Crypto News

Market Madness: Strategy Surges 20% Amid Critics’ Meltdown – Is This the Bottom?

Over the past 24 hours, critics like Jason Calacanis, host of the “All In” podcast, have been telling everyone to dump MSTR and buy Bitcoin directly because, and I quote, “Told y’all this would happen.” Strategy? “A stunning pyramid,” he says. Because what’s a tech stock without a little pyramid scheming? 🏰

Bank of America’s Bitcoin Gambit: 4% of Your Wealth?

Bank of America, one of the U.S.’s largest financial institutions, has become the latest Wall Street giant to warