In the grand theater of markets, Bitcoin now pauses, its bearish fervor cooling like a poorly brewed samovar. The price clings stubbornly above November’s nadir, yet even the most ardent optimist might squint at the frailty of bullish hope. A recent missive from the analytical priesthood, Ali Martinez, claims to divine the future via the MVRV metric-a tool as mystical as a dowsing rod for gold. One can only hope it’s better than tea leaves.

Analyst Maps Bitcoin’s Cosmic Battlefields

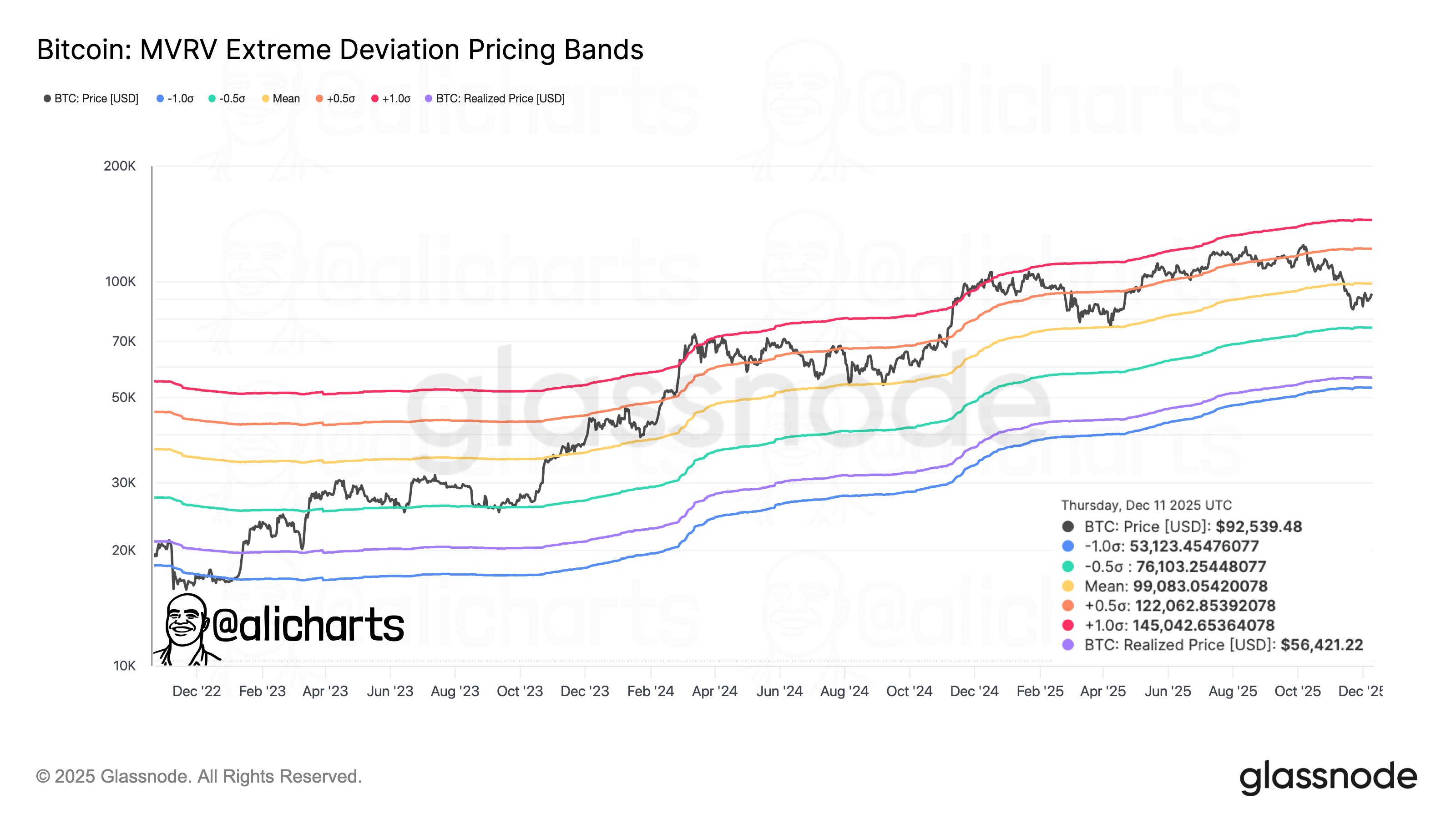

In a digital scroll dated December 12, Martinez proclaims the fate of Bitcoin rests on its duel with two sacred numbers: $99,000 and $76,000. The MVRV bands, he insists, are the celestial coordinates of this struggle. Whether Bitcoin is overvalued or undervalued depends on its dance with the Realized Price, a metric that plots extremes like a poet counting syllables. The +0.5 band? A mere trifle. The +1.0 band? A veritable Mount Olympus.

Behold, $99,000-the glittering mirage of short-term euphoria. History whispers that this price has long been a wall of sellers, as fickle as a Russian winter. Break it, and the bulls may rally like Cossacks; fail, and profit-takers will flee faster than a serf from a tax collector. Meanwhile, $76,000 lurks below, a shadowy haven where Bitcoin could retreat, undervalued and weeping. Should it fall further, the abyss at $53,000 awaits-a price so low, one might mistake it for a typo.

The chart, dear reader, is a canvas of chaos. Sellers and buyers tussle like lovers in a Tolstoy novel, each vying for dominance. The MVRV bands, with their ±0.5 and ±1.0 incantations, are the only rules in this madness. Martinez, our modern-day Nostradamus, warns that a slip below $76,000 might summon a bear market deeper than a Siberian pit. Conversely, a leap above $99,000 could ignite a bullish inferno-though one suspects the flames would be extinguished by the next rainstorm.

The Next Frontier: $122K or Oblivion?

Should Bitcoin ascend past $99,000, the +1.0 band beckons at $122,000. A lofty peak, indeed, where past bulls have met their demise. To breach it would be to flirt with history’s cruel joke: the all-time high that isn’t. Conversely, should the -0.5 band crumble, the descent to $53,000 becomes inevitable-a price so pitiful, even the most desperate investor might trade Bitcoin for a loaf of black bread.

At press time, Bitcoin hovers near $90,400, a figure that might as well be written in sand. The market, ever the enigma, marches to a drumbeat of uncertainty. And as the old adage goes: “Buy the dip, sell the rally”-unless the dip is a chasm and the rally a mirage. Then, dear reader, you are but a pawn in a game played by gods.

Read More

- Gold Rate Forecast

- BitMEX’s Great Crypto Pruning: 48 Contracts to Bite the Dust 🌡️🔥

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- XRP’s Little Dip: Oh, the Drama! 🎭

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- When Bitcoin Takes a Tumble, Who’s Laughing Now? 🤷♀️

- Bitcoin’s Wild Ride: Will It Crash or Soar? Find Out Now! 🚀💰

- Silver Rate Forecast

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

2025-12-13 22:38