Good morning, dear reader! The price of Bitcoin doth stand at £92,364, with its market cap hovering at a rather grand £1.84 trillion. The 24-hour trading volume of £55.80 billion moves within a narrow band between £89,425 and £93,467. Though the chart may appear tame, the momentum beneath is anything but-whispering not sweet nothings, but sharp warnings indeed. 😏

Inside the Charts: Bitcoin Spot Market Outlook Across 1H, 4H, and Daily Views

On the daily timeframe, bitcoin’s trajectory resembles the aftermath of a particularly raucous ball-priced dashed from a peak of £126,272 to a sobering low of £80,537, before retreating to a consolidation near £90,000, as if nursing a hangover. Volume tells a tale of transition: fading red candles and steadier greens hint at accumulation, not apathy. One might say the market is “resting its pretty head.” 🛌

The trend may not yet scream reversal, but a breakout above £95,000, especially with volumetric conviction, would flip the mood decisively. Until then, the price churn between £89,000 and £92,000 remains a psychological chessboard for patient traders. Caution to the impulsive-for this is a waiting game, not a sprint. 🐢

Shift your gaze to the 4-hour chart and you’ll find bitcoin flexing its short-term strength, much like a debutante at her first ball. Since a dip to £83,814, price action has clawed its way to £94,652, now grinding within a tighter channel. Higher lows and strengthening green candles suggest the bulls are warming up. Still, resistance around £94,000-£94,500 looms like a stern chaperone-bitcoin knocks, but does not yet enter. With repeated support tests holding above £89,000, the setup favors sharp entries, though one must tread carefully, lest they trip over their own ambition. 👠

The 1-hour chart, bitcoin’s version of a scandalous gossip, shows a market cooling off after a flirtation with £94,652. A pullback has returned the price to £92,000-£92,500, where it now idles like a carriage waiting for its driver. The momentum oscillator (momentum) flashes 1,060-a classic overextension signal-while the RSI at 49 confirms the malaise. With volume drying up, short-term players may find themselves stuck in quicksand unless a catalyst jolts the chart back into motion. Until then, it’s all side glances and sideways candles. 👀

Oscillator readings across all timeframes display classic symptoms of indecision. The RSI, Stochastic, CCI, ADX, and Awesome oscillator all clock in as “neutral,” with only momentum leaning negative and MACD contradictorily positive. Translation? The market is split between catching its breath and plotting its next move. For the seasoned trader, this is the kind of ambivalence that can either trap or reward depending on timing and temperament. A delicate balance indeed! 🤷♀️

Moving averages (MAs) present a curious contradiction: the 10-day and 20-day EMAs & SMAs align with upward bias, while the 30-day EMA tips bearish at £93,146. Beyond that, the 50-day through 200-day MAs are firmly tilted downward, with the 100-day and 200-day SMAs resting at £105,792 and £108,771. This split dynamic implies one thing: short-term signals are trying to muscle past longer-term bearish pressure. Any sustained move higher will need to defy gravity. Until then, the tone is best described as “hesitantly optimistic, with a chance of whiplash.” 🌀

