Ah, the sweet taste of victory! Bitcoin‘s recent surge has left more than $1.09 billion in short contracts wiped out within a 24-hour period. 🎉💸

The Great Bitcoin Rally of 2025: Traders Beware! 📈💸

Bitcoin’s rally to a new all-time high of over $118,000 has triggered a massive wave of liquidations, wiping out more than $1.11 billion in short contracts in a single 24-hour period ending on July 11. 😱💸

According to data from cryptocurrency futures trading platform Coinglass, the value of short contracts liquidated on July 10 represents the largest single-day event of its kind so far this year, surpassing the previous high set on May 10. 📈💸

In sharp contrast, long contracts valued at nearly $120 million were liquidated during the same period, underscoring the market’s renewed bullish momentum. In total, some 261,866 traders were liquidated, with the combined value of all forced liquidations reaching $1.24 billion. 😱💸

The largest single liquidation was a BTC/ USDT contract on the HTX exchange, valued at a staggering $88.55 million. 😱💰

Leading Exchanges Account for Bulk of Liquidations: A Tale of Woe and Greed! 🏦💸

Derivatives exchange Bybit accounted for a significant portion of the total liquidations, with $291 million in contracts liquidated, of which over 98% were shorts. HTX followed with $133 million, while Gate, OKX and Binance completed the top five with $71.8 million, $54.61 million and $54.56 million in liquidations, respectively. 🏦💸

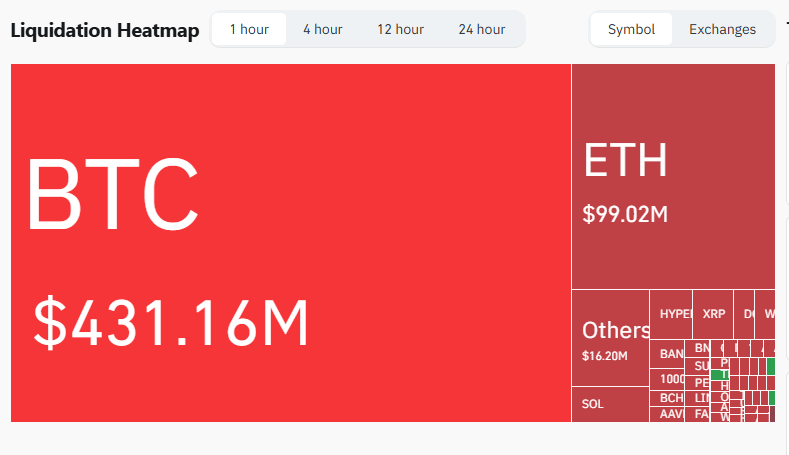

Meanwhile, the data reveals that short liquidations vastly outpaced long liquidations across all major cryptocurrencies over the past 24 hours, indicating a strong upward price movement that caught traders betting against the market off guard. With its price up by 4.82%, BTC saw the most significant liquidations. A total of $547.59 million in short positions were liquidated over 24 hours, compared to only $12.13 million in long positions. 💸💸

Following a 7.04% price increase, ETH experienced $149.09 million in 24-hour short liquidations, while long liquidations totaled $22.79 million. 💸💸

Solana ( SOL) and XRP both saw their prices rise by over 4%, with their liquidations also dominated by short positions. For SOL, $14.34 million in shorts were liquidated versus $3 million in longs. For XRP, $10.98 million in shorts were liquidated against just $1.15 million in longs. 💸💸

DOGE, up by 5.91%, also showed a strong skew toward short liquidations, with $4.73 million in shorts liquidated compared to $1.58 million in longs. In total, the top five cryptocurrencies saw over $720 million in short liquidations in 24 hours, while long liquidations for the same period amounted to approximately $40 million. 💸💸

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- Schrödinger’s Bitcoin Ruse in El Salvador? 🤔

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- Bullish Stock Soars 218% – Wall Street Finally Gets It (Or Is This a Joke?) 🐄💸

- XRP’s Little Dip: Oh, the Drama! 🎭

- Whales, Wallets, and Woeful Wealth: The Curious Case of 200 Million DOGE Moves!

- Get Ready for Ether’s Dramatic Ascent-More Than Just a Craving for Fame! 🚀💥

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

2025-07-11 09:27