Ah, the capricious dance of Bitcoin! In recent days, its price has fluttered like a moth around the flame of $102,000, only to be buffeted by the winds of selling pressure and the lethargy of fresh demand. How very… human of it. 🌪️💸

On-chain data from CryptoQuant-that modern oracle of the digital age-reveals a tale as old as time itself: long-term holders, those stoic guardians of the crypt, have been cashing in their chips. Yet, the market, once a voracious beast, now yawns indifferently, its appetite for their sell-offs waning. A tragedy? Perhaps. A comedy? Most certainly. 🎭📉

The Eternal Waltz of Long-Term Holders

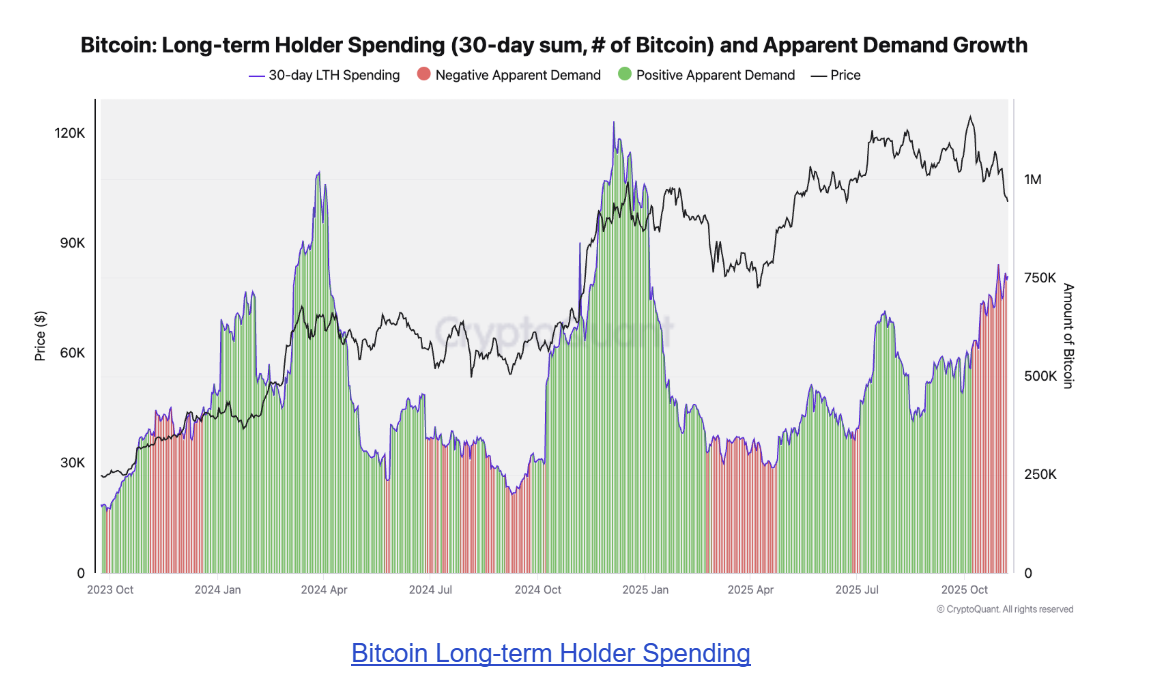

Julio Moreno, the sage of CryptoQuant, has shared insights that would make even the most jaded observer raise an eyebrow. Long-term holder selling, he explains, is but a natural rhythm in the bull’s grand ballet. As Bitcoin ascends to its celestial heights, these holders, ever pragmatic, take their profits. Yet, the data-oh, the data!-shows a divergence. Since early October, the 30-day sum of their spending has swelled, a purple line on a chart that tells a story of greed, fear, and indifference. 🕺💰

In the halcyon days of early and late 2024, such selling was but a prelude to greater glories, as demand swelled to meet the supply. But now? Now, the market seems to shrug, its once-robust demand entering a “red zone”-a term that, one imagines, would make even the most stoic Russian novelist chuckle at its dramatic flair. 🌹🚨

Bitcoin Long-term Holder Spending: A Symphony in Purple 🟣

Since October 2025, the trend has reversed. Long-term holders sell, and the market, once a sponge, now repels. Bitcoin, poor soul, struggles to cling to its perch above $102,000, its momentum as fleeting as a Russian summer. 🍃❄️

The Slumbering Giant of Demand

Moreno, ever the astute observer, notes that the true drama lies not in the selling itself, but in the market’s ability-or inability-to keep pace. When demand is strong, long-term holder sell-offs are but a pause in the march upward. But when demand falters? Ah, then we have the makings of a tragedy: prolonged corrections, sideways movement, and the haunting specter of stagnation. 🦥🔍

And where, one might ask, has this demand gone? Look no further than the Spot Bitcoin ETFs, those modern-day sirens whose song once lured investors in droves. Yet, even they have fallen silent, with net outflows of $558.44 million on November 7-a figure that would make even the most hardened capitalist wince. 💼💨

Unless demand awakens from its slumber and long-term holders cease their selling spree, Bitcoin may find itself trapped in a purgatory of consolidation, bouncing between $101,000 and $103,000 like a caged bear. A fitting metaphor, perhaps, for the state of the market. 🐻🌀

At the time of writing, Bitcoin trades at $101,655, down by 0.6% in the past 24 hours. A minor dip, one might say, in the grand scheme of things. Yet, in the world of cryptocurrency, even the smallest movements can portend the greatest dramas. 🌍🔮

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- Bitcoin to $200K?! 🚀 The Experts Say YES!

- TRON’s Fee Slashing: A Comedy of Stablecoin Errors? 🎭💸

- Silver Rate Forecast

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- THORChain Founder Loses $1.35M After Deepfake Zoom And Telegram Scam

- XRP’s Little Dip: Oh, the Drama! 🎭

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Will SUI Soar to $7 Despite 6% Plunge? 📈🚀

2025-11-09 15:07