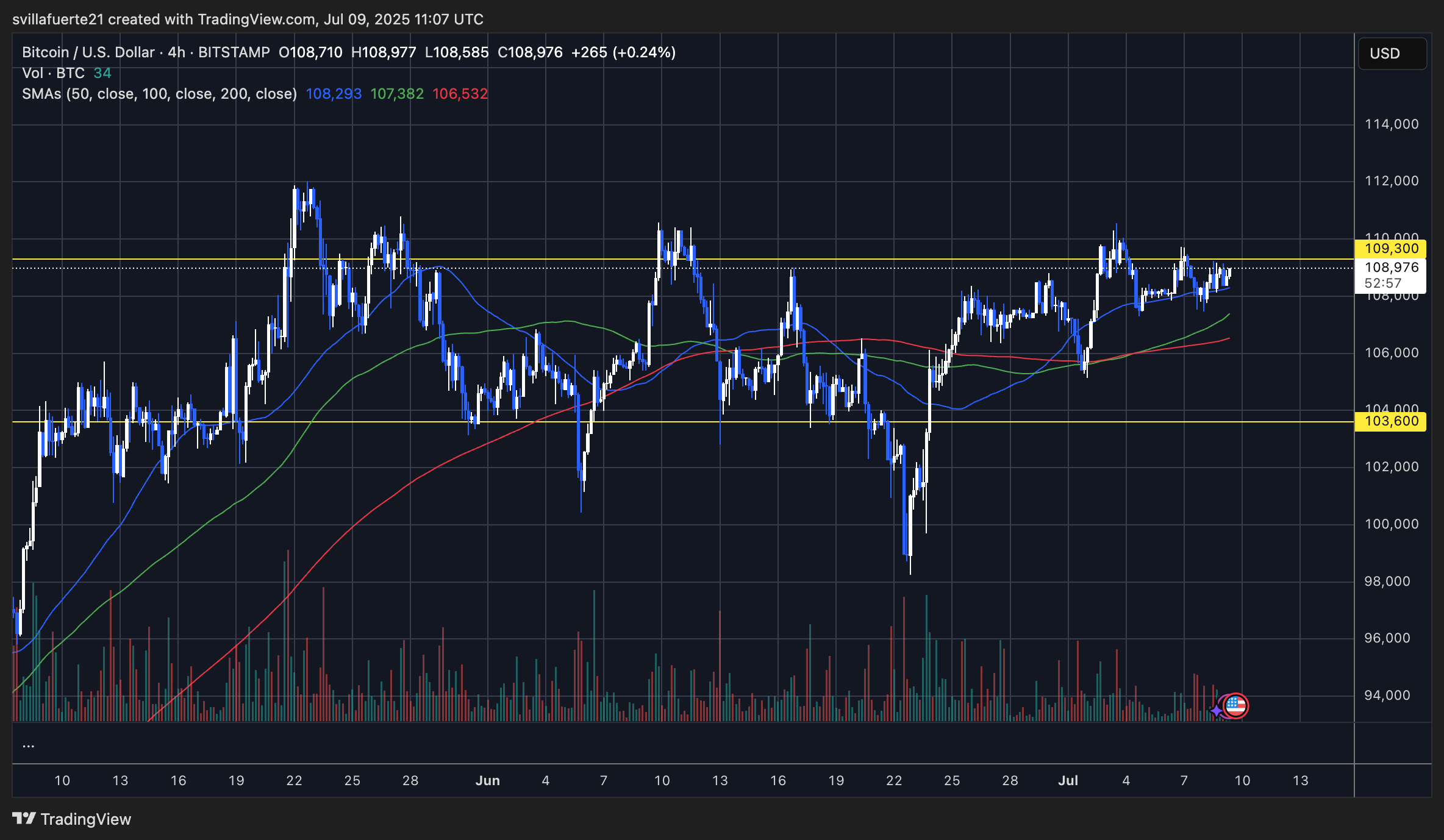

Bitcoin has risen more than 3% since the start of July, holding firmly above the $107,000 local low, despite the persistent resistance at the $110,000 level. This sustained strength is a testament to the underlying buyer support and growing momentum as BTC continues to consolidate just below its all-time highs. The $110K resistance remains a formidable barrier, but once breached, analysts predict a strong move into price discovery, as bullish momentum builds.

The market has, thus far, absorbed a wave of macroeconomic and geopolitical developments with a grace that would make any seasoned performer envious. Global trade dynamics, including rising tariffs, export restrictions, and the deglobalization trend, continue to influence sentiment. Yet, compared to the sharp volatility seen earlier this year, both Bitcoin and US equities appear more resilient. This suggests that much of the uncertainty has already been priced in, reducing the downside risk for risk assets like BTC.

A key technical factor reinforcing the bullish case is, once again, the low 30-day average of funding rates. This indicator reflects a neutral-to-cautiously optimistic market environment—a stark contrast to the overheated bullish phases that often precede corrections. Calm periods like this often set the stage for explosive moves, particularly when supply squeezes and strong demand meet a macro environment ripe for risk-taking. With BTC coiling tightly and sentiment balanced, a breakout could be imminent.

The 4-hour chart reveals Bitcoin (BTC) in a tight consolidation, holding above the key support at $107,000 and testing resistance around $109,300. This price level has consistently acted as a local ceiling, with several failed breakout attempts in late June and early July. However, the bulls continue to defend higher lows, signaling strength and setting the stage for a potential breakout.

The 50, 100, and 200 simple moving averages (SMAs) are stacked close together and gradually trending upward, suggesting that the consolidation phase could soon transition into a more directional move. Volume remains low, a condition that often precedes a volatility spike, especially near key resistance levels.

The $103,600 support remains the crucial line in the sand for bulls. A breakdown below that level would invalidate the short-term bullish structure and likely lead to a deeper retrace. On the upside, a daily close above $109,300 with volume confirmation could trigger a rally toward price discovery above the all-time high.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- XRP’s Little Dip: Oh, the Drama! 🎭

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

- Silver Rate Forecast

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Gemini’s New XRP Credit Card Pays 4% – Swiping Never Felt So Crypto!

- Crypto Chaos: Nasdaq’s $50M Wink to Gemini & Tether’s New Stablecoin Shenanigans!

2025-07-10 05:22