Bitcoin Company’s 2028 Cliffhanger!

They’ve bought SO much Bitcoin, they’re basically a whale… but like, a blue whale. A 🐳 whale that could potentially displace some water. Just saying.

They’ve bought SO much Bitcoin, they’re basically a whale… but like, a blue whale. A 🐳 whale that could potentially displace some water. Just saying.

“Vivopower got Ripple’s blessin’ to start buying preferred shares,” they say, “and now they’re chitchatting with big institutional sharks-hoping to snag another $300 million worth of Ripple treasure.” It’s like getting in line for the candy store, but never having to fork over the pennies. 🤑

The Hong Kong government has officially released a 10-year masterplan that could make even your grandmother want to invest in digital assets. This document is the ultimate guide to building a digital asset market where blockchain technology and traditional finance hold hands and skip through the financial meadows. And yes, they promise to keep investors safe-no guarantees on sanity though.🤹♂️

Technically speaking, SOL is the quarter’s greatest disappointment, shedding 37% of its luster. A performance so dismal, it rivals the tragic heroes of my plays. In fact, this is SOL’s most dramatic quarterly hemorrhage since Q2 2022, leaving FOMO to wither in the corner like an unloved houseplant. 🪴

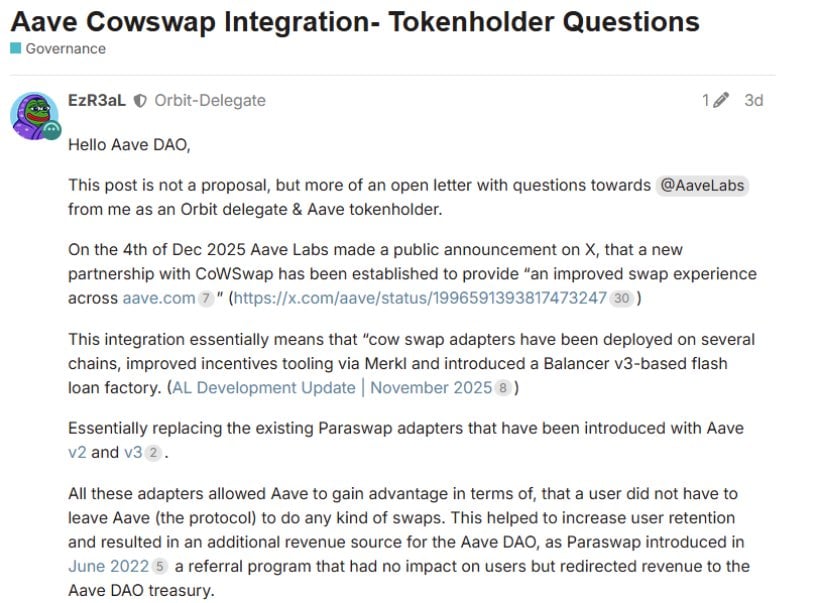

On the fateful day of December 11, 2025, a masked delegate, EzR3aL (a name fit for a tragic hero), penned an open letter in the Aave governance forum. “Wherefore art thou, swap fees?” they cried. Lo and behold, through on-chain sleuthing, our hero traced the fees to a private address controlled by Aave Labs, not the DAO treasury. Scandalous! 😱

This market standstill appears less about Bitcoin’s fundamental sprightliness and more about the peculiar arrangement of today’s financial tea-party.

According to the wise folks at the Board of Governors of The Federal Reserve System, this Julio, once a trusted employee of Synovus Bank, had a knack for signatures-not his own, mind you, but those of his unsuspecting customers. Between the chill of December 2023 and the frost of January 2024, he danced with deceit, pilfering a cool $38,000 from three poor souls. 🕵️♂️💰

Half a billion dollars, they say, slipped through their fingers like sand-or perhaps, like a poorly written Chekhov play’s third act. 🏖️

