In the grand theater of finance, where fortunes are made and lost faster than a moth can find fire, the esteemed Bitcoin (BTC) whispers its secrets to those audacious enough to listen. The whispers, as reported by the sage-like firm Swissblock, indicate that the illustrious crypto titan may soon be scaling the lofty heights of all-time highs once more. Can you believe it? 🎢

In a dazzling revelation on the vibrant social media platform X, Swissblock boldly proclaims that Bitcoin still has upside potential! How shocking! Key metrics, like stubborn house guests, show no signs of overstaying their welcome at the top.

“Has BTC reached its pinnacle? The current market structure says, ‘Not even close!’ Let’s indulge in three neat, data-driven charts that point to further ascendancy, anchored firmly in:

- A complete lack of psychic abilities

- The prevailing absurdity of human greed

- Charts that may or may not resemble an artist’s fever dream

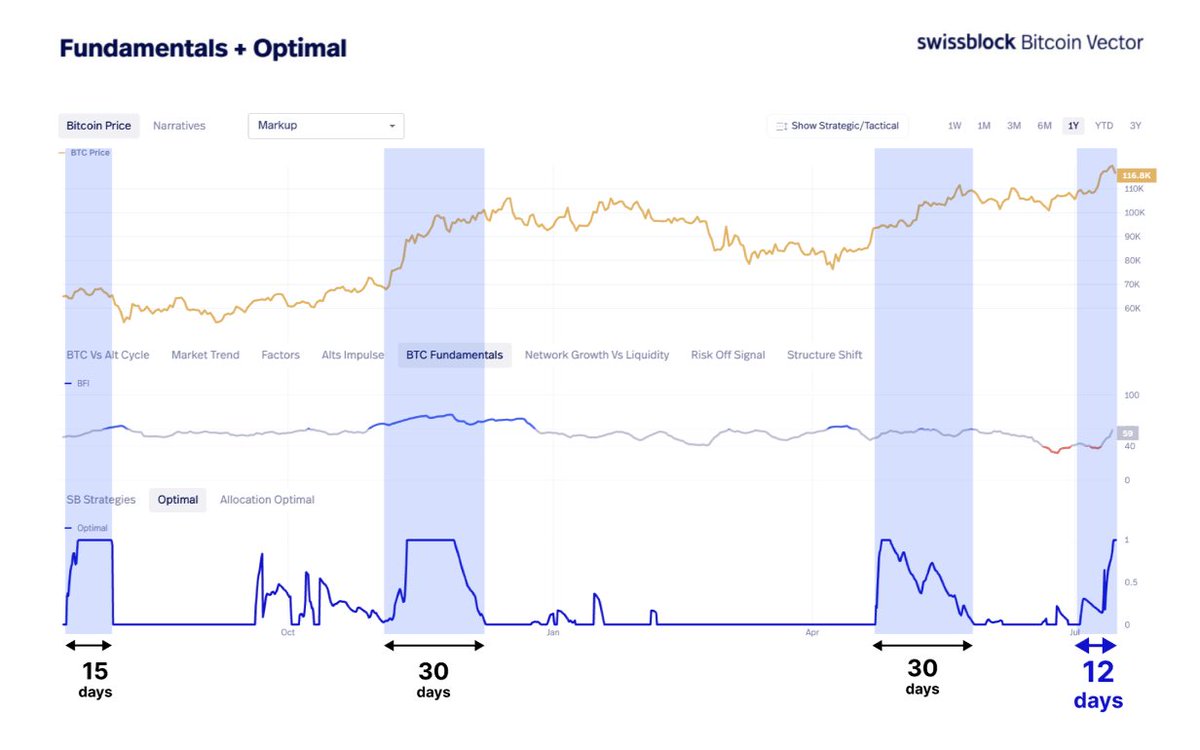

According to Swissblock’s “Optimal Signal,” a rather pretentious-sounding metric, the duration of Bitcoin’s prior explosive moves suggests we still have over 10 days of delightful uptrends left to enjoy—cozy, isn’t it? 🕰️

“According to the illustrious Bitcoin Vector’s Optimal Signal, prior major expansions have lasted anywhere from 15 to 30 days. We’re currently on day 12—like a climactic soap opera episode, with excitement bubbling up as capital also sidesteps into ETH. This cycle, dear friends, is just warming up.”

