Bitcoin, that fickle lover, has once again found itself in the arms of a bear market, according to Cryptoquant, whose onchain research reveals a tale of waning demand, shrinking liquidity, and a technical structure as fragile as a glass of vodka on a hot day.

Cryptoquant Researchers See No Relief Yet for Bitcoin’s Bear Market

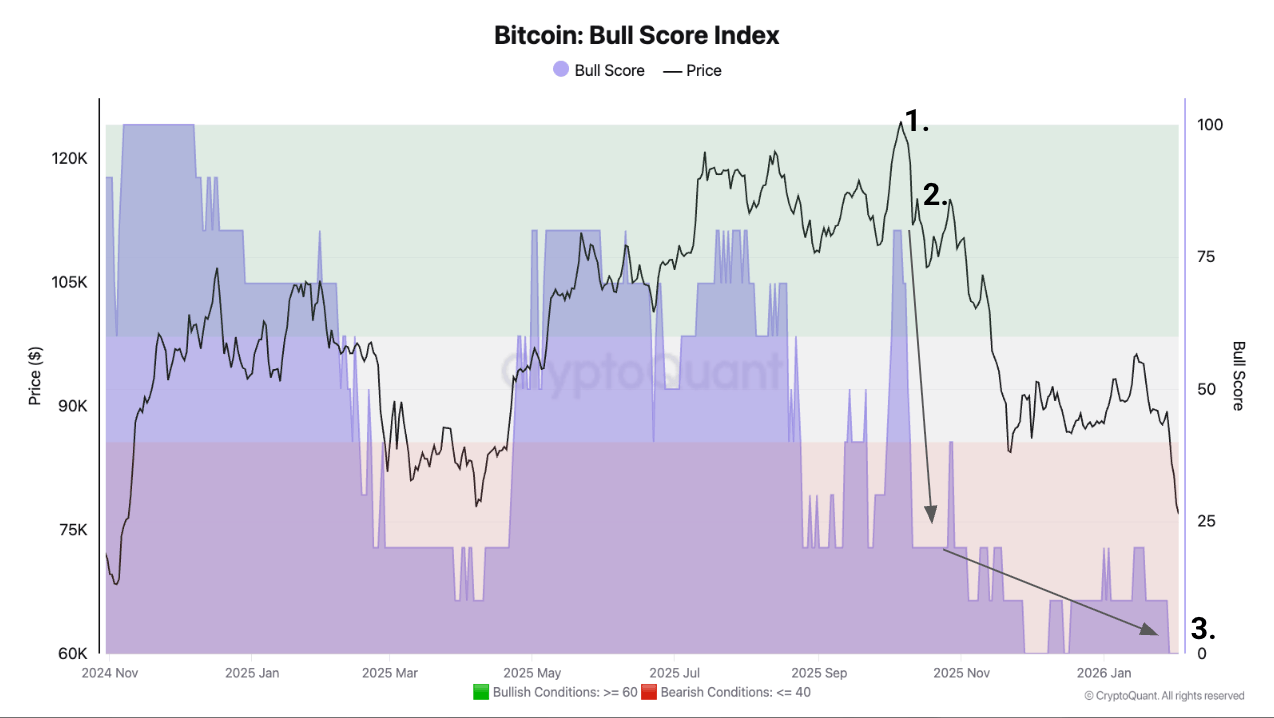

In its February “Bear Market Assessment” report, Cryptoquant researchers lament that bitcoin peaked near $126,000 in early October, when the Bull Score Index stood proudly in bullish territory at 80. But alas, the fateful liquidation event of October 10th sent the index plummeting to zero-a reading so bearish it would make a grizzly bear weep.

Since then, the index has slid to zero-its most bearish reading-while price hovers around much lower ranges, signaling broad structural weakness, according to cryptoquant.com data. One might say the market is as stable as a house of cards in a hurricane.

The report also points to a clear reversal in institutional behavior. U.S. spot bitcoin exchange-traded funds (ETFs), which had accumulated roughly 46,000 BTC at this point in 2025, have become net sellers in 2026, shedding about 10,600 BTC. That swing represents a 56,000 BTC demand gap year over year-a dynamic the researchers say is adding persistent selling pressure. One might call it the institutional equivalent of a midlife crisis.

Despite lower prices, Cryptoquant notes that U.S. investors remain largely absent. The Coinbase Bitcoin Price Premium has stayed negative since mid-October, indicating weaker spot demand in the U.S. compared with global markets. Historically, the analysts say data shows sustained bull markets coincide with a positive U.S. premium-something notably missing this cycle. A curious case of the U.S. falling behind its own expectations.

Liquidity trends are also flashing warning signs. The market strategists report that the 60-day growth rate of Tether’s USDT market capitalization has turned negative, falling by $133 million. This marks the first contraction since October 2023 and follows a peak expansion of $15.9 billion in late October 2025, a pattern Cryptoquant analysts associate with bear market phases. A liquidity crisis, if you will.

Longer-term demand metrics reinforce the bearish case. According to the researchers, apparent spot demand growth has collapsed by 93% over the past four months, dropping from 1.1 million BTC in early October to just 77,000 BTC today-evidence, researchers say, that most of this cycle’s demand has already passed. A sad tale of missed opportunities.

From a technical perspective, the report highlights that bitcoin has broken below its 365-day moving average for the first time since March 2022. Prices are down significantly in the days since that breakdown, a steeper decline than seen at the start of the 2022 bear market, when losses totaled just 6% over the same period. A technical breakdown, if you will.

Finally, Cryptoquant’s analysis warns that bitcoin has lost several key onchain support levels, including repeated rejections at the Traders’ Onchain Realized Price. With price now below the lower band of that metric, Cryptoquant identifies the $60,000 range, a place where BTC tapped yesterday, as the next major support zone to watch. A last resort, perhaps.

FAQ ❓

- Is bitcoin officially in a bear market?

Cryptoquant researchers say multiple onchain indicators confirm a bear market regime. A verdict as certain as the sunrise, though perhaps less cheerful. - Why are bitcoin prices under pressure?

Cryptoquant attributes the decline to weak demand, ETF selling, and contracting liquidity. A trifecta of woes, if you will. - Are U.S. investors buying the dip?

Cryptoquant data shows U.S. spot demand remains weak, with a negative Coinbase premium. A chilling tale of indifference. - How low could bitcoin go?

According to Cryptoquant, the next major support zone sits at $60,000. A price point that may or may not save the day.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- Bitcoin to $200K?! 🚀 The Experts Say YES!

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- Altcoins Rise: BNB Hits New High, LINK Takes the Cake 🍰

- Crypto Chaos: Nasdaq’s $50M Wink to Gemini & Tether’s New Stablecoin Shenanigans!

- Silver Rate Forecast

- Pasternak’s Hot-ETH Ticket: Half a Billion Bucks & the Moon’s Already Jealous!

- Shiba Inu’s Trillion Token Tumble: A Comedy of Errors 🐶💰

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

2026-02-07 00:08