Oh, what a splendid morning it was, until the U.S. Bureau of Labor Statistics decided to rain on everyone’s parade with its gloomy inflation report. Early Thursday, the digital world of cryptocurrencies, particularly our dear Bitcoin, took a nosedive, much like a character in a poorly written drama.

A Market Melodrama Unfolds

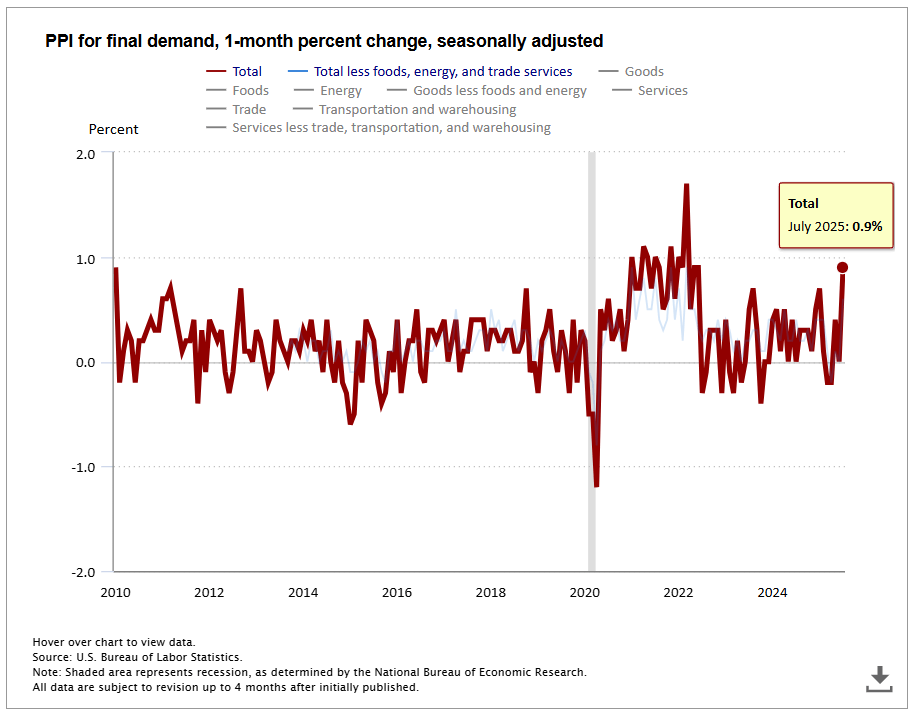

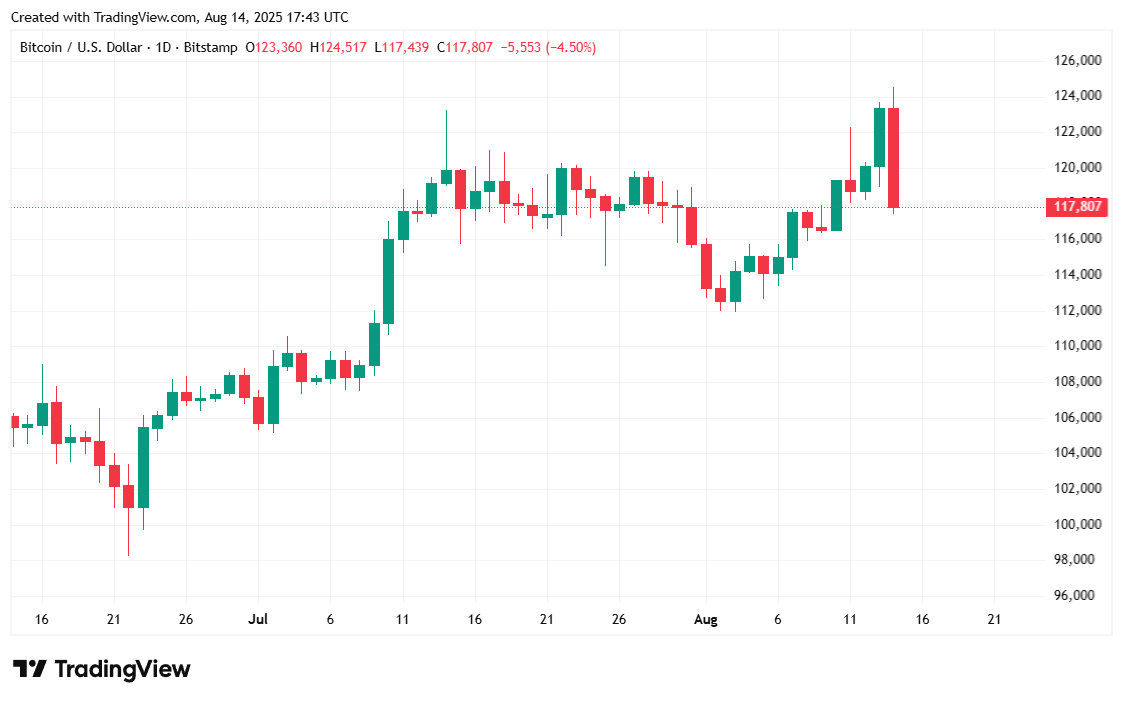

At precisely 8:30 am, the U.S. Bureau of Labor Statistics (BLS) unveiled its latest inflation data, sending shockwaves through the financial realm. The Producer Price Index (PPI), a rather important metric for those who care about such things, leaped an astounding 0.9%, from 2.4% in June to 3.3% in July. This was far beyond the modest 0.1-0.2% rise that the so-called experts had predicted. Bitcoin, our beloved digital currency, couldn’t help but join the fray, plummeting to $117K after reaching a peak of $122K just the day before. 📉