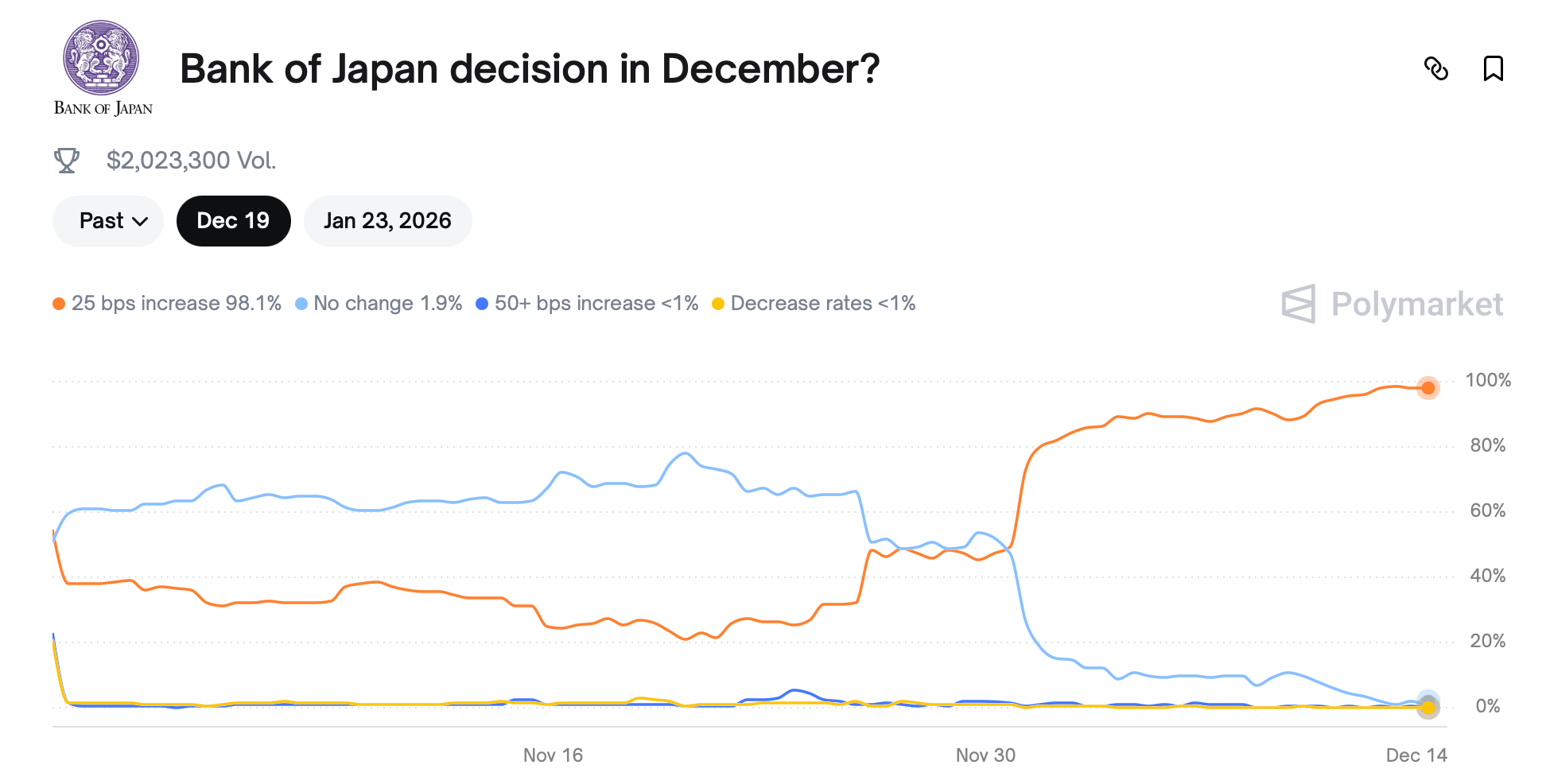

What, pray tell, has caused this latest descent into the abyss? The whispers point to the Bank of Japan (BoJ), that august institution, whose mere hint of an interest rate hike has sent traders into a tailspin. No official announcement, mind you, but the mere specter of history repeating itself is enough to send Bitcoin into a cold sweat. Data, that sacred cow of market analysts, reveals that Bitcoin has a penchant for dramatic falls-23% to 31%, no less-after previous BoJ rate hikes. How very predictable. 🤡

The Federal Reserve, ever the drama queen, has just trimmed its rates by a quarter point, and now markets are betting that the January FOMC meeting will deliver no adjustment. Attention has since shifted to the Bank of Japan, where expectations are building that the central bank will lift its short-term interbank rate next week. 🤝