Ah, behold the chaotic theater that is the Bitcoin derivatives market – where on Tuesday, as if summoned by some infernal bell, a monstrous 201,435% liquidation imbalance thundered through like an uninvited guest at a funeral, according to the oracle CoinGlass. 🍿

Meanwhile, Michael Saylor, that titan of audacity, strode onto the stage to announce yet another multibillion-dollar grand gesture from Strategy Holdings: a purchase of 4,048 BTC for $449 million, each coin dearer than a luxury Russian doll at $110,981 apiece. A bargain! Or so one might dream.

But no, dear reader, instead of a triumphant parade, what followed was a merciless sell-off, dragging the cryptic king below $109,000 – a price level that set leveraged positions trembling across exchanges as though caught in a sudden Siberian winter. ❄️

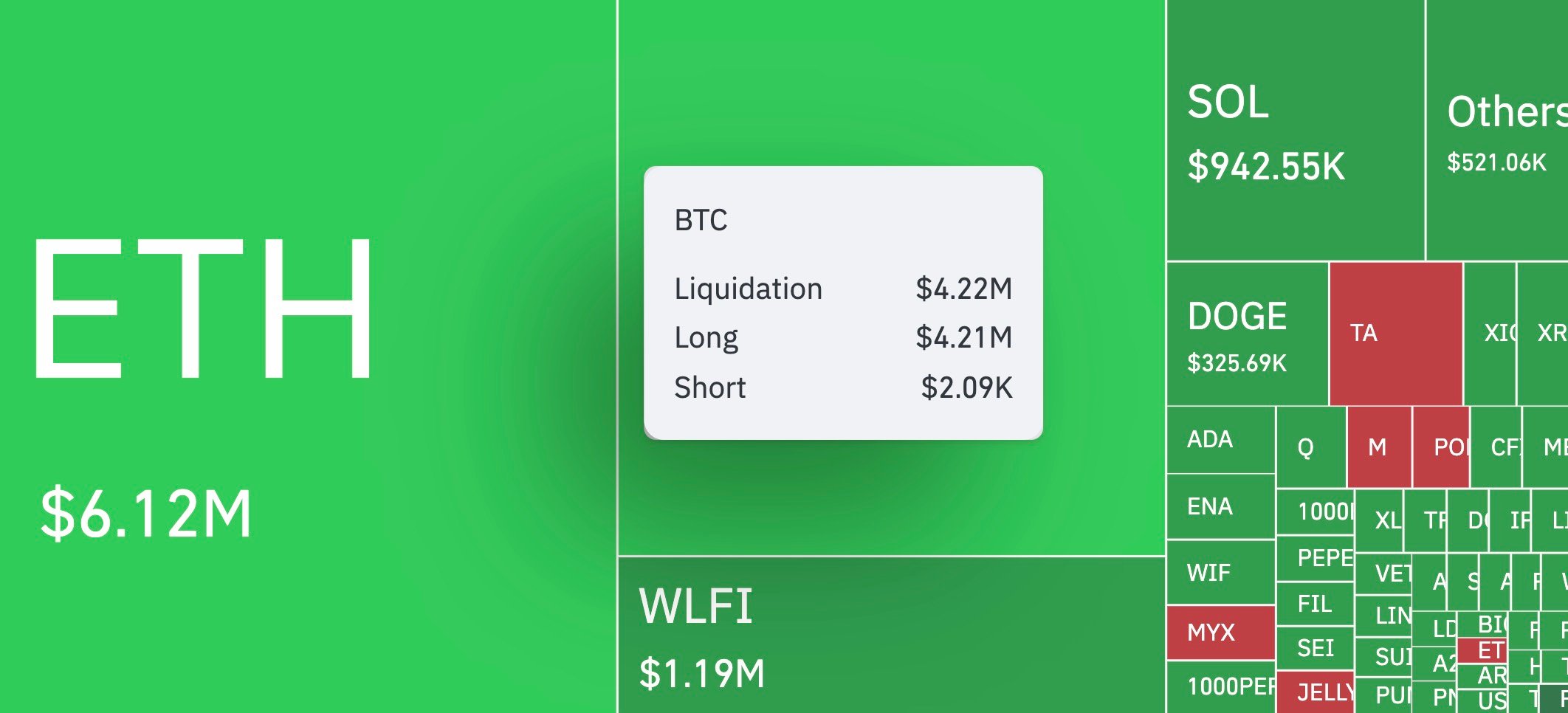

In a mere hour following the fanfare, a spectacular $4.21 million in Bitcoin longs were liquidated, while a mere $2,090 fell on the short side – clearly, the imbalance was crouching in the shadows, giggling like a mischievous cat.

But lo, this was not a lonely incident. Across a single day, over $393.9 million in leveraged positions evaporated into the digital ether, with long contracts suffering the heavier blow: $292 million compared to $101.8 million on shorts. The market, it seems, has a wicked sense of humor.

Whose margin call was most painful? Grab your popcorn.

Binance played its part in this melodrama, enduring the largest liquidation spectacle – an ETH/USDT position worth nearly $9.8 million. And so the collateral damage spilled beyond Bitcoin, dragging altcoins into the maelstrom like innocent bystanders in a brawl gone sideways.

Meanwhile, Saylor’s horde of 636,505 BTC gleams at an average cost of $73,765 per prized coin, amassing a kingdom valued at $46.95 billion – a papery 25.7% gain that would make any accountant nervously sip their vodka. 🥂

The moral of this tale? Despite the heroic accumulation by lords like Saylor, Bitcoin’s price dance is choreographed more by the shadowy puppeteers of derivatives than by corporate shopping sprees. And today’s colossal imbalance is the punchline to that bitter joke.

Read More

- Gold Rate Forecast

- USD HKD PREDICTION

- Trump Jr.’s Crypto Gamble: $1M Bitcoin & 2,500 Doge Miners! 🐕🚀💸

- Web3’s Global Tango: Asia’s Retail Flair Meets Western Institutional Swagger

- Bitcoin Booms Again! Whale Frenzy, Hype & a Shot of Hyper to the Moon 🚀

- Harvard Sage’s Bitcoin Blunder: Rogoff’s 2018 Prophecy Spectacularly Implodes 🚀😂

- Grayscale’s Avalanche ETF: A Tale of Hope and Volatility 🚀💰

- Why BNB Price Almost Broke $1,000 (And Why You Should Care)

- Binance Bewildered: 900 Million Dogecoins Crash the Party-Is the Moon Cancelled?

- Bitcoin’s Grand Finale: A Symphony of Chaos 🚀💣

2025-09-02 17:52