Ah, Bitcoin-a modern-day Morse code signal for patience-or perhaps just buggered if I know. This week, it’s been about as lively as a Sunday afternoon in an abandoned manor. After flirting with the dizzying heights of $122,000, it’s politely refused to move an inch, limping along with a 3.1% decline over the past week and a decently unimpressive 5.8% for the month. Quite the rollercoaster, if your idea of fun involves waiting with a martini and a prayer.

Meanwhile, ETF outflows have surpassed the billion-dollar mark, stretching longer than a queue outside a trendy boutique in April. Traders are whispering of a correction-perhaps a plunge to spice things up. Yet, beneath the supposed calm, signals hint that Bitcoin might be tiptoeing toward a grander spectacle, if it can just stumble past that stubborn resistance hurdle. Think of it as an amateur magician’s act-nothing yet, but possibly something spectacular behind that velvet curtain.

Short-Term Traders Are Bleeding, albeit at a More Leisurely Pace

Every time our dear Bitcoin brushes $115,000 or some nearby fancy number, the new kids on the blockchain-those who bought within the last few weeks-start selling their freshly minted coins. The data, as reliable as a weather vane in a tornado, confirms this: on July 22, July 28, and August 6, every attempt to push higher was met with brisk selling from wallets holding coins for less than a month, as if they’ve read ‘Sell High, Cry Later’ in the crypto handbook.

This suggests that the newcomers are eager to cash out, possibly just to buy another round of overpriced coffee. But, surprisingly, since July 25, these selling sprees are losing their gusto, as if traders realize they’re flogging a dead horse. Perhaps they’ve run out of coins-or are finally learning patience is a virtue, or at least less stressful.

The Spent Output Age Bands are essentially a giant ticking clock for coins, revealing whether recent movers are fresh or seasoned veterans. When young coins are flying off the shelves, it spells a seller’s market. Less movement usually hints at a calm before the storm-or just boredom.

Want more brain food on crypto? Sign up for Harsh Notariya’s Daily Crypto Newsletter – it’s like a breakfast buffet of insights, no calories included.

Is SOPR hinting at Bottoming Out? Or Just Playing Hard to Get?

The Spent Output Profit Ratio (SOPR)-the crypto version of “Are you in profit or just pretending?”-tells us whether coin holders are cashing in at a profit or losing their shirts. When SOPR peaks, it’s usually the top of the market; when it dips, it’s the bottom-an indication you might want to sit tight and nibble on popcorn.

Recent patterns include:

- July 16: SOPR hits 1.06, price peaks at roughly $118K-lucky traders, indeed.

- July 25: SOPR drops from 1.016 to 1.01, yet the price rises-a divergence that could make a Zen master nod in approval.

- August 5: SOPR dips again, but price still climbs-confusing the critics and delighting the contrarians.

Fewer profit-takers and some who’ve decided to sell at a loss-something that often signals the market has run out of steam and might be preparing to turn the tide or at least have a sit-down.

