Ah, Bitcoin-never a dull moment. Just when you think the crypto crowd has learned their lesson, they go and do something like flushing $30 billion worth of leverage down the drain. Turns out, the futures market is having a “leverage hangover” and needs a financial sauna. 🚿

Bitcoin Futures Open Interest Has Seen A Reset

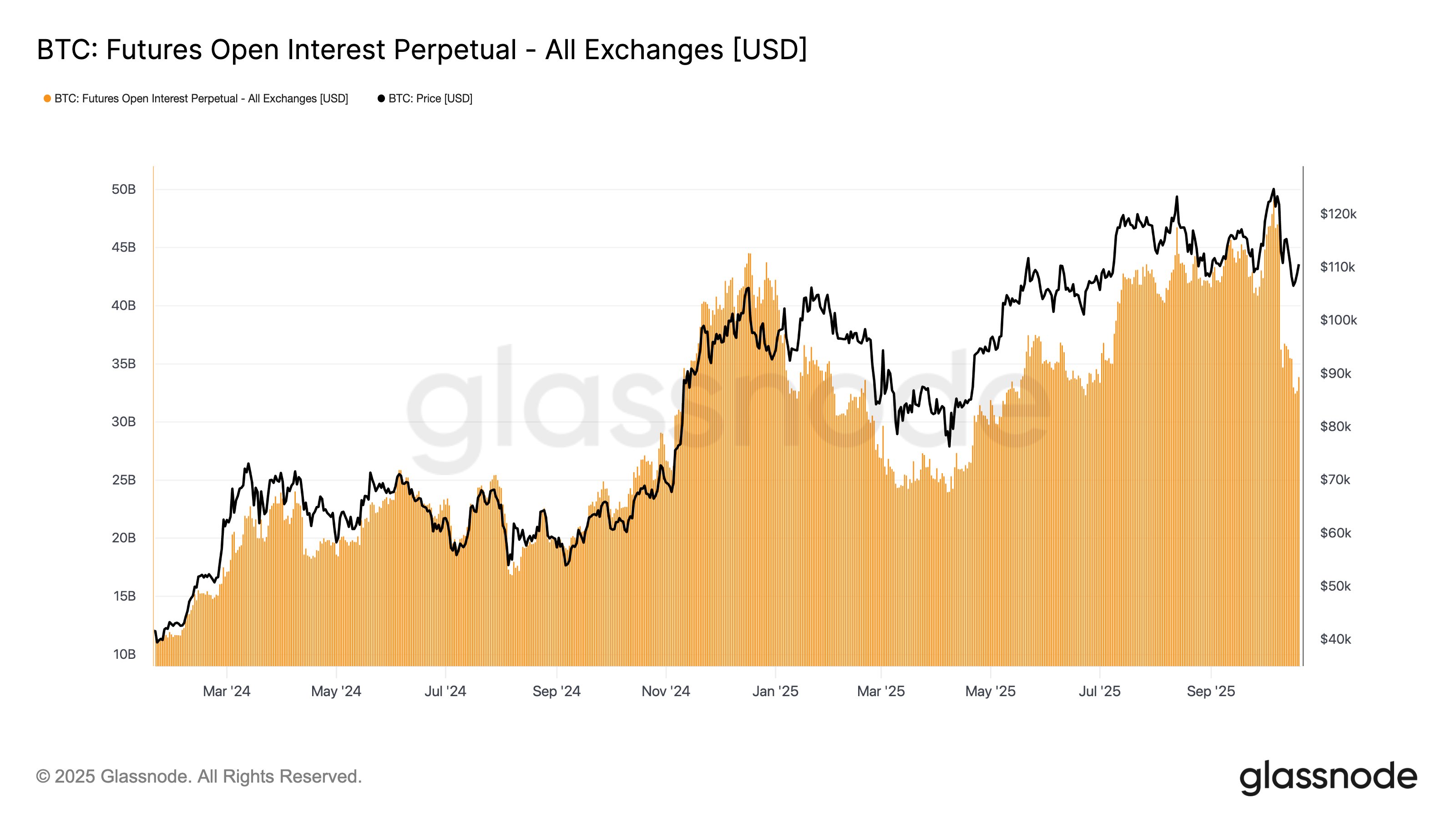

Glassnode, the on-chain analysts who probably know more about Bitcoin than your gym trainer knows about your squat form, dropped a chart showing the Bitcoin Futures Open Interest plummeting like a bad investment in 2008. This metric, which basically counts how many people are gambling on crypto’s future (literally), has taken a nosedive. 📉

For the uninitiated: when Open Interest goes up, it’s like everyone’s shouting, “I’m in!” and opening new bets. But when it crashes? That’s the market’s version of a detox. Either traders are voluntarily packing up their crypto tents 🏕️ or their platforms are yanking their positions like a financial exorcist. Either way, it’s a sign of chaos cooling off-or a prelude to more chaos. Only time will tell if this is a pause or a setup for a sequel. 🎬

Here’s the chart Glassnode shared, because nothing says “I care” like a graph:

Notice that glorious spike when Bitcoin hit $126k? Classic. Everyone thought they were Warren Buffett in a crypto cape, until reality hit like a 10,000-ton whale. The subsequent crash in Open Interest? That’s the market saying, “Oops, too much leverage. Time to reset.” 🚨

Leverage, as we all know, is the crypto equivalent of a loaded gun at a barbecue. When it piles up, the price becomes a yo-yo-swinging wildly until someone gets whiplash. Then comes the dreaded “squeeze,” where prices swing so hard it liquidates half the market. It’s like a domino effect, but with more panic and fewer dominos. 🃏

After Bitcoin’s ATH, the squeeze happened. Positions got flushed out like a bad week of takeout. Since then, BTC’s been on a rollercoaster, but with Open Interest down 30%, maybe the excess leverage has finally been scrubbed. Or maybe it’s just the calm before the next storm. Either way, it’s a relief… for now. ☕

Glassnode also noted that the Funding Rate-a fancy term for how much traders are paying each other to keep their bets alive-is now “neutral.” Translation: no one’s in charge of the crypto party right now. Longs aren’t gloating, shorts aren’t grinning. It’s the financial equivalent of a tie in a chess game. 🤷♂️

So, is this the end of the leverage madness? Or is another liquidation cascade brewing? Only the market knows, and it’s not talking. But hey, at least Bitcoin’s price isn’t doing the cha-cha anymore. For now. 💃

BTC Price

Earlier today, Bitcoin tried to play hero and surge to $114k, but then promptly backpedaled like it remembered it had a mortgage. Now it’s chilling at $110,800, which is basically crypto’s version of a midlife crisis. Here’s what the price looks like:

So, will the market stabilize? Or will it crash into a fiscal dumpster fire? 🚀 Who knows. But one thing’s certain: crypto’s still the wild west, and the only thing more unpredictable than its price is the people trading it.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Silver Rate Forecast

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- Bitcoin to $200K?! 🚀 The Experts Say YES!

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- XRP’s Little Dip: Oh, the Drama! 🎭

- Ethereum: The Unlikely Hero of Financial Futurism Nobody Saw Coming! 💰🚀

- BONK Falls, Pump.fun Reclaims Throne – Can BONK_FUN Fight Back?

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

2025-10-22 13:48