Ah, Bitcoin – the digital darling that has the audacity to confuse and bewilder investors at every turn! It recently took a tumble, dropping approximately 6% to $90,400, following a rather dramatic $18,000 fall in November, according to the ever-reliable TradingView and Yahoo Finance. While the short-term outlook is tinged with shades of bearishness, the die-hard institutional fans are apparently sticking around to lend support to this volatile beast.

Bitcoin Faces Short-Term Pressure – Hold On Tight!

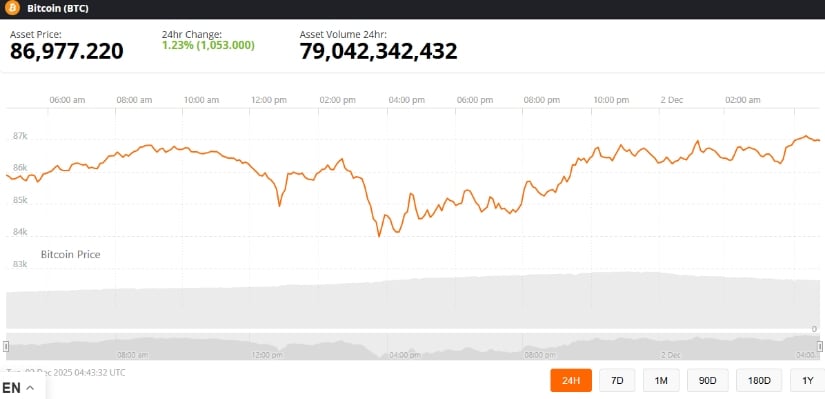

In the thrilling rollercoaster that is 2025, Bitcoin (BTC) has been tossing and turning with extreme volatility, largely due to a mix of technical corrections and market sentiment – which, let’s face it, is about as stable as a house of cards on a windy day. As of December 1, 2025, the digital token found itself hovering at $90,400 after November’s dramatic dive. Traders, in their infinite wisdom, are currently reassessing their positions, having presumably recovered from prior gains… or perhaps just taking a moment to breathe.

Quantitative trader @KillaXBT, known for publishing models and charts that make even the most seasoned analyst sweat, has forecasted a possible medium-term correction. His charts – with their intricate overlays of Bitcoin’s wild ride in 2021 and its shocking 75% crash – suggest we may be headed toward a similar fate. But, as he wisely advises, “Don’t shoot the messenger,” because, after all, predicting the future of Bitcoin is akin to predicting the weather in a tornado.

Technical Indicators Suggest Bitcoin Might Need a Nap

Let’s dive into the technicals, shall we? Oh, how they love to tease us. According to TradingView, Bitcoin’s monthly charts are showing signs of a sluggish decline and potential reversals. Translation: buyers are losing a bit of their vigor, and the bulls may need to take a coffee break. But not to worry, the long-term fundamentals (such as growing institutional adoption and ETF enthusiasm) are still in Bitcoin’s corner, like a cheerleader holding a pom-pom that says “don’t panic, we’ve got this!”

As for Bitcoin’s price? Well, it may have become a little too eager and overbought, with prices rising faster than a teenager’s heart rate before a big exam. This could mean a quick correction is on the horizon. But hey, what’s life without a little volatility, right?

The Dreaded $55K – Could Bitcoin Head There Next?

Some ominous voices in the crypto world are suggesting that Bitcoin might slump towards the abyss – or, at least, the low $55,000 range – if the current bearish momentum keeps up. Yes, according to @KillaXBT’s analysis, if things go south, Bitcoin may take a dive towards the $55,000 zone. But don’t start planning your exit strategy just yet – this is all speculation, of course.

For those brave enough to trade in such turbulent waters, some analysts are suggesting a strategy: sell between $85,000 and $95,000 and consider a re-entry near $60,000. But remember, these are just “illustrative scenarios,” not a surefire blueprint for success. Because who doesn’t love a good guessing game?

Long-Term Hope – The Bullish Vision for Bitcoin’s Future

Now, before you rush off to sell your BTC holdings and buy a nice, stable stock like… well, anything else, there’s still hope on the horizon. Despite the short-term drama, Bitcoin’s long-term outlook remains bullish. Based on TradingView and CoinDCX data, the current correction is just a tiny hiccup in an otherwise upward trajectory. Key support levels between $80,000 and $82,000 – with even deeper support around $76,000 – might just keep Bitcoin from spiraling too far down. Think of it as a safety net for the brave.

Should Bitcoin break below $76,000, there may be cause for concern – but not enough to sound the alarm just yet. However, if it holds steady, we might see Bitcoin eyeing that sweet spot around $123,000-$125,000, where it’s previously found a comfy resting place before resuming its ascent. Oh, the sweet scent of nostalgia.

Key Levels to Watch – Don’t Blink!

For those bold enough to chart the stormy seas, Bitcoin has been hovering in the $85,000-$87,000 range, where it’s currently finding some demand. Key technical indicators – including RSI and MACD – suggest Bitcoin may be oversold, while a weakening bearish divergence hints that the downtrend might be nearing its end. But who knows? The crypto market has a knack for keeping us all on the edge of our seats.

-

Support Levels: $85,000 (swing low), $83,000 (next demand)

-

Resistance Levels: $86,500 (breakout test), $89,500-$93,500 (supply)

These price ranges might help traders make sense of the chaos, but remember, Bitcoin is like that unpredictable friend who shows up at your party uninvited – and leaves with your best snacks.

Bitcoin’s Forecast – Hang On, It’s a Wild Ride

While short-term caution is still the name of the game, Bitcoin enthusiasts are holding on to the long-term promise of this digital revolution. Analysts suggest that keeping an eye on technical patterns, demand zones, and institutional activity is key. So, stay tuned – macro factors like ETF inflows and interest rates could tip the balance one way or another.

In summary, while Bitcoin may be eyeing a brief flirtation with the $55,000 range, long-term prospects remain shiny. Strong technical support and an ever-growing list of supporters could very well see Bitcoin on its way to that much-anticipated $125,000 mark… or at least that’s the dream. 🤑

Read More

- Crypto’s Wall Street Waltz 🕺

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Centrifuge Hits $1B & My Mother Finally Asks “What’s a Token?” 😱

- EUR KRW PREDICTION

- Crypto Chaos Unveiled: Gains, Losses & More Drama Than Your Aunt’s Tea Party! ☕🪙

- USD HKD PREDICTION

- XRP: The Cryptocurrency That Dares to Dream (and Fail) 😅

- Dash Crypto Implodes: Will It Crash Like a Mel Brooks Movie?

2025-12-02 22:12