Amidst the tumultuous sea of financial speculation, the Bitcoin, once a mere whisper in the corridors of cyberspace, has surged to an unprecedented peak of $123,231 on the fateful day of July 14th. Yet, like all things that climb too high, it began to waver, its strength exhausted, as if the very heavens themselves had decided to test its mettle. 🌟

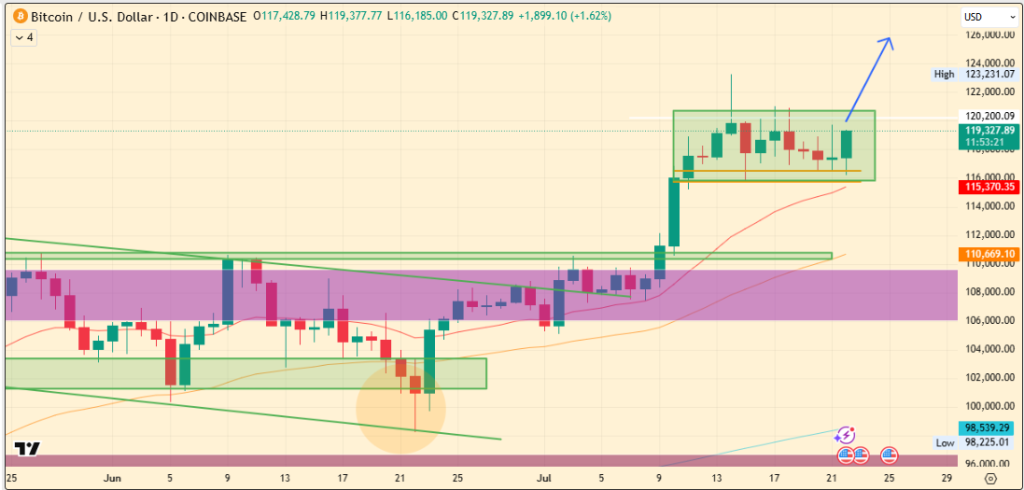

Presently, it hovers within the ominous range of $116,000 to $120,000, a zone that has become a veritable battlefield of sentiments, where bulls and bears clash in a daily spectacle of financial might. 🐂🐻

Even as I pen these words, the bulls, with a tenacity that borders on the absurd, have managed to push Bitcoin up by 1.34%, placing it at a formidable $119,018, with a staggering 24-hour volume of $74.46 billion and a market cap that rivals the GDP of small nations, standing at $2.37 trillion. 💰🌍

The air is thick with anticipation as traders and analysts alike, their eyes glued to screens, ponder the enigma of Bitcoin’s next move. Is this a mere retest, a healthy pause in its ascent, or the harbinger of a more profound correction? Only time will tell, and perhaps, the stars above. ⏳🌌

Rising Exchange Reserves Hint at Selling Pressure

A shadow looms over the horizon, a primary concern that gnaws at the hearts of investors: the rise in Bitcoin exchange reserves to their highest point since late June. According to the sagacious insights of CryptoQuant, this surge often heralds the movement of coins onto exchanges, a prelude to selling. A phase of short-term profit-taking, one might say. 📈📉

//image.coinpedia.org/wp-content/uploads/2025/07/22174722/Screenshot-2025-07-22-173915-1024×265.png”/>

Michael Saylor, ever the steadfast believer, continues his relentless accumulation, joined by other firms eager to partake in the bounty. These steady inflows underscore the enduring interest of large capital allocators, even as retail traders cash in their gains. 🤝💰

Analyst Finds $116K–$116.4K Zone As Crucial

Technically speaking, the Bitcoin price has oscillated within a narrow band of $116K to $120K over the past few days. The $116K to $116.4K range, as identified by a CryptoQuant analyst, stands as a critical support zone. From this very level, the recent intraday rise in BTC was observed. Should the momentum gather strength once more and breach the $120K mark, the near-term targets of $125K and $130K may well come into view. 🚀

However, should the consolidation in the current range persist, the immediate support must hold firm to maintain the upward trajectory. Conversely, if BTC were to break below $116K with significant volume, it could signal a steeper retracement, potentially to $112K or even $110K. Analysts, with their usual optimism, assert that the bullish thesis remains intact as long as the $110K level remains unbreached. 🛡️✨

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- The Universe’s 3 Favorite Ways to Crash Crypto (And Why Yen Just Won)

- USD THB PREDICTION

- EUR NZD PREDICTION

- Brent Oil Forecast

- Why Coinbase’s ‘Super App’ Might Be a Dud (But Buy $BEST Anyway!) 🤷♂️

- USD CAD PREDICTION

- CRO PREDICTION. CRO cryptocurrency

- Dogecoin: $1 Dream or Financial Nightmare? 🚀💸

2025-07-22 15:39