Ah, Bitcoin! The digital currency that seems to have the emotional stability of a lovesick teenager. Currently, it has settled at a tranquil $89,000, much like a cat lounging in the sun, thanks to the U.S. Federal Reserve deciding that interest rates will remain as stable as your uncle’s opinions at family gatherings, nestled comfortably between 3.5% and 3.75%.

- Bitcoin is clinging to its channel low like a life raft in a sea of uncertainty.

- Reclaiming the point of control suggests that perhaps, just perhaps, it has a plan.

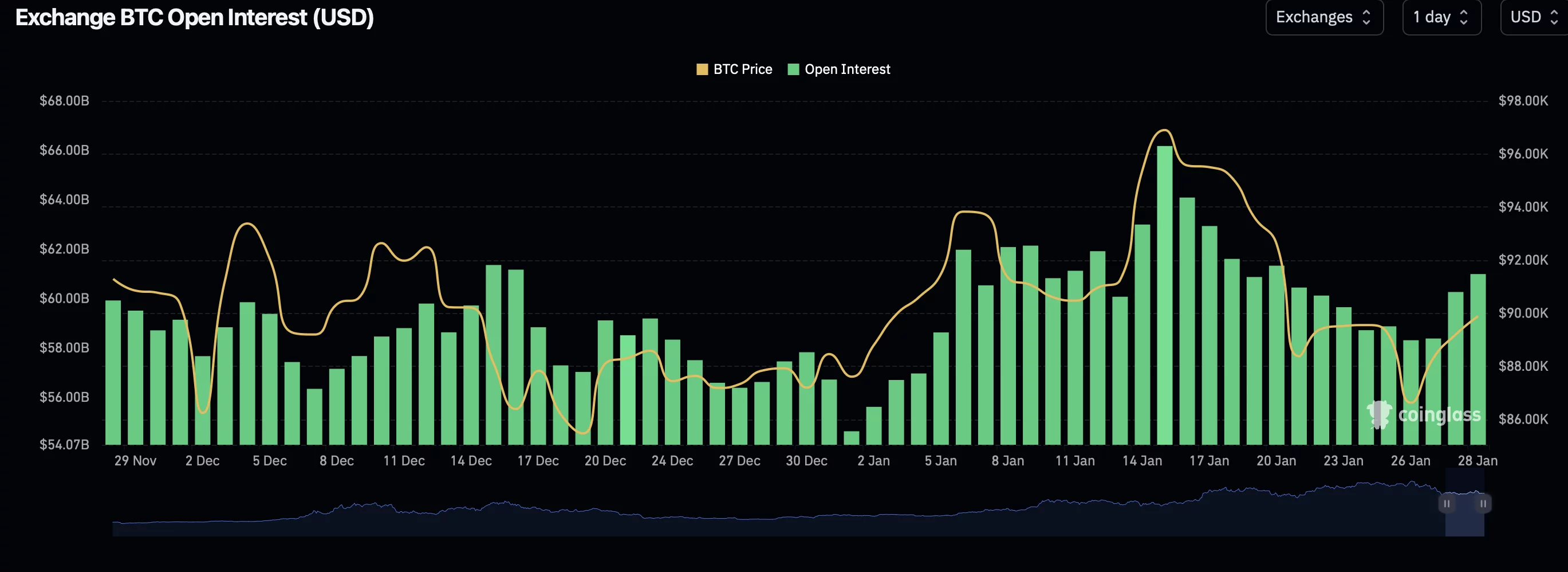

- Rising open interest hints at a potential relief rally-because who doesn’t love a good comeback story?

Our friend Bitcoin appears to be showing signs of life after a corrective phase, responding positively from a technical support zone, which is about as exciting as watching paint dry but in the world of crypto, it’s practically fireworks.

Currently flirting with the channel low, market behavior indicates that selling pressure may be easing-like a waiter cautiously approaching a table of rowdy diners. This shift is bolstered by a notable uptick in open interest, suggesting that more folks are joining the party in the derivatives market, perhaps for the free snacks.

While we await confirmation of this newfound confidence, the combination of technical support and rising positioning hints at the possibility of a short-term relief rally. Or, as we like to call it, the ‘please don’t let me fall’ phase.

Fed Rate

When the Federal Reserve decides to keep interest rates steady, it sends a signal so clear that even your grandmother could understand it: borrowing costs remain stable, making cash and bonds as appealing as a soggy sandwich.

