If you thought Bitcoin was taking a leisurely stroll into the sunset, think again. The recent bounce, a kind of desperate hop, has slowed to a crawl after an aggressive dash upward. Last week, it vaults past a few big milestones-only to find itself in a tight squeeze, fighting to reclaim the throne above resistance, all while the on-chain whispers suggest fewer and fewer folks are paying attention.

Technical Analysis

By some number-cruncher named Shayan, but really, just another guy trying to read the cosmic scrawl of charts.

The Daily Chart

Picture Bitcoin bouncing off the $80K demand zone like a rubber ball, only to get caught inside a descending channel-imagine a kid in a slide, climbing back up only to slide down again. It’s now stuck just below the resistance line, as if the market’s playing a game of “Come on in, the water’s fine” but nobody’s actually diving. The 100- and 200-day moving averages are still hanging out around 108K, watching from afar like distant relatives you never see. As long as BTC stays below these, the trend’s not exactly singing “happy days are here again.” The RSI is flirting around 45, refusing to yell “Buy!… or sell!” – instead, it just sulks in the middle.

The $90K-$95K territory? That’s the line in the sand. Cross it convincingly, and maybe-just maybe-this bear-market Bambi can start to walk upright. Until then, we’re just watching a rally in the middle of a bigger downslide, the crypto equivalent of a toddler’s wobble.

The 4-Hour Chart

Zoom in, and it’s a game of “breakout or breakdown.” Bitcoin’s forming a figure that looks like a kid showing off a new jump. It poked above a descending trendline that’s been forming since late October, only to float back down to $91K like a balloon losing helium. Meanwhile, the RSI shows signs of giving up, resistance itself waning. If the buyers can’t hold the line around $90K, a tumble back to the $80K abyss looms like Monday morning. But if they rally enough to punch through $94K-watch out, 100K+ dreams are back in play, like a cat chasing a laser pointer.

On-Chain Analysis

Active Addresses (100-Day Moving Average)

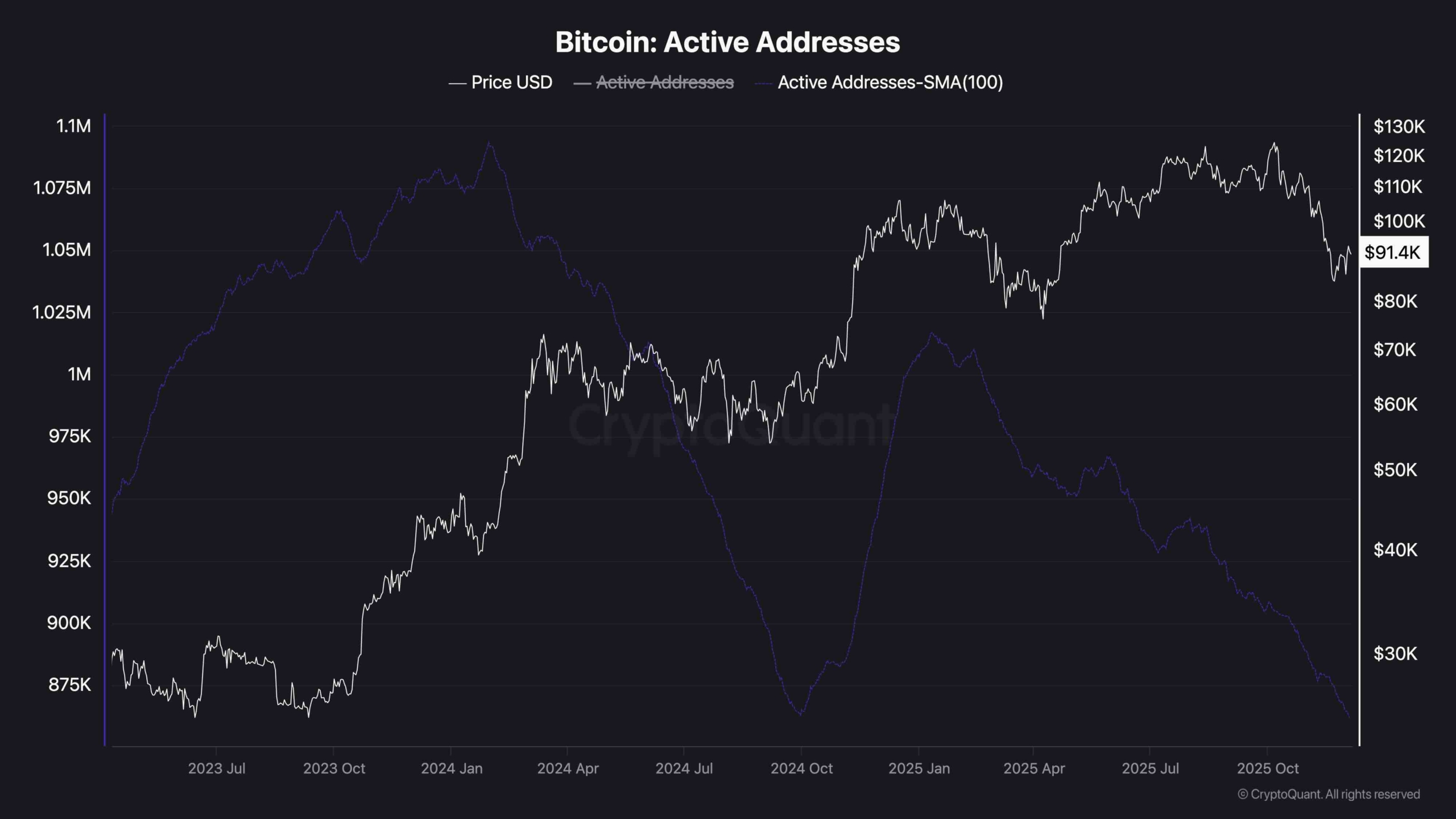

Here’s a plot twist-despite Bitcoin’s shiny new highs, the number of active addresses has been shrinking like a sponge in the rain since February 2025. During October and November’s stomach-churning dips, this divergence became mouthy. Now, even as the price climbs a bit-to $91K-fewer folks seem to be tapping into the network, with active addresses dipping below 875K. It’s as if the crowd has decided to take a permanent coffee break, leaving whales and big institutional players to throw the party solo.

For a rally to have legs, we like to see more activity, more chatter-morehood. Until that recommences, this bounce feels more like a trick than a treat-suspicious and a little disappointing.

And there we have it-the wild, weird rodeo that is Bitcoin now. 🎢🤪

Read More

- Gold Rate Forecast

- Crypto’s Wall Street Waltz 🕺

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- Trump Jr.’s Thumzup Bags $50M-Because Why Mine Diamonds When You Can Mine Meme Coins? 💰🤑

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- Solana’s $200 Gambit: Will This Blockchain Darling Finally Deliver? 🚀

- 🚨 IRS Goes on Vacation: Crypto Taxes in Chaos! 🚨

2025-12-05 16:44