And so, the markets, like a chorus of wailing sirens, echoed the distress. Ether ( ETH), another notable player, also took a hit, shedding 3.50% to settle at $4.5K. Even the venerable S&P 500, Nasdaq, and Dow could not escape the carnage, each falling 0.19%, 0.12%, and 0.43% respectively. It was, indeed, a day of reckoning for all who dared to trade in these tumultuous times. 💀

The PPI, being a forward-looking indicator of sorts, suggested that the Consumer Price Index (CPI), which measures inflation at the consumer level, might soon follow suit. Tuesday’s CPI report, while showing a flat overall inflation rate, revealed a spike in “core” inflation, excluding the ever-volatile food and energy sectors, to a two-year high. With the PPI now surging to a three-year record, the forecast for the future looked grim, and the markets reflected this somber outlook. 😢

A Glimpse into the Market’s Mood

As of the latest reports, Bitcoin was trading at $117,919.94, marking a 3.03% decline over 24 hours but managing a slight 1.31% gain for the week, according to Coinmarketcap. The digital currency has been oscillating between $117,457.51 and $124,457.12 since Wednesday, much like a pendulum in a grand clock tower. ⏳

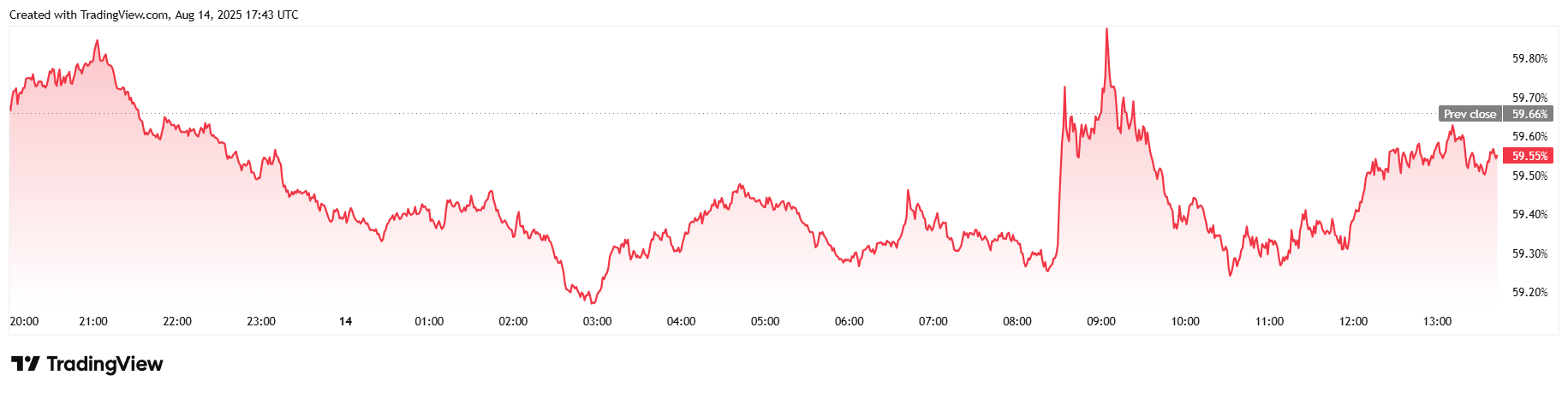

The trading volume over the past 24 hours surged by more than 30%, settling at around $108.16 billion. However, the market capitalization dipped 3.09% to $2.34 trillion, and Bitcoin’s dominance in the cryptocurrency market, always a point of pride, slipped below 60%, falling to 59.55%. 📉

The total open interest in Bitcoin futures on Coinglass increased by 1.08% to $83.13 billion, and the liquidations, oh the liquidations! They reached a staggering $225.75 million. The bulls, caught unawares by the sudden turn of events, were mercilessly liquidated to the tune of $159.25 million, while the shorts managed to salvage a mere $66.50 million. It was a day of brutal clarity, where the weak were weeded out, and the strong, if there were any left, clung to their positions with grim determination. 🦁

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- EUR KRW PREDICTION

- ATOM Soars to $2.65-Can It Reach $3.3? 🚀💸

- The Universe’s 3 Favorite Ways to Crash Crypto (And Why Yen Just Won)

- Bitcoin: A Dance Of Fragile Hope Amid Frenzied Spot Market!

- EUR USD PREDICTION

- USD THB PREDICTION

2025-08-14 22:41