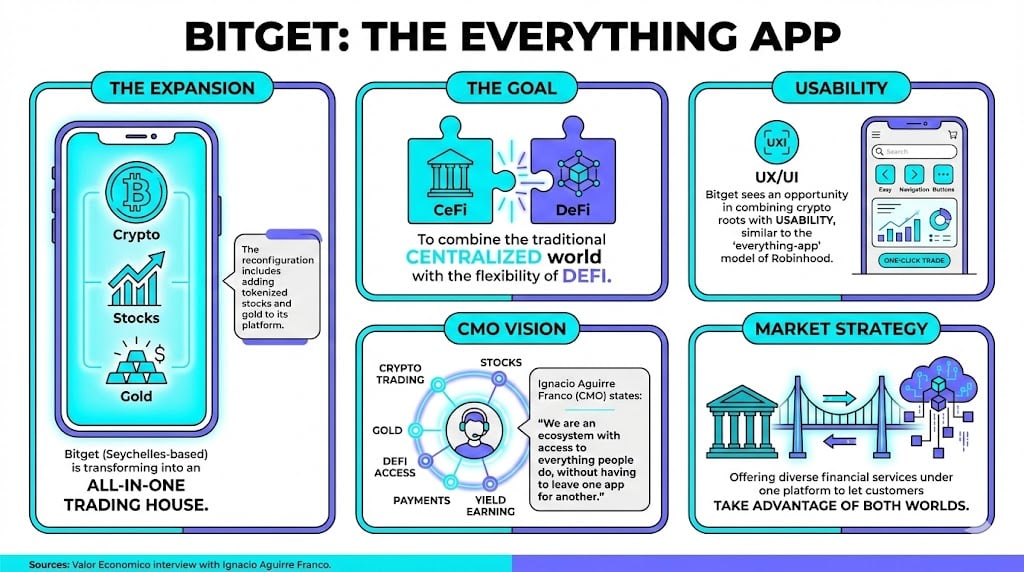

Bitget’s Bold New Move: Crypto Meets Wall Street (With a Side of Gold!) 🚀

Bitget, the crypto platform that’s already mastered the art of dodging regulatory scrutiny like a pro, is now pivoting to become an “all-in-one trading house.” Spoiler: it’s just crypto, stocks, and gold all squished into one app. Because nothing says “financial empowerment” like forcing users to navigate a labyrinth of assets without a map. 🌀