A Look at the Leverage Machine: Bitcoin Futures, Options, and Max Pain in Focus

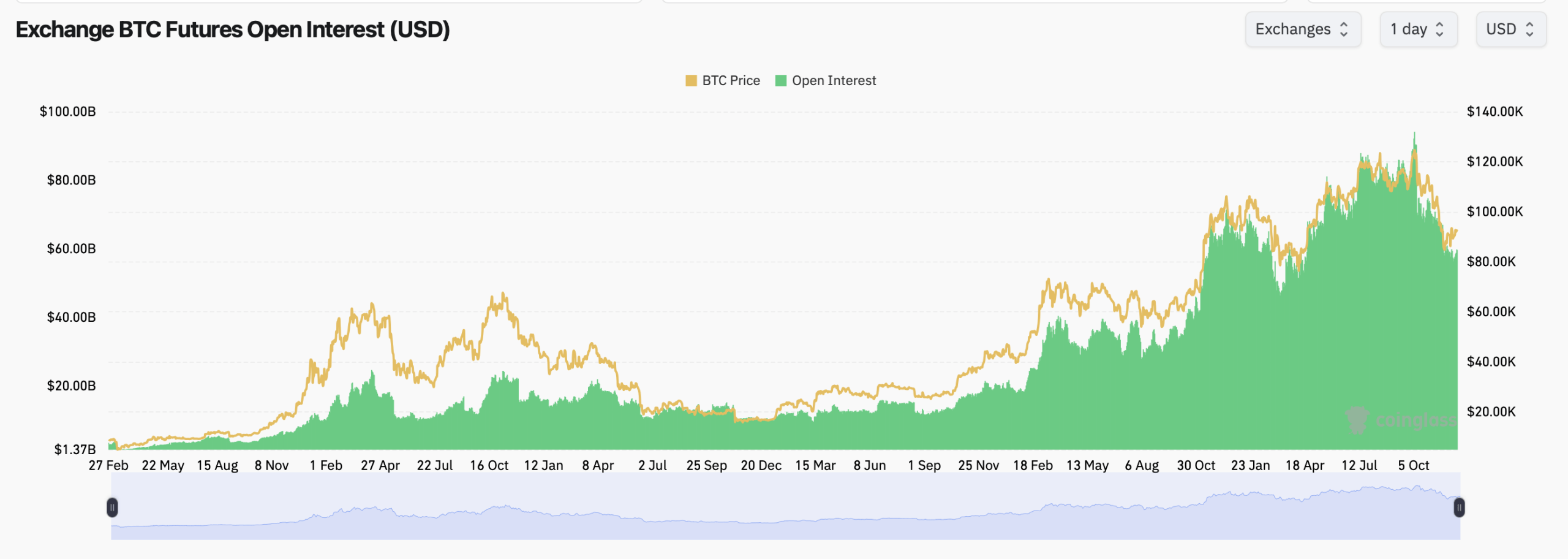

Open interest across all bitcoin futures exchanges has climbed to £59.57 billion, according to coinglass.com, with 645.34K BTC in contracts. CME leads with £11.67 billion in open interest, now accounting for 19.58% of the total-no surprise, considering its 2.10% 24-hour increase. One might say the institutions have not left the ballroom. 🎉

Binance follows closely with £10.92 billion in open interest, though its hourly growth is more of a yawn than a bullish sprint. Bybit and Gate, however, are flashing red, with declines of -0.66% and -2.24% respectively-suggesting a cooldown or a strategic repositioning. A most intriguing dance of leverage. 💃

Zooming out, the broader futures open interest trend tells a tale: it has ballooned alongside price surges, peaking mid-year before descending in unison. This pairing reflects the kind of leverage that fuels both euphoria and despair. Yet, even as bitcoin lingers in the low £90K range, open interest remains stubbornly high. The market is not merely holding its breath-it is hedging aggressively. A most prudent, if dramatic, approach. 🎭

