Ah, Bitcoin! The modern philosopher’s stone, where logic is as fleeting as a Gatsby party guest. One might suppose that the short-term holder balance, that most elusive of metrics, could divine market tops and bottoms with the precision of a Victorian séance. Alas, it now whispers cryptic riddles instead of revelations.

Bitcoin’s Short-Term Holders: As Static as a Portrait of Oscar Wilde

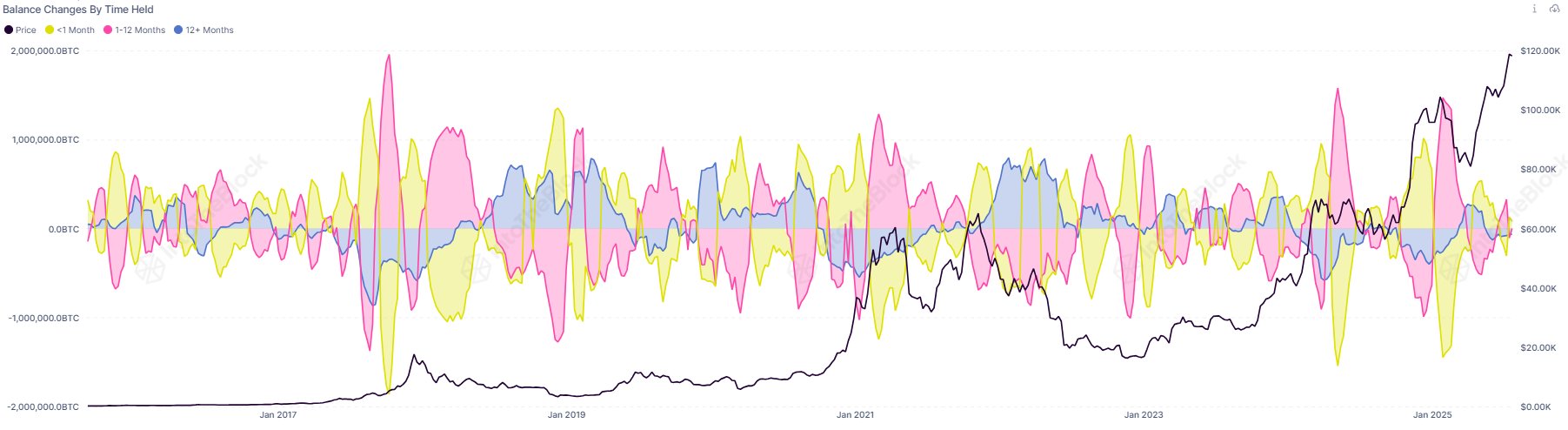

In a recent missive on X, Sentora (formerly IntoTheBlock) has graced us with a chart that divides Bitcoin’s adherents into three distinct classes: traders, cruisers, and hodlers. A most scientific endeavor, one might say, though it’s hard to imagine these categories surviving a Wildean satire. Traders, those ephemeral beings who hold their coins with the same permanence as a summer romance, are the first to dance to the tune of market whims.

Cruisers, one might say, are the socialites of the crypto world—neither fully committed to the ballroom nor content to sit in the shadows. Should they manage to hold their coins for a year, they ascend to the exalted rank of hodlers, a title as noble as it is absurd. One wonders if Wilde himself would have penned a sonnet to their fortitude.

Behold, the chart of net supply changes among these three factions. As the graph reveals, the traders’ balances have remained as uneventful as a tea party in a monastery. “Interestingly, we’re not seeing major shifts at the moment,” quips Sentora, a statement as thrilling as a monologue on the weather. One can only hope the market’s next move is as dramatic as a Wildean tragedy.

During market tops and bottoms, the traders’ balances spike with the enthusiasm of a debutante at her first ball. Cruisers and hodlers, in their turn, sell with the desperation of a man who’s just discovered his pocket is empty. The coins, thus divested, are reborn as traders’ holdings, a cycle as inevitable as the fall of a tragic hero.

Bitcoin’s recent rally to all-time highs is as subtle as a peacock strutting through a library. Yet, the traders’ supplies remain unchanged, a fact that Sentora presents with the gravitas of a Victorian sermon. Whether this means the rally still has legs or is merely treading water remains to be seen. One suspects Wilde would have called it “a most unprofitable mystery.”

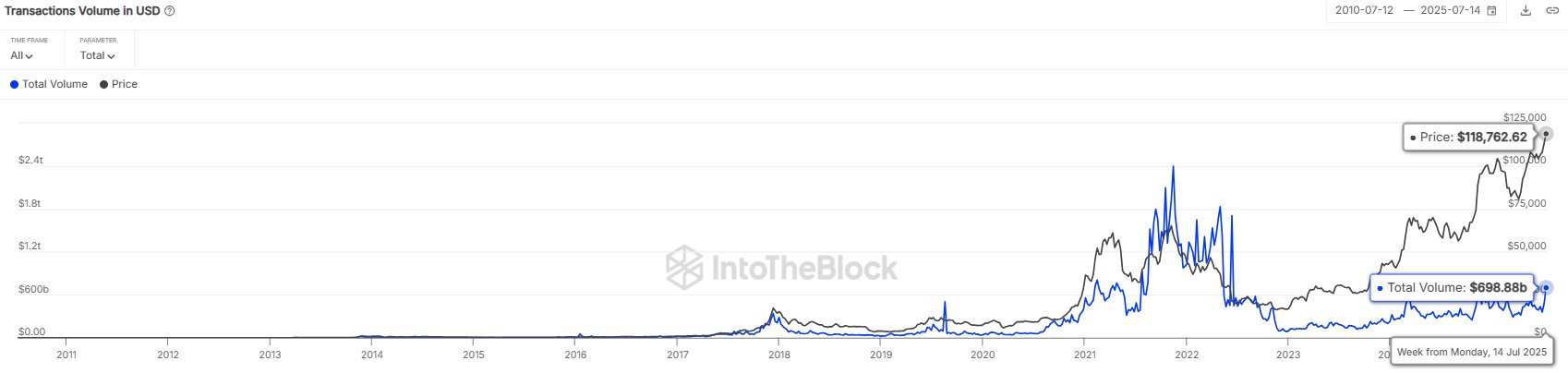

In other news, on-chain transaction volume has reached $700 billion, a figure that would make a Gatsby himself blush. Yet, compared to 2021’s frenzied heights, it’s as dull as a monochrome portrait. A most curious paradox, indeed.

BTC Price: A Dance of Indecision 💸

Bitcoin’s price, that most capricious of companions, now trades around $119,000, a figure as stagnant as a drawing-room conversation. One might say it’s in a state of “sideways movement,” a phrase that sounds far more elegant than “trading in a manner that would make a chandelier weep.”

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- EUR NZD PREDICTION

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- USD THB PREDICTION

- Davos Drama: XRP’s CEO Faces His Nemesis! 😱

- CRO PREDICTION. CRO cryptocurrency

- PUMP Gains 10%: The Memecoin Showdown You Didn’t Know You Needed! 😂💰

- China’s Crypto Dream: Stablecoins, Yuan & a Bit of Chaos-Will They Make It or Just Flop? 🚀💰

2025-07-25 08:14