As of July 14, 2025, Bitcoin dances precariously on the edge of $121,680, buoyed by the weighty breath of its market capitalization, now an impressive $2.42 trillion. With a staggering 24-hour trade volume of $56.62 billion, the fluctuation whispers tales of a range from $117,935 to $123,236—a story of triumph and impending doom.

Bitcoin

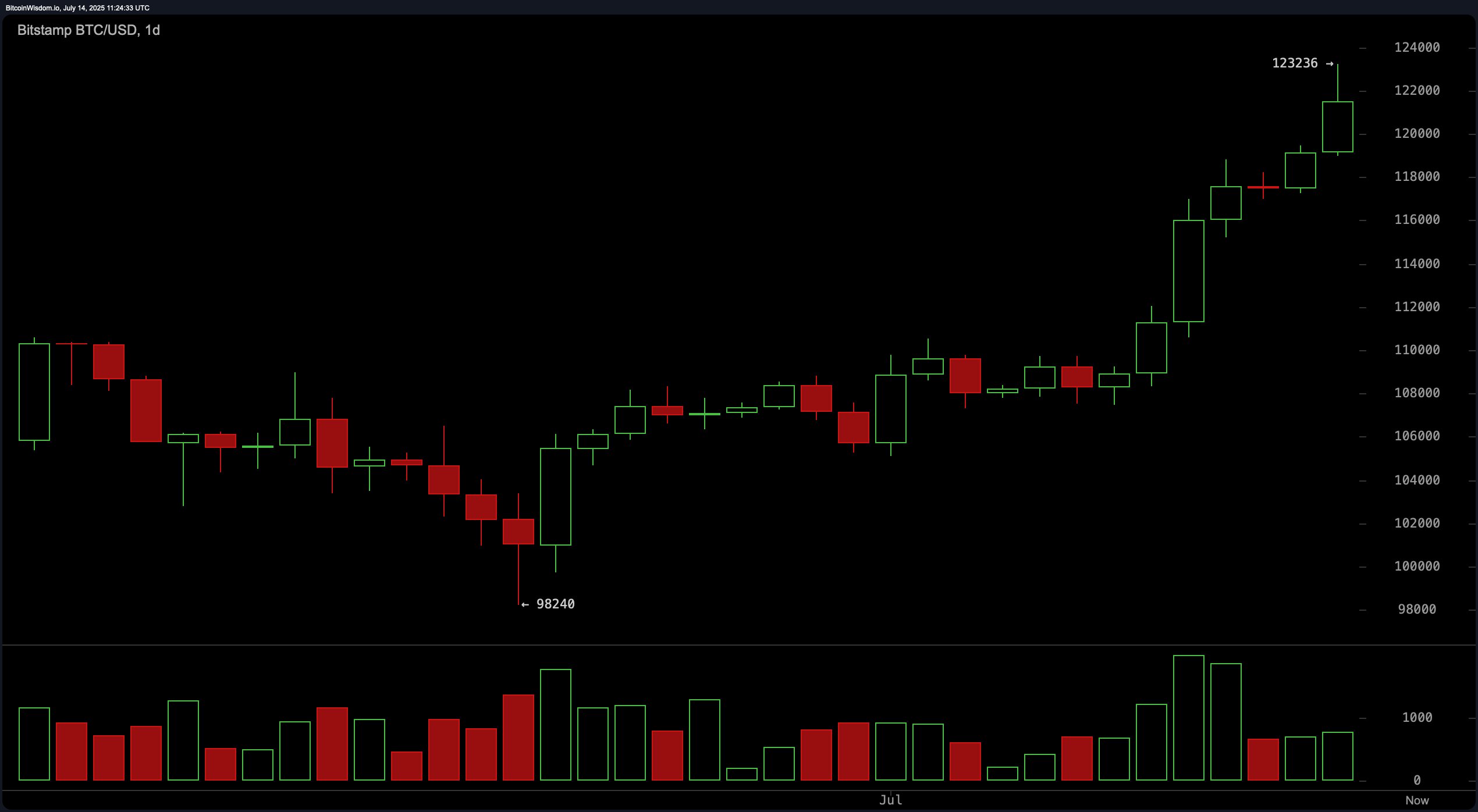

In the theater of cryptocurrency, bitcoin struts confidently in a bullish play, amidst the clamor of signals suggesting continuation of the act. Yet, beneath the glittering facade, shorter timeframes warn of exhaustion, as if the stage lights are flickering. The daily chart reveals a shiny 25 percent increase, having ascended from a humble $98,240 to touch the nearly heavenly heights of $123,236. This exuberance follows a cataclysmic consolidation, witnessed by a surge in volume—a spectacle demanded by the players. Resistance tightly clutches the $123,000 mark, while the old guard of resistance turned cozy support resides in the $110,000 realm. Our technical analysts, the vigilant sentinels, await a retest of this benevolent support, eyeing a chance to step back into the fray.