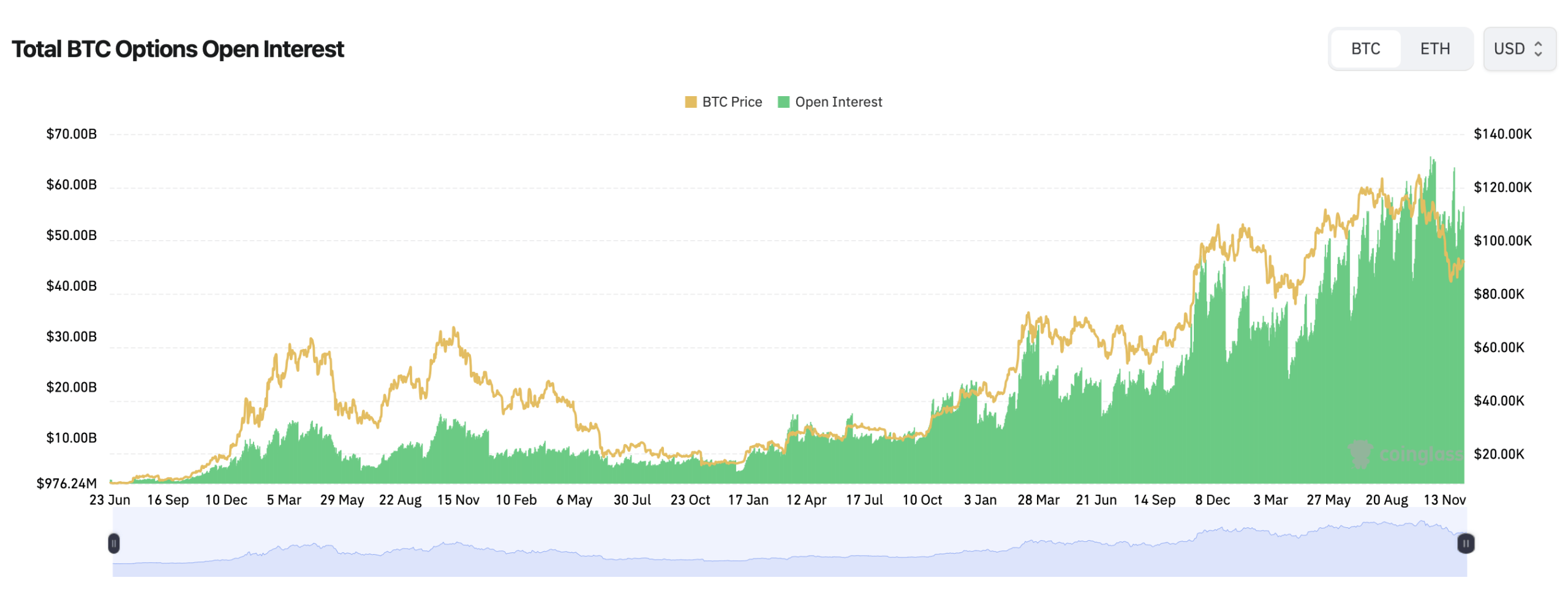

On the options front, the data is equally rich. Calls dominate open interest at 64.26%, while puts trail at 35.74%. The most crowded trade? Deribit’s Dec. 26 £100,000 call, with 18,117 BTC in open interest. Traders bet on a holiday miracle, while others fortify against the storm. A battlefield of optimism and paranoia, with neither side sparing a glance. ⚔️

And then there’s max pain-the level where options expire with the most financial discomfort, and where the market gravitates like a moth to flame. Coinglass stats show Deribit’s Dec. 26 max pain level at £100,000, a psychological magnet. Binance clings to the same level, while OKX’s pain point hovers near £93,000. This clustering suggests the market is heavily optioned for upside, but those max pain levels could pull the price back like gravity. A most precarious balancing act. ⚖️

In sum, derivatives buzz with energy, and positioning reveals a market undecided whether it’s topping off or gearing up. With open interest high, leverage thick in the air, and fireworks primed-wait for the spark. Traders may differ, but one truth remains: bitcoin’s derivatives markets are a spectacle to behold. 🎆

Bull Verdict:

The bullish case hinges on bitcoin holding its footing above £90,000 while derivative traders lean long, stacking calls at six-figure strikes and driving open interest higher. With support zones respected and spot volume suggesting quiet accumulation, the setup favors a breakout-if, and only if, bitcoin can push past £95,000 with conviction. Until then, the bulls may be loading, not leading-but the coil is tight, and the catalyst only needs to flicker. 🔥

Bear Verdict:

Despite surface-level stability, the bears have a case rooted in fading momentum, overloaded leverage, and a spot market that’s clearly winded. Oscillators have gone limp, volume dries up, and futures open interest looks more like a trap than a signal. If bitcoin fails to break above resistance and slides below £89,000, the unwind could be fast, sharp, and unforgiving-especially with max pain levels pulling price back into discomfort zones. A cautionary tale indeed. 🧨

FAQ ❓

- What is bitcoin’s current price trend?

Bitcoin is consolidating near £92,000 with resistance around £95,000 and support near £89,000. - How are bitcoin futures performing today?

Bitcoin futures open interest remains high at £59.57B, with CME leading exchange activity. - Where are bitcoin options traders focusing?

Most bitcoin options are concentrated around the £100,000 strike for the December expiry. - What’s the max pain level for bitcoin options?

The max pain point is currently clustered near £100,000 on major exchanges like Deribit and Binance.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- CNY RUB PREDICTION

- Ethereum Whales on a Buying Spree: Is $3,400 ETH Price Next? 🐳📈

- TRX PREDICTION. TRX cryptocurrency

- South Korea’s 2026 Bitcoin ETF Plan: Genius or Absolute Chaos?

- USD MYR PREDICTION

- EUR INR PREDICTION

- QNT PREDICTION. QNT cryptocurrency

2025-12-12 18:17