So, here’s a story about a Cardano user who thought they were just swapping some ADA for USDA, only to watch their $6.05 million evaporate like it was a bad Tinder date. ZachXBT, our favorite onchain analyst, is here to confirm that low liquidity isn’t just a buzzword-it’s a financial execution.

Dormant Cardano Wallet Awakens, Instantly Burns Millions in ADA on Liquidity Slip

Another onchain mishap unfolded this week when a Cardano blockchain user set out to grab some stablecoins and ended up parting with a hefty sum in the process. Onchain analyst ZachXBT broke the story, pointing out that the trader lost $6.05 million “due to low liquidity causing the price to sharply spike temporarily.”

Essentially, a long-dormant cardano ( ADA) wallet from 2020 jolted back to life and swapped 14.4 million ADA – roughly $6.9 million – for a mere 847,000 USDA on the Minswap dex. Because why not? The Minswap dex was probably just sitting there, sipping tea and saying, “Oh, you’re here to break things?”

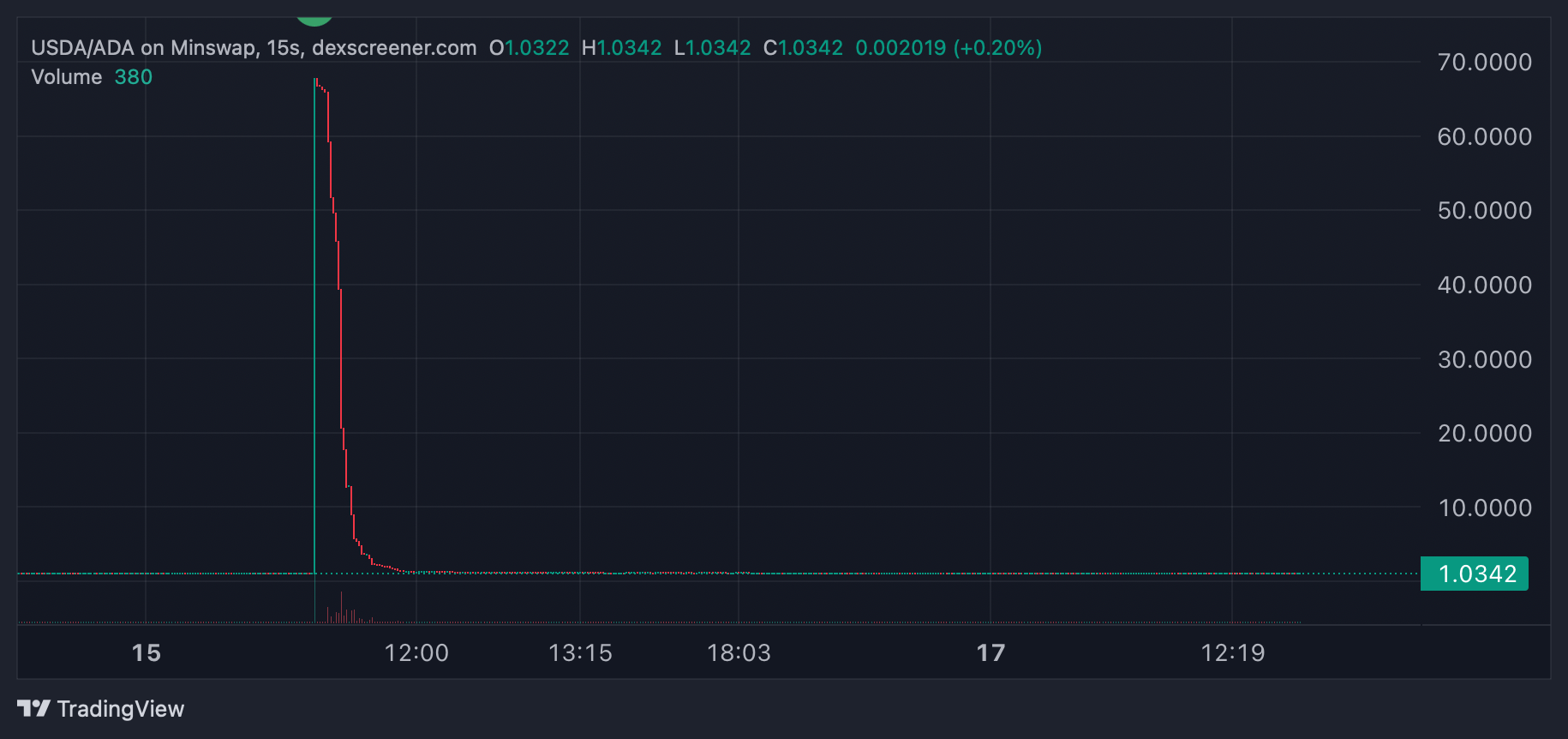

With the ADA-USDA pool holding only $1.5 million in liquidity, the trade nosedived into brutal slippage and sent the USDA stablecoin briefly careening to an eye-popping $60 to $70 per coin. Well above the intended $1 peg. Because who needs stability when you can have chaos and a side of regret?

Arbitrage traders wasted no time pouncing on the chaos, scooping up millions in ADA as the price snapped back within the hour. Classic crypto: one man’s loss is another man’s lunch. 🍽️💸

Some market trackers like Coingecko captured only a modest pop, showing USDA topping out at $4.85, while others – including Dexscreener and onchain sleuths like Lookonchain – recorded the token blasting past the $60 mark. Based on Dexscreener’s 15-second interval chart, the wild price jump lasted roughly 20 minutes, give or take, before cooling off. Because nothing says “financial disaster” like a 20-minute rollercoaster. 🎢