Bitcoin, that rebellious teen of finance, often moves inversely to the dollar. So, if the dollar is having a rough day, crypto might just find a few fans eager for an alternative to stuffing their cash under a mattress.

Steady rates also suggest the Fed isn’t tightening the noose on inflation too aggressively, encouraging investors to embrace risk. And who loves risk more than our dear Bitcoin? It’s like giving a toddler a sugar rush-what could possibly go wrong?

Bitcoin price key technical points

- Channel low and value area low holding as support-like a lifeguard at a kiddie pool.

- Point of control reclaimed, signaling an improving structure, or at least a better hair day.

- Rising open interest supports the bullish relief thesis-because who wouldn’t want to believe in happy endings?

Bitcoin’s recent bounce originated from the channel low, which closely aligns with the value area low. It’s a technically dense region, much like a New Year’s resolution: full of good intentions but often lacking follow-through.

This confluence often attracts buyers looking for discounted entries within a broader range. Thankfully, the initial reaction from this zone has been constructive, suggesting a faint glimmer of hope for those brave enough to invest.

Importantly, this bounce was not immediately rejected. Instead, the price followed through just enough to reclaim a key level that often defines the range’s control, much like a cat reclaiming its favorite sunny spot.

Reclaim of the point of control signals strength

One of the more encouraging developments is Bitcoin’s reclaim of the point of control (POC). The POC represents the price level where the highest volume has traded recently and often serves as a dividing line between bullish exuberance and bearish despair.

Holding above the POC shifts short-term bias in favor of buyers. As long as Bitcoin maintains acceptance above this level, the probability increases that the recent move is more than just a simple dead-cat bounce-it could be a developing rotation higher within the channel. At least, that’s what we’re all hoping for.

Alongside the improving price structure, open interest has been increasing, adding an important layer of confirmation to the setup. Rising open interest during consolidation near support suggests that traders are actively opening new positions rather than merely closing old ones-like switching from one bad relationship to another.

This behavior typically indicates conviction, particularly when it occurs at technically important levels. In this context, the increase in open interest implies that derivatives traders are positioning for a continuation upward rather than immediate breakdown, because who doesn’t love a good plot twist?

However, open interest alone is neither inherently bullish nor bearish. Its significance depends on whether the price holds support. If Bitcoin were to lose the reclaimed levels, rising open interest could instead amplify downside-like adding fuel to a fire. But for now, positioning aligns with the relief rally narrative.

Value area high becomes the next test

If Bitcoin continues to hold above the POC, attention shifts to the value area high, which now acts as immediate resistance. Acceptance above this level would confirm that the price is transitioning back into higher value territory, strengthening the case for a move toward the channel high resistance-something akin to trying to reach the top shelf without a ladder.

This step-by-step reclaim process is critical. Relief rallies often fail when the price cannot move beyond the upper boundary of value, resulting in renewed consolidation or rejection. A clean reclaim, backed by sustained open interest and volume, would materially improve upside probabilities.

Market structure is still cautious but improving

From a broader market structure perspective, Bitcoin is still recovering from a bearish phase. While the immediate downside momentum has slowed, a full trend reversal has not yet been confirmed. Instead, the current setup favors a relief rally within a larger range rather than an outright bullish breakout, much like waiting for a flower to bloom in a concrete jungle.

That said, the improvement in structure, from holding channel support to reclaiming the POC, marks a meaningful shift compared to recent weakness. We’re cautiously optimistic, like a cat eyeing a new toy.

Bitcoin price action: What to expect

Bitcoin is at a pivotal short-term inflection point. As long as the price remains above the point of control and channel low support, the probability favors a continued relief rally toward the value area high and potentially the channel high resistance. Rising open interest supports this scenario by suggesting that traders are actively positioning at support.

However, failure to hold these reclaimed levels would weaken the bullish case and reopen downside risk. In the immediate term, price acceptance above value will determine whether this relief move develops into a sustained rotation higher-or simply fizzles out like last year’s fashion trend.

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- Get Ready for Ether’s Dramatic Ascent-More Than Just a Craving for Fame! 🚀💥

- 📉DOW DOES THE FLAMINGO: 200-Point Faceplant on Red-Hot PPI Flambé!

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- XRP’s Little Dip: Oh, the Drama! 🎭

- Will SUI Soar to $7 Despite 6% Plunge? 📈🚀

- Ripple Swoops in on Bitcoin’s Heels: 2030 Gold Rush

- A Gentleman’s Guide to Dogecoin’s Imminent Gallop-Or Perhaps a Tumble

2026-01-28 22:59