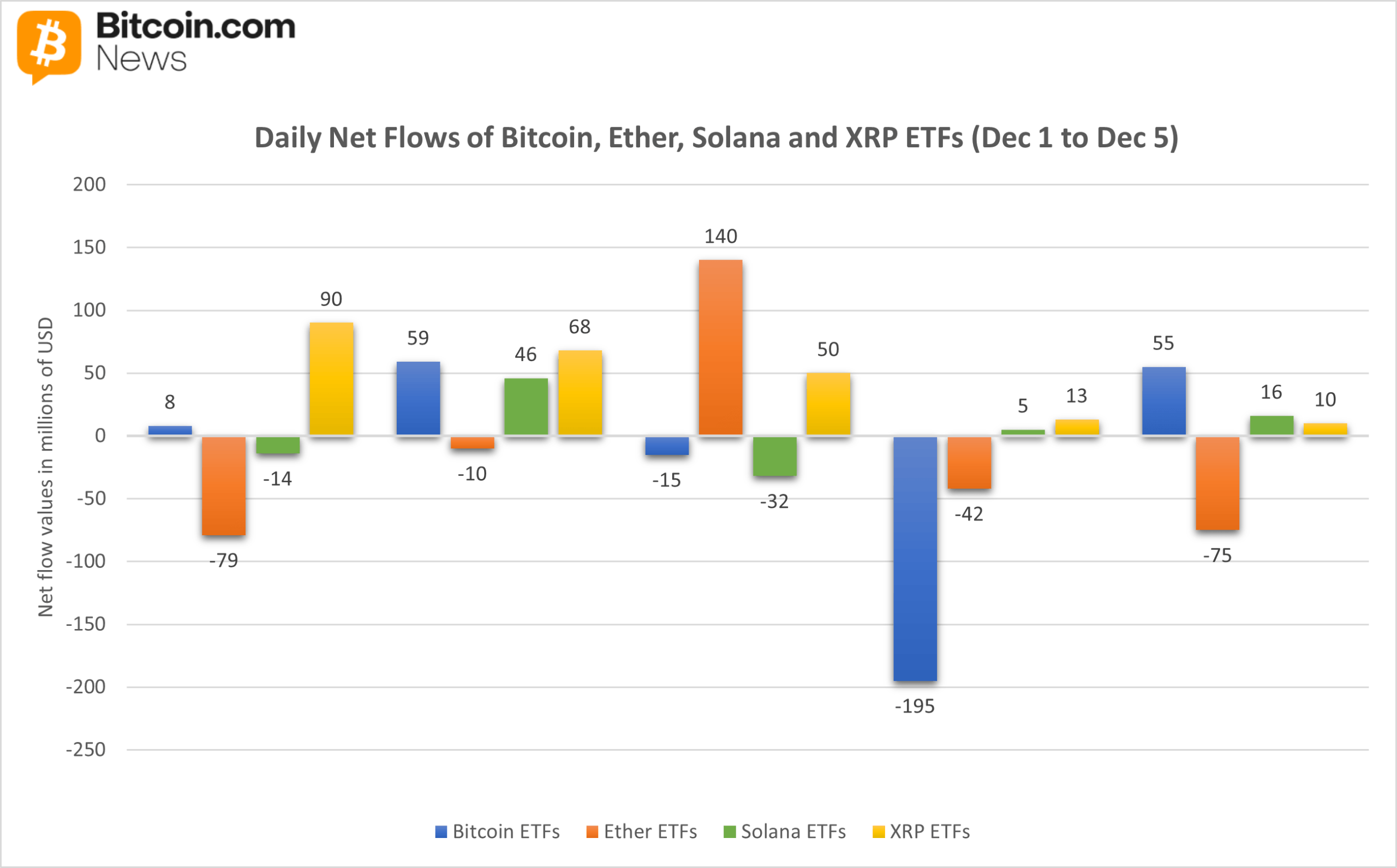

Crypto Chaos: Bitcoin & Ether Cry, Solana & XRP Laugh All the Way to the Bank! 💰

The first week of December? More like the first week of “What the heck is going on?” 🤪 Bitcoin and Ether ETFs took a nosedive after some mid-week shenanigans, while Solana and XRP were quietly stacking coins like it’s a game of Monopoly. 🤑 Each issuer had its own drama-some were recovering, some were tripping over their own feet, and others were riding the momentum like a boss! 🕺