In the labyrinthine corridors of financial speculation, Grayscale Investments, that modern-day oracle, has cast its gaze upon Bitcoin, that enigmatic sphinx of the digital realm. Lo, its latest Market Byte research note reveals a metamorphosis most peculiar: Bitcoin, once hailed as the “digital gold,” now dances to the tune of growth assets, its price movements mirroring the capricious whims of high-growth software stocks rather than the stoic resilience of precious metals.

- Bitcoin, that restless spirit, has forsaken its golden shackles, choosing instead to frolic with the high-flying growth stocks, its price action a symphony of risk and reward, according to the sages at Grayscale.

- In the short term, Bitcoin’s fate is tethered to the fickle winds of risk sentiment, not the steady hand of store-of-value demand, rendering it a poor shield against the tempestuous equity market drawdowns.

- Yet, Grayscale, ever the optimist, clings to its long-term vision, prophesying that Bitcoin may yet evolve into a gold-like monetary asset, its volatility tamed, its equity correlations weakened, should the winds of adoption continue to blow in its favor.

The report, a tapestry of numbers and insights, reveals that Bitcoin’s precipitous fall in early February-a plunge to the depths of $60,000 on February 5, followed by a modest ascent-was not a flight to safety, but a march in lockstep with the broader risk assets. A tragic comedy, indeed, for those who had cast Bitcoin as their financial savior.

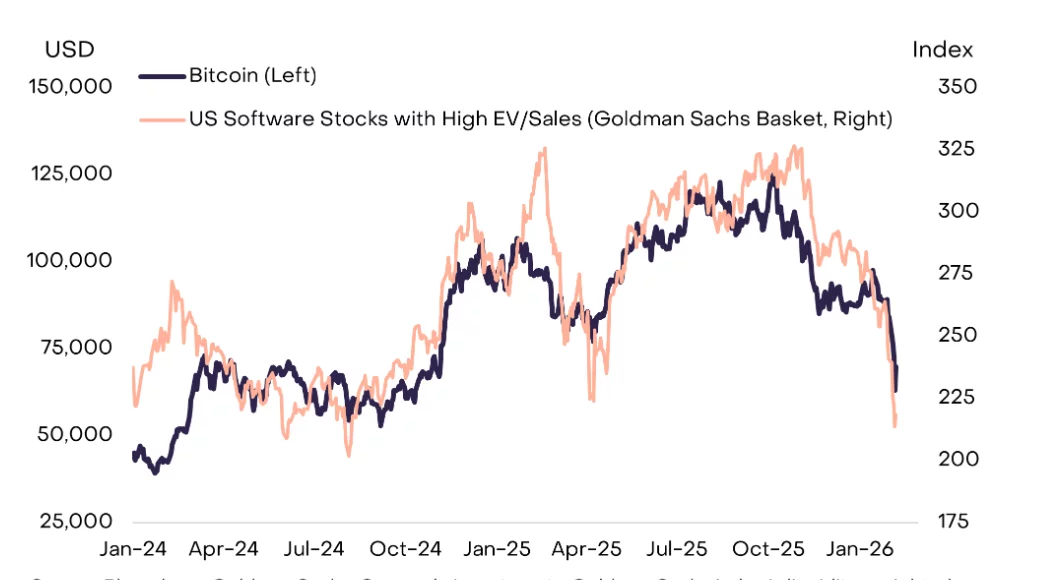

Grayscale’s research, a beacon in the fog of uncertainty, shows that Bitcoin’s price movements have been entwined with those of high-growth software stocks, particularly since the dawn of 2024, both falling in unison during the recent market sell-offs. A digital pas de deux, if you will, but one that offers little comfort to the risk-averse.

This behavior lays bare Bitcoin’s vulnerability to the ebb and flow of market sentiment, its cyclical risk appetite akin to that of technology or growth equities during times of turmoil. A mirror, perhaps, reflecting the speculative fervor of our age.

The Trader’s Conundrum

For the traders, those modern-day alchemists, this shift demands a recalibration of strategy. Bitcoin, once a hedge against the storms of macro uncertainty and inflation, now behaves more like a beta-driven risk asset, declining in tandem with broader speculative assets and forsaking its safe-haven pretensions. A bitter pill to swallow for those who had placed their faith in its golden promises.

This transformation has profound implications for portfolio construction and risk management. Traditional strategies, built upon the sands of Bitcoin’s supposed stability, may crumble when faced with its newfound affinity for growth asset risk cycles. A cautionary tale, indeed, for those who would build their financial houses upon shifting foundations.

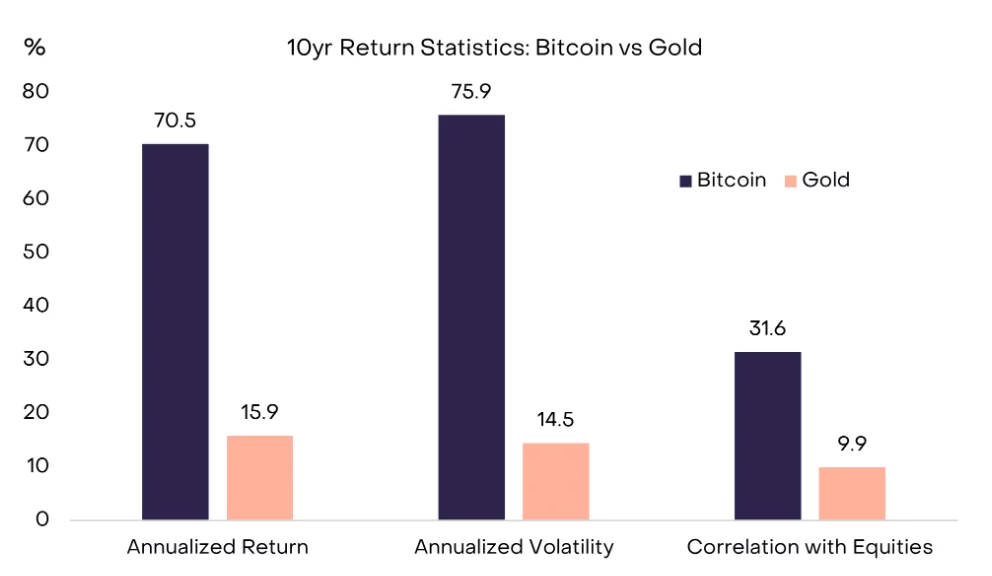

Grayscale, ever the pragmatist, acknowledges that Bitcoin has yet to attain the gold-like status of a monetary asset, a gap that lies at the heart of its investment thesis. Yet, in a future where AI agents roam the digital plains, humanoid robots toil in the fields of industry, and capital markets are tokenized, the firm argues that a digital, blockchain-based commodity like Bitcoin is better suited to claim the mantle of dominant store of value than the archaic relics of gold or silver.

Should Bitcoin succeed in this grand endeavor, its return profile may undergo a metamorphosis, its price behavior coming to resemble that of gold rather than growth stocks. Lower volatility, weaker equity correlations, and more stable, though lower, expected returns-a future both promising and prosaic, a far cry from the wild west of its early days.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- A Gentleman’s Guide to Dogecoin’s Imminent Gallop-Or Perhaps a Tumble

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- ETH Holders, Brace Yourselves: The Wait for New Highs Just Got Longer 🚀⏳

- US & UK Team Up To Save Crypto – Or Just To Keep Up With Each Other?

- XRP’s Little Dip: Oh, the Drama! 🎭

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- ETH’s $2B Liquidation Drama: Will It Crash or Soar? 🚀💸

2026-02-11 12:46