Bitcoin, that elusive specter, has remained trapped within the narrow confines of its price range, a prisoner of its own volatility. Over the last day on Saturday, Feb. 21, 2026, it meandered between $67,563 and $68,636, while derivatives traders, those relentless gamblers, have not ceased their feverish activity. Futures and options data reveal a labyrinth of billions in open interest, a testament to humanity’s enduring obsession with control. Calls, that most arrogant of bets, have maintained their stranglehold over puts, as if the market itself were a chessboard and the traders its pawns.

Bitcoin Derivatives Snapshot: $45B in Futures, Calls Dominate

According to coinglass.com stats, global bitcoin futures open interest stands at 671,140 BTC, currently valued at $45.97 billion. Over the past 24 hours, open interest has increased 1.44%, even as shorter-term changes show a modest 0.39% dip over four hours and a slight 0.07% gain in the last hour, signaling repositioning rather than retreat. A dance of desperation, perhaps?

The Chicago Mercantile Exchange (CME) leads the futures pack with 122,470 BTC in open interest, worth $8.38 billion, accounting for 18.23% of the market. Binance follows closely with 116,190 BTC, or $7.96 billion, while OKX holds 46,600 BTC valued at $3.19 billion. Bybit, Gate, and MEXC round out the top tier, each commanding multibillion-dollar positions. A satanic dance of capital, indeed.

Market action this week suggests steady leverage appetite. Binance posted a 2.03% increase in open interest over 24 hours, OKX gained 2.35%, and Bybit rose 2.22%. Gate added 4.57% during the same period, while MEXC recorded a 10.75% jump. In contrast, BingX saw a 36.39% decline over 24 hours, a sharp outlier in an otherwise expanding field. A tale of two exchanges, one ascending, one descending into oblivion.

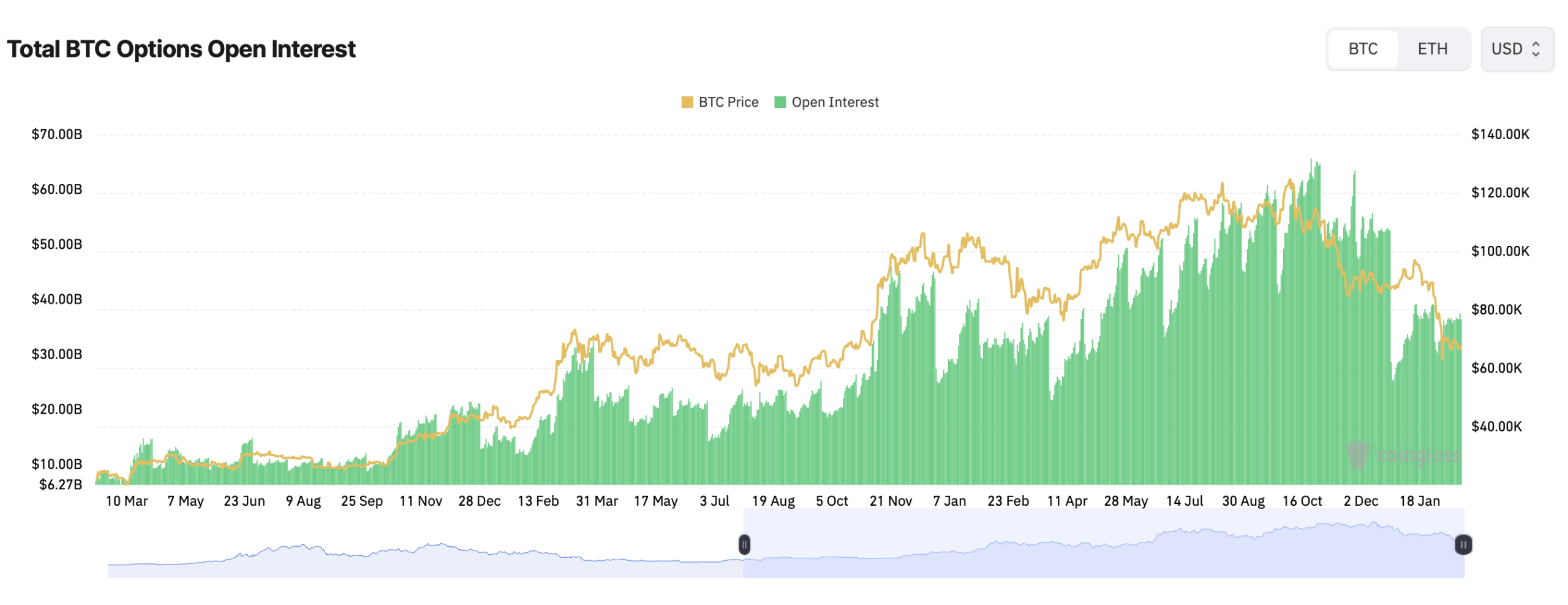

On the options side, total bitcoin options open interest has mirrored the broader derivatives buildout. CME’s options open interest chart shows layered expirations stretching from one month out to contracts beyond six months, with notable concentrations in the two- to three-month and three- to four-month windows. The stacking by expiration illustrates a market not merely chasing weekly volatility, but positioning further down the curve. A long game, played by those who believe they can outwit the gods.

Stacked by position, CME data show puts and calls rising in tandem, yet calls consistently outpace puts. Overall options open interest stands at 283,456.92 BTC in calls versus 219,725.98 BTC in puts, giving calls a 56.33% share. In 24-hour volume terms, calls represent 55.91%, compared with 44.09% for puts. The tilt suggests traders are leaning bullish, though not recklessly so. A calculated risk, perhaps, but risk nonetheless.