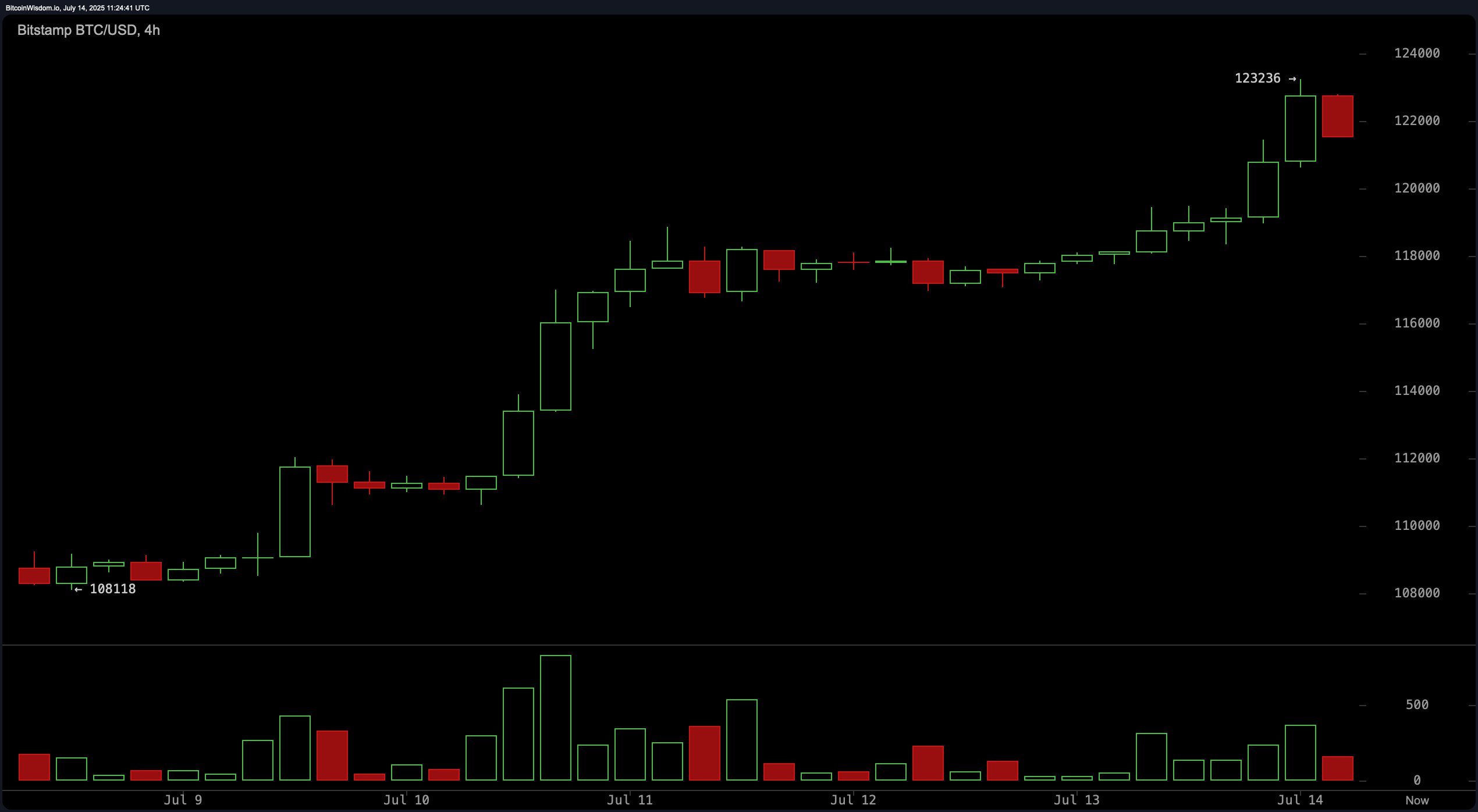

Glancing at the 4-hour BTC/USD chart, the rally appears meticulously structured, reminiscent of a staircase—albeit one currently experiencing a bout of vertigo. The present candle, as if in a comedic twist, showcases bearish inclinations after recently reaching its peak, with volume in decline as if buyers are retreating to their corners. While this bearish whisper does not herald a trend reversal, it hints at a delicate short-term pullback. Enter, our gallant traders, poised to seize opportunities beneath $120,000 and $121,000, hoping for a triumphant return to the hallowed $123,000 territory if momentum awakens from its slumber.