Charting the Bullish Outlook Amid Rejections

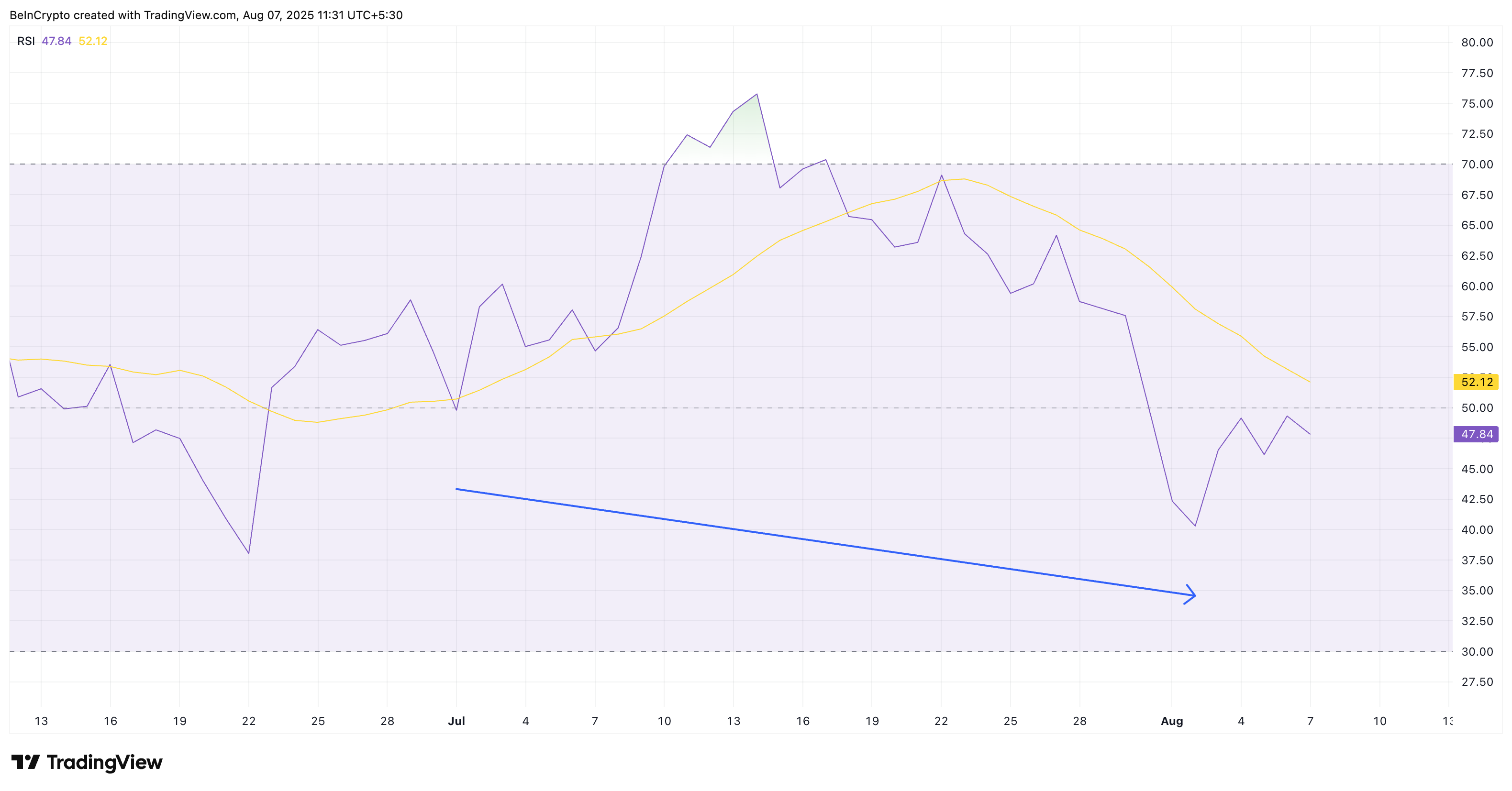

Despite flunking their resistance tests at around $115,000, Bitcoin’s good old RSI (Relative Strength Index) is whispering sweet nothings that the trend remains bullish. It’s forming higher lows-every dip less disastrous than the last-like a puppy trying to reach the cookie jar, undeterred.

Meanwhile, the RSI is showing a hidden bullish divergence-a fancy way of saying, “Hey, strength is building even if the price isn’t showing it yet.” Think of it as the quiet kid in class who suddenly drops a killer joke-they’re hinting at a bigger punchline soon enough.

Bitcoin is snug inside a bullish pennant pattern, a sort of price consolidation dance-a lot of higher lows beneath the stubborn $115K fence. If it can muster the courage to close above $117K and then $118K, we might see the breakout everyone’s waiting for. But, if it drops below $114K or especially $112K, then it might be time to sharpen those cucumbers for a nice, cold dip-say, down to $107K.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Bitcoin’s Wild Ride: A Tall Tale of $HYPER Hype & $BTC Lunacy 🐍

- Brent Oil Forecast

- 🤑 Bitcoin’s Wild Ride: Bessent’s Backpedal Leaves Markets in a Tizzy! 🌀

- Ether’s Dance: A Tragic Waltz of Gain and Greed

- Bitcoin’s Big Breakout: Fed Cuts, Crypto Cash, and a Million BTC Heist 🚀

- USD CNY PREDICTION

- KakaoBank’s Bold Venture into Stablecoins: The Future of Digital Money or Just a Digital Distraction? 🚀💰

- WIF’s Bullish Surge: Will It Break the $1.30 Ceiling or Just Keep Dancing?

2025-08-07 11:42