Strike-level data reinforce that bias. Among the largest open interest contracts are Deribit’s Feb. 27, 2026 $75,000 calls at 8,342.9 BTC and $40,000 puts at 7,375.6 BTC. Longer-dated bets include December 2026 $120,000 calls and March 2026 $90,000 and $80,000 calls, underscoring that some participants are eyeing six-figure territory. A dream, perhaps, but a dream fueled by greed.

Max pain levels add another layer of intrigue. On Deribit, max pain hovers near $85,000, while Binance’s curve peaks closer to $120,000 before easing toward roughly $90,000 for later expirations. OKX’s max pain sits near the $80,000 to $85,000 range. With bitcoin trading below $70,000, these levels suggest a theoretical gravitational pull higher as expirations approach. A cruel joke, played by the market itself.

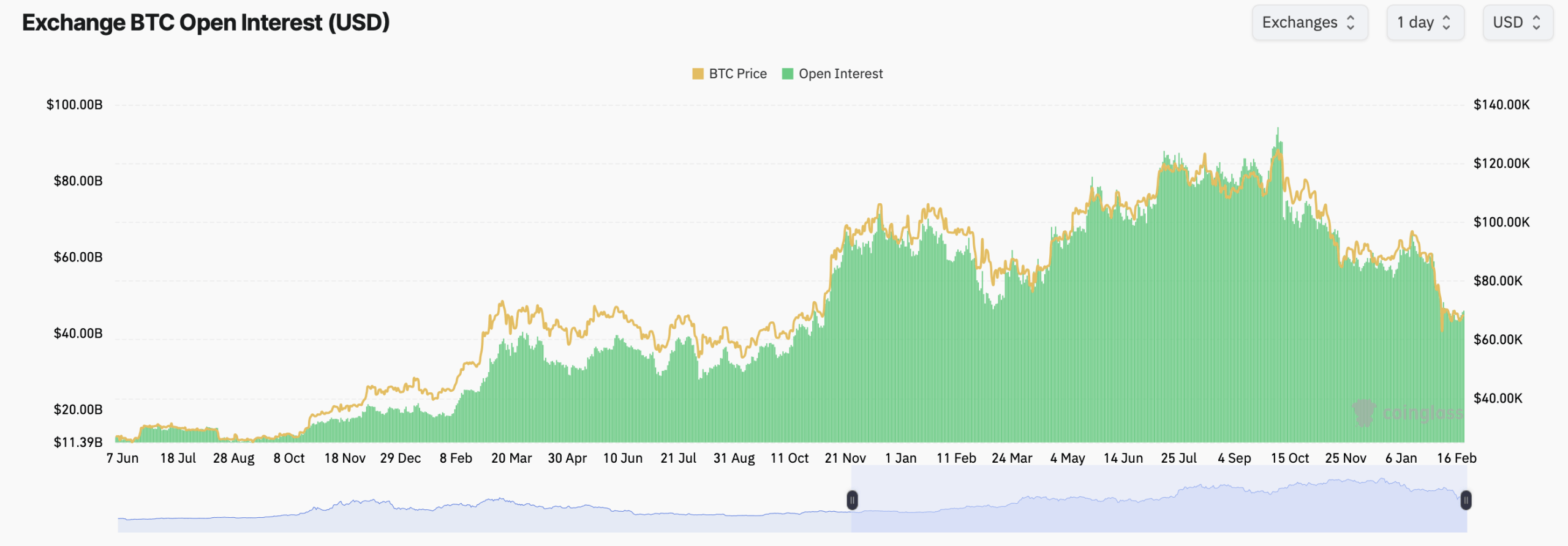

Exchange-wide bitcoin open interest, measured in U.S. dollars, peaked above $80 billion in late 2025 and now sits near $46 billion. The decline from those highs reflects deleveraging from prior peaks, yet current levels remain historically elevated, indicating derivatives markets remain central to price discovery. A relic of a bygone era, or a harbinger of what’s to come?

In short, bitcoin at $68,485 is not drifting in isolation. Beneath the surface lies a $45.97 billion futures market and a call-heavy options complex stacked across CME, Binance and OKX. Whether price marches toward the $80,000-plus max pain clusters or retraces lower, one thing is clear: derivatives traders are firmly in the driver’s seat. A cabal of modern-day scribes, etching their bets into the annals of financial history.

FAQ 🐻🐂

- What is total bitcoin futures open interest right now?

Global bitcoin futures open interest stands at 671,140 BTC, valued at $45.97 billion. A staggering sum, yet nothing more than a whisper in the void. - Are calls or puts dominating bitcoin options markets?

Calls lead with 56.33% of open interest compared with 43.67% for puts. A testament to the bullish delusion of the masses. - Which exchange has the largest bitcoin futures open interest?

CME leads with 122,470 BTC in open interest, worth $8.38 billion. The old guard, still standing. - Where are current bitcoin max pain levels?

Max pain clusters near $80,000 to $85,000 on Deribit and OKX, and around $90,000 on Binance. A cruel irony, as the market teeters on the edge of its own making.

Read More

- 🚀 XRP’s ETF Waltz: Less Exchange Drama, More Market Flair! 💃

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Logan Paul’s $16M Pokémon Scandal: The Price of Greed

- The Surprising Altcoins Poised for Glory Just Before the Fed’s Big Decision!😲

- PUMP Pumped or Plundered? Traders Beware the Bull! 🤦♂️

- XRP’s 2026 Forecast Collapses-Banks Wave Goodbye to Crypto Dreams!

- Bitcoin’s Golden Quest: 20 Years or a Midnight Snack?

- XRP’s Wild Thrilling Orphan Adventure to $70? Find Out!

2026-02-22 01:28