In the end, this episode is a blunt reminder that even blockchain architecture can’t outsmart everyday human slipups. Smart contracts, immutable ledgers, and decentralized rails may keep the gears turning, but they can’t shield users from costly misclicks, overpaid onchain fees, or overlooked liquidity pools. Cardano’s DeFi stack will evolve, but no upgrade can fully patch the oldest bug in the system – human error. Because nothing says “future of finance” like a trader who can’t read the fine print. 💸💥

FAQ

- What caused the Cardano trader’s $6.9 million loss? Low liquidity in the ADA-USDA pool triggered extreme slippage during the swap. Or, as the market might say, “Oopsie-daisy.”

- Why did USDA briefly trade above $60? A massive imbalance pushed the stablecoin far off its peg until arbitrage traders corrected it. Because nothing says “stability” like a midlife crisis.

- How long did the USDA price spike last? Dexscreener’s 15-second chart shows the jump lasted roughly 20 minutes. Long enough for the trader to panic-sell their soul to the crypto gods.

- What does this incident highlight for Cardano’s defi sector? It exposed persistent liquidity weaknesses and renewed calls for stronger stablecoin infrastructure. Or, as the market might say, “Here’s a new lesson in why you don’t trust a coin that can’t stay stable.”

Read More

- BTC Plummets: Fed Cuts Ignored in Crypto’s Absurdist Farce! 🤡💸

- OpenAI Just Made AI Models Free – Because Who Doesn’t Love Free Stuff?

- 🤯 Ethereum Whale’s $26M Gamble: Will They Survive or Get Liquidated? 🚨

- Bitcoin to $200K?! 🚀 The Experts Say YES!

- Altcoins Rise: BNB Hits New High, LINK Takes the Cake 🍰

- Crypto Chaos: Nasdaq’s $50M Wink to Gemini & Tether’s New Stablecoin Shenanigans!

- Silver Rate Forecast

- Bitcoin’s Laziest Coins Finally Roll Off Couch-What Happens Next Will Blow Your Mind! 🍿

- US Bill Proposes 21st-Century Privateers to Take on Cybercrime – Seriously

- Gemini’s New XRP Credit Card Pays 4% – Swiping Never Felt So Crypto!

2025-11-18 00:44