Gold’s $5,000 Faceplant: Will It Bounce or Just Lie There Like Larry After a Bad Date?

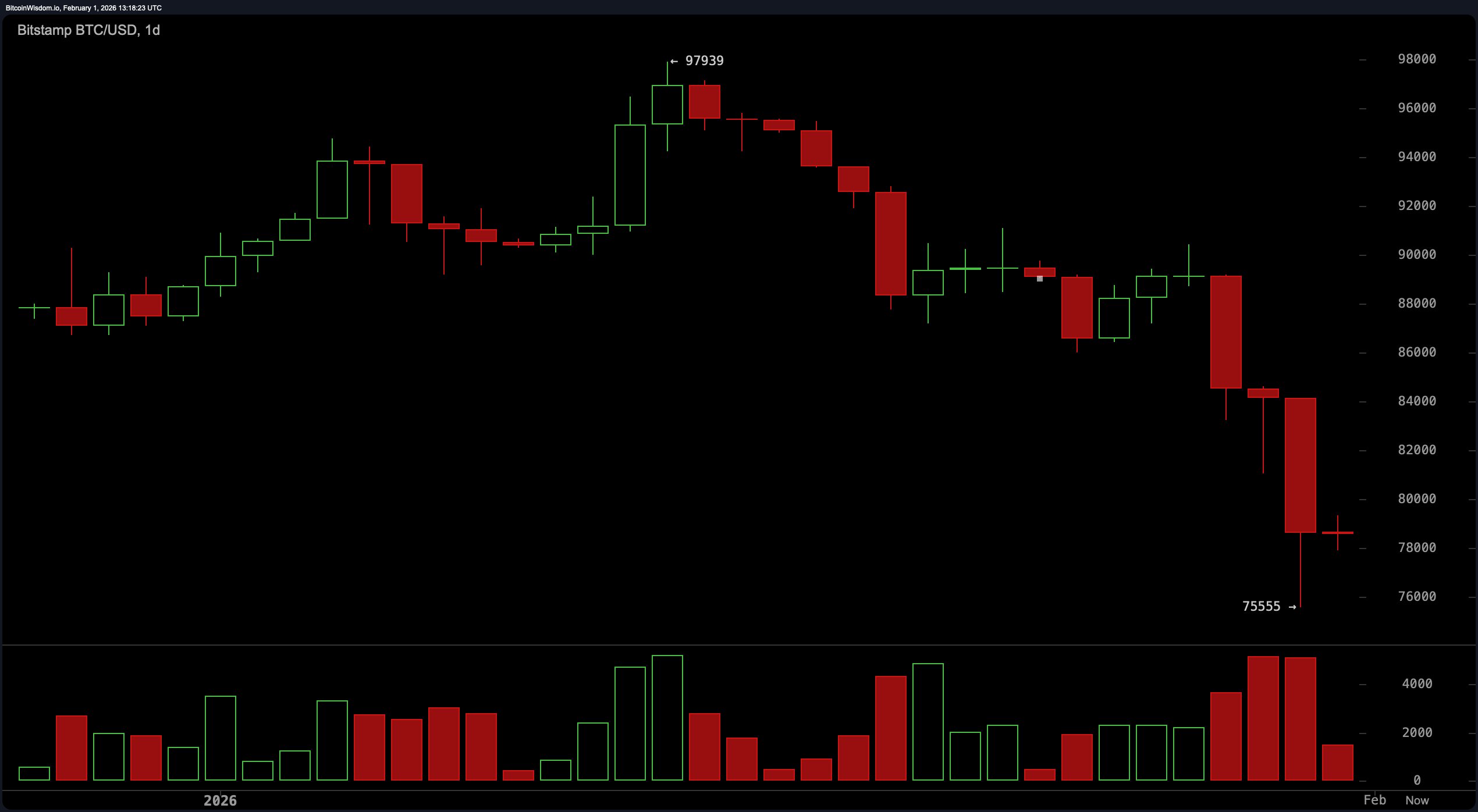

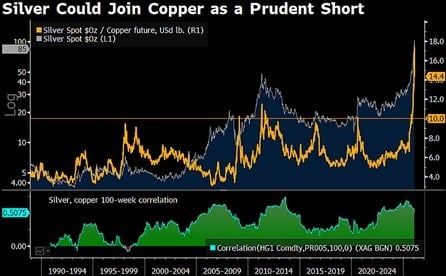

Now everyone’s panicking, asking if this is a blip or the start of a full-blown midlife crisis. Volatility’s through the roof, and macro headwinds are blowing harder than my ex’s complaints. Analysts? They’re scratching their heads like I do when I see a gluten-free menu. Correction or consolidation? Who knows? Maybe gold’s just taking a nap.