Were one sufficiently dull or unfortunately full of hope to possess a modest stash of Bitcoin, the past few days would have proved rich in suspense and poor in cocktails. Bitcoin, that digital darling of feverish hedge fund managers and opinionated uncles, found itself hovering awkwardly near $108,000—an indecisive ghost at a particularly expensive banquet. This was, perhaps, due to the ritual calming of international tensions, which had recently set financial strategists on edge and sent more than one junior analyst sobbing into his desk salad.

With the echoes of a 90-day tariff holiday still ringing in traders’ ears, Bitcoin staged a recovery that was less “glorious resurrection” and more “budget three-act play.” Lately, though, the price gyrations seem to hint at a potential reversal. That ineffable bearish mood (“bearish” being code for: time to blame Goldman interns) has sauntered back onto the scene, shrugging off all institutional optimism, not least from two beasts of burden rather grandly named Strategy and Metaplanet (presumably one a PowerPoint and the other a German electronic band).

Midterm Bitcoin Blues: Here’s the Gory Anatomy

Unruly Technical Headwinds 🧭

The price of Bitcoin in the daily timeframe has embarked on a brave, if ill-advised, swan dive. The move follows a bearish breakout from a rising wedge, conveniently formed in late May 2025—when everyone was supposed to be on holiday, not trading cryptocurrency. Daily RSI (an indicator beloved by technical analysts and mystics alike) continues its tumble, while the MACD line—presumably bored—has slouched beneath the zero marker.

According to those who pretend to know these things, Bitcoin seems democratically poised to plunge towards $92,000, presumably to visit fond memories of support. (Ah, support levels: the well-worn sofa of crypto trading.) A grander, statelier support still reigns at $76,000, a number with all the excitement of a tax accountant’s summer picnic.

High-Octane Short Liquidation Leverage 🚀💥

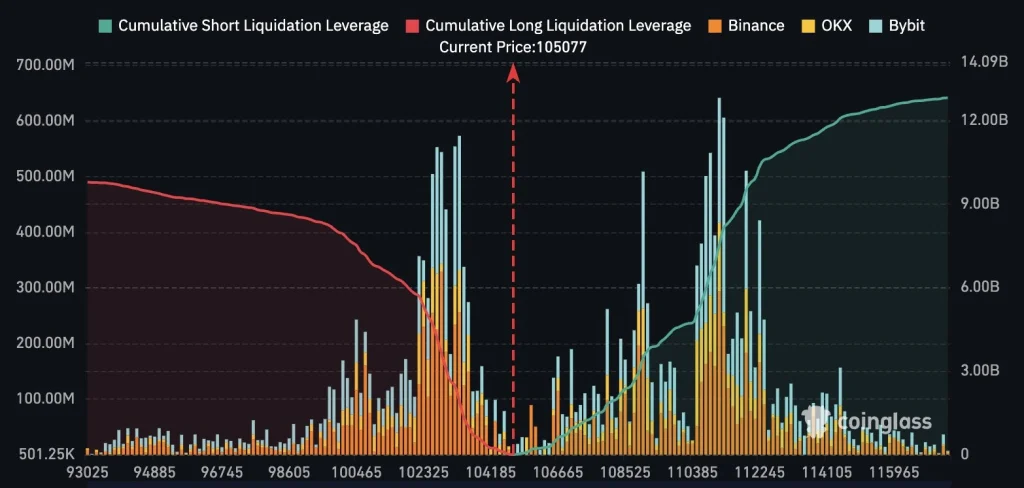

As if the technicals weren’t sufficiently gloomy, the bear parade grows rowdier: short liquidation leverage has swelled to an eye-watering $12 billion near $112,000. Time and again, institutional whales—those strange creatures who holiday in Zurich and feed on spreadsheets—leverage the futures market in what appears to be an elaborate mating dance of accumulating crypto before the masses arrive, parabolic rally hats askew.

On-chain data confirms what the suspicious already suspect: institutions are snapping up BTC with the fervor of hedge fund kids at an open bar, amassing 3.47 million Bitcoins across 251 impressively named treasuries. Should the coin ever actually “moon,” there will presumably be a stampede—followed by the raising of several entirely new taxes.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- EUR KRW PREDICTION

- 🚨 IRS Goes on Vacation: Crypto Taxes in Chaos! 🚨

- The Davos Drama: Crypto, Banks, and Brian Armstrong’s High-Stakes Tea Party

- Solana Staking Soars! Is $60 Billion the Secret Sauce for Success?

- USD PKR PREDICTION

- EUR NZD PREDICTION

2025-06-26 22:54