Welcome, dear reader, to the US Crypto News Morning Briefing-a daily dose of financial absurdity served with a side of caffeine. ☕

What happens when the sagacious musings of Warren Buffett collide with Bitcoin’s erratic charm? A Canadian fintech, Mogo Inc., has decided to play matchmaker, proving that patience, discipline, and digital assets can coexist-like a vegan steakhouse. 🥩🌱

Crypto News of the Day: Berkshire Hathaway’s Investing Ethos Finds a Crypto Ally

Mogo Inc., a Canadian fintech par excellence, has somehow managed to convince the digital asset world that Warren Buffett’s investment wisdom can coexist with Bitcoin, much like one might convince a chihuahua to guard a castle. 🐶🏰

In May 2024, Mogo adopted the Berkshire Hathaway playbook, a document so sacred it’s rumored to be written in invisible ink and whispered by monks. The goal? To integrate long-term, disciplined investing principles into its wealth platform. A bold move, akin to suggesting a lobster should learn jazz. 🦞🎷

This pivot away from speculative trading was a masterstroke of restraint, emphasizing patience, temperament, and behavioral discipline-core tenets of Buffett’s philosophy, which, if we’re being honest, sounds suspiciously like advice from a therapist. 🤔

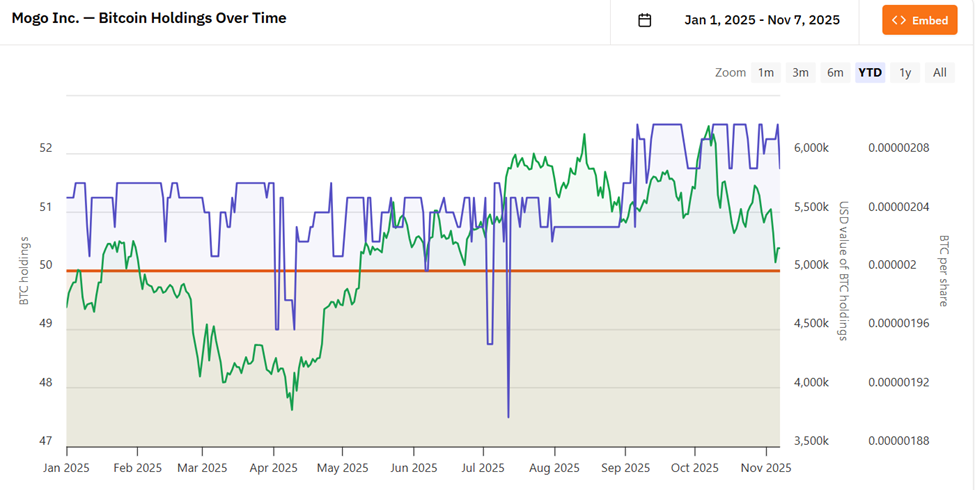

Eighteen months later, that philosophy is showing tangible results in Mogo’s digital asset strategy, particularly Bitcoin. Their Bitcoin treasury has grown by 300% quarter-over-quarter, reaching $4.7 million. One can only assume the boardroom now smells of ambition and freshly mined cryptocurrency. 💰

“Mogo reports continued platform growth and record assets under management in Q3 2025,” said Mogo Inc. President and co-founder Greg Feller. A statement so understated, it could be the new definition of humility. 😅

In Q3 2025, the company increased its Bitcoin holdings by over 300% quarter-over-quarter, bringing the total to $4.7 million. This follows a July 2025 move, where Mogo’s board approved a strategic initiative authorizing up to $50 million in Bitcoin allocations as a long-term reserve asset and capital benchmark. A decision made with all the subtlety of a marching band in a library. 🎺📚

The Q3 allocations were funded through excess cash and monetization of other investments, all while maintaining operational liquidity. A feat so impressive, it’s like baking a soufflé while solving quantum physics. 🧁⚛️

Bitcoin as a Strategic Reserve: Merging Buffett Discipline with Digital Assets

The board has formally designated Bitcoin as a long-term reserve asset and capital benchmark. This signals a structured, treasury-focused approach to crypto holdings rather than short-term speculation. A revelation so profound, it could make a monk reconsider his vows. 🙏

The initiative forms part of a broader evolution of Mogo’s Intelligent Investing platform, which integrates both self-directed and managed investing. A system so clever, it might just convince your cat to trade stocks. 🐱📈

The system utilizes behavioral science to reduce impulsive trading and encourage measured, long-term decisions. These principles align with the Berkshire Hathaway ethos. A strategy so wise, it could even convince a goldfish to save for retirement. 🐟💼

By pairing this disciplined framework with a growing crypto allocation, Mogo is bridging traditional value investing and modern digital assets in a way rarely seen in the fintech space. A feat so rare, it’s like finding a four-leaf clover in a desert. 🌵🍀

Mogo’s approach contrasts sharply with the typical retail crypto market, dominated by high-frequency trading and leveraged bets. By treating Bitcoin as a strategic reserve, the company is signaling that disciplined, long-term investment principles can survive, and even thrive, in crypto markets. A statement so bold, it could make a cynic blush. 😏

//assets.beincrypto.com/img/8JEf3GJehsDSyvG42qGYoYxjHmQ=/smart/357b62bd9685470a83164f356c773805″/>

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

Company At the Close of November 6 Pre-Market Overview Strategy (MSTR) $237.20 $230.65 (-2.71%) Coinbase (COIN) $295.22 $290.88 (-1.47%) Galaxy Digital Holdings (GLXY) $30.38 $29.27 (-3.65%) MARA Holdings (MARA) $15.96 $15.65 (-1.94%) Riot Platforms (RIOT) $17.34 $16.77 (-3.29%) Core Scientific (CORZ) $20.59 19.65 (-4.57%)

Read More

- Brent Oil Forecast

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- TRON’s Fee Slashing: A Comedy of Stablecoin Errors? 🎭💸

- Bitcoin’s Quiet Sabotage: Hidden Dangers and Mow’s Cryptic Wisdom

- EUR HKD PREDICTION

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- France’s Crypto Crackdown: How Binance is Feeling the Heat 😅💸

- Ethereum: A 50% Rally or Cosmic Coin Collapse? 🚀💥

- USD UAH PREDICTION

- XRP’s Little Dip: Oh, the Drama! 🎭

2025-11-07 18:19