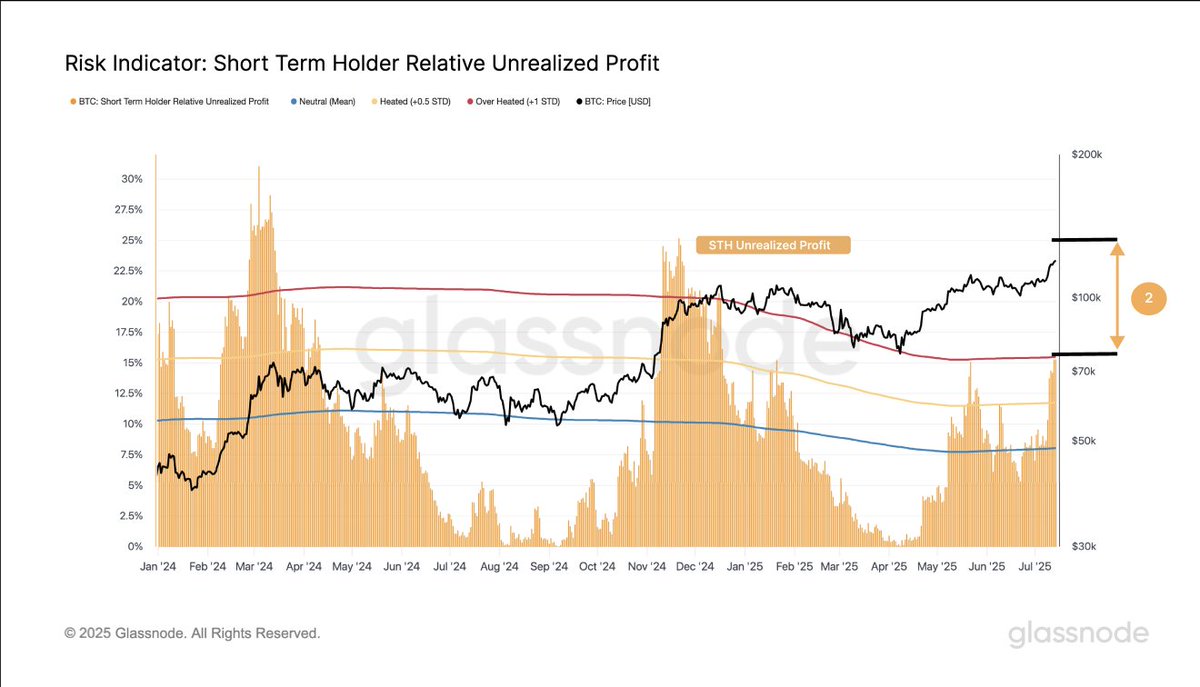

The narrative continues with insights from the mighty Glassnode and their Short-Term Holder (STH) Relative Unrealized Profit metric—a tongue-twister if there ever was one! Essentially, it measures the total profit of every coin that has traveled through the ominous gates of lower pricing before flourishing at its current value.

“Glassnode’s STH Relative Unrealized Profit is still sulking below the heights of past cycle tops (January and April 2024). Market participants seem blissfully unaware of any profit-taking mania or euphoric ecstatic dances—yet.”

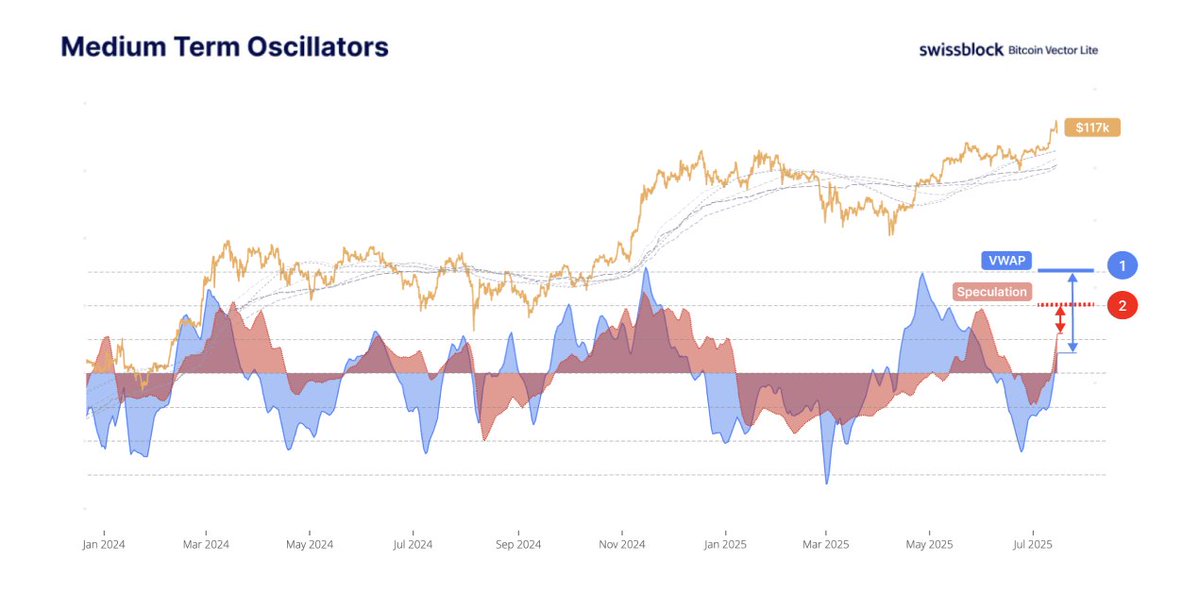

To cap off this enlightening spectacle, we must turn our eyes to the venerable Willy Woo, a sage among mere mortals. His volume-weighted average price (VWAP) indicator, alongside his whimsical “Speculation Index,” suggests that Bitcoin hasn’t quite reached its cycle peak—yet another jaw-dropper!

VWAP, for those not versed in the arcane arts of finance, represents the average price but is weighed gloriously for trading volume. A true marvel!

“Both [Willy Woo’s] Speculation Index and VWAP Liquidity reaffirm that the market remains refreshingly unbothered. Neither indicator has approached the exaggerated extremes of prior cycles, implying ongoing support for those ascending prices.”

As the clock ticks away, Bitcoin is trading for a stunning $119,042 at the time of our reflection. Who wouldn’t want to hold onto a ticket for this rollercoaster ride of raucous capitalism? 🎟️💰

Read More

- Gold Rate Forecast

- Crypto’s Wall Street Waltz 🕺

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto ATMs: The Wild West of Fraud 🤑🚨

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- YZY Token: A Tale of Hype, Folly, and 🤑

- Ripple’s RLUSD Invades Japan: Crypto’s New Empire Begins?

- DOGE ETF: Because Who Needs Bitcoin Anyway? 🚀

- EU’s Crypto Crackdown: Can Regulations Keep Up with the Wild West?

2025-07-17 17:42