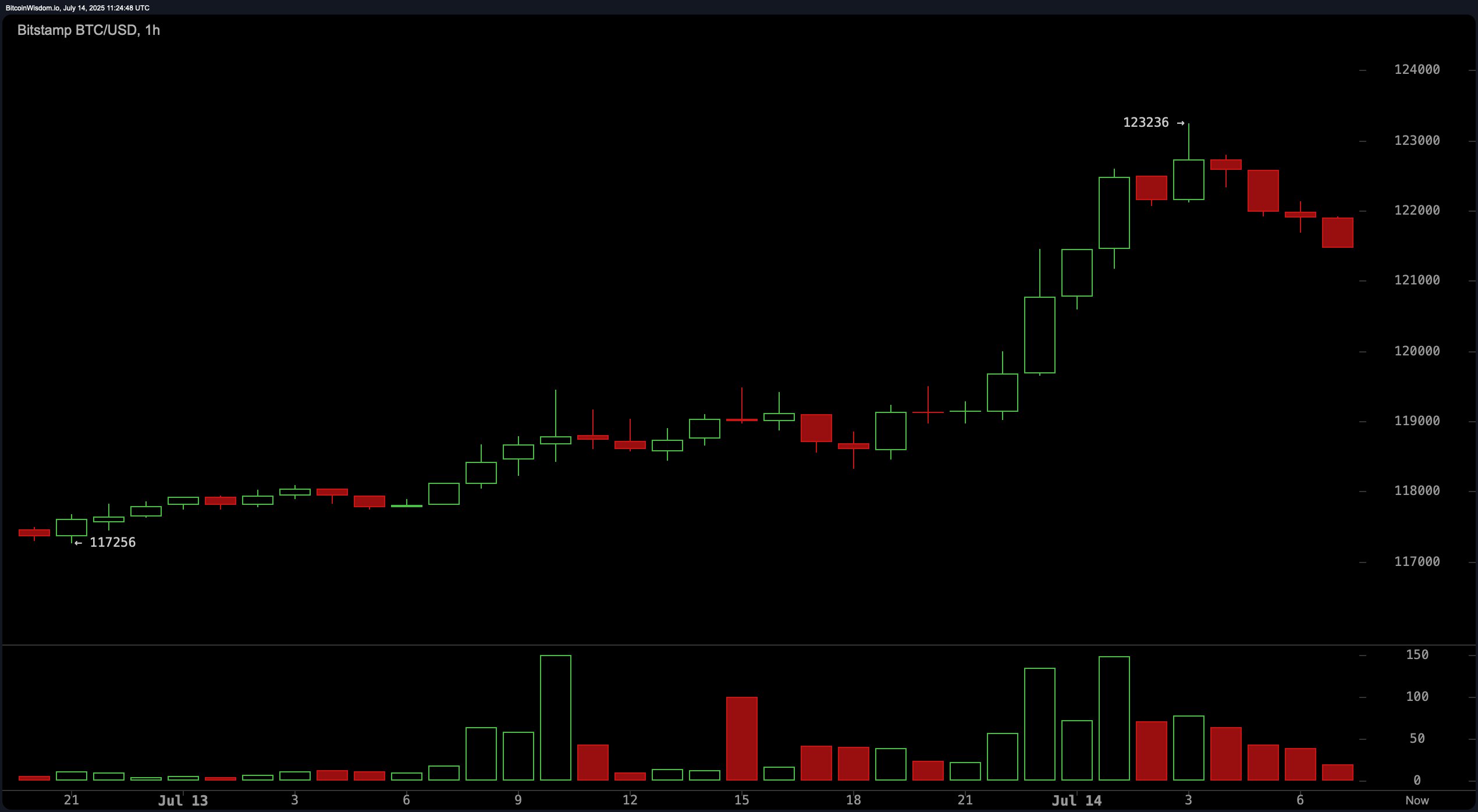

Within the confines of the 1-hour timeframe, bitcoin’s journey has morphed into a parabolic affair that now seems to cool its ardor. Treading carefully, it presents a series of lower highs following the pinnacle at $123,236, plagued by dwindling trading volume—a clear indication of profit-taking and perhaps even a touch of RSI divergence. Scalpers, like hawks, are eyeing strategic entry points between $121,000 and $121,500, while resistance lurks ominously near $123,000, ever waiting to test the mettle of even the most valiant twitch of volume.

A glance at the oscillators reveals a tapestry woven of contradictions. The relative strength index (RSI) stands at 77.8, marking overbought conditions—yet it teeters on a neutral precipice. The stochastic %K, a steadfast warrior, finds itself slightly elevated at 92.7, equally neutral in demeanor. The commodity channel index (CCI) at 195.6 dares to declare a sell signal, contrasting with the momentum indicator’s potent reading of 13,559.0 and the MACD level of 3,380.0—both heralding a call to arms for buyers. Yet, in this chaotic marketplace, the awesome oscillator and average directional index (ADX) sit coolly at neutral, a standoff that hints at waning momentum.

The moving averages (MAs), that venerable sage, endorse the overarching bullish sentiment that enfolds us all. Each temporal duration’s moving average, whether simple or exponential, exudes a buy signal. The exponential moving average (10) marks a point at $115,153.0, dwarfing the simple