MYX’s Mysterious Dance: Bull or Bear? Let’s Decode This Financial Tango! 💃📉📈

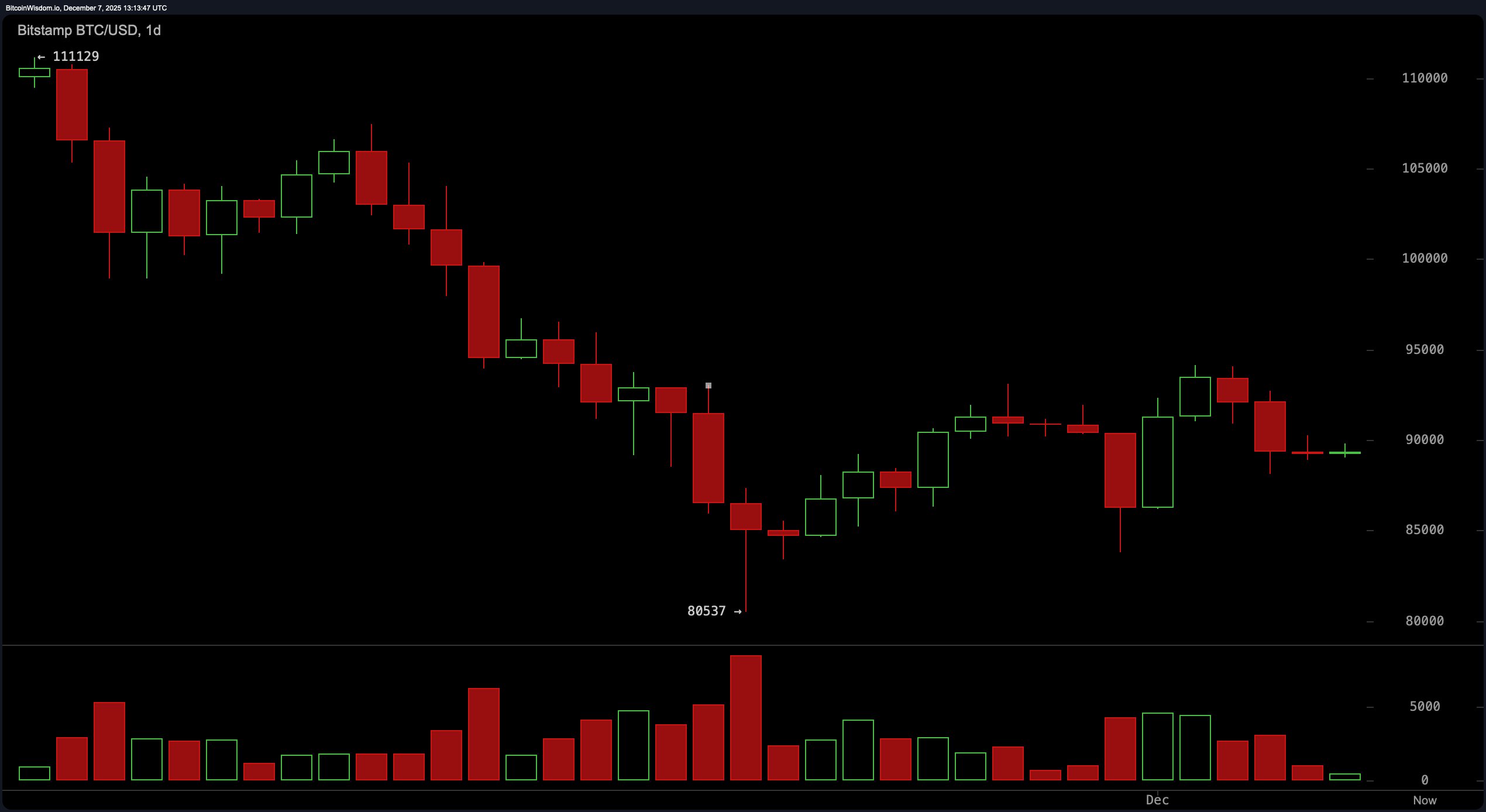

Yet, beneath its coquettish rise lurks the ghost of volatility, waving its spectral hand from October’s chilly shadow. A swift, savage sell-off still haunts us like a bad ex. Thus, while optimism flickers more brightly than a drunken chandelier, caution must be as muted as a debutante’s compliment, especially when altcoins have been performing the financial equivalent of a drunk cousin at a wedding. 🍸