moving average (200) resting languidly at $97,133.0—a stark reminder of how high the price has soared from its long-term anchor. This convergence typically signals strength in the trend’s direction, although our wise traders must remain ever-vigilant against the dangers of overextension.

Bull Verdict:

The multi-faceted tapestry woven by Bitcoin, blessed by aligned moving averages and robust momentum indicators, supports a bullish forecast. Short-term retracements, akin to theatrical intermissions, are likely due to momentary fatigue, yet the grand trend remains upward, with prospects soaring towards the exalted realm of $125,000–$130,000 if the $123,000 resistance is ultimately vanquished.

Bear Verdict:

However, in the shadow of Bitcoin’s rising tide, signs of fatigue and bearish divergence loom among the short-term canvases, suggesting the current rally may teeter on the edge of overextension. Should it stumble in its quest above $123,000, a retreat toward the $110,000–$112,000 zone could become an unsettling reality, especially if volume wanes and sentiment fades like a whisper in the wind.

Read More

- Gold Rate Forecast

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- USD HKD PREDICTION

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Silver Rate Forecast

- Bitcoin’s Grand Finale: A Symphony of Chaos 🚀💣

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Brent Oil Forecast

- Tokenization: The New “Mutual Fund 3.0” You Didn’t Know You Needed

- WazirX Miracle: Hacked Bucks Bounce Back! 💸😂

2025-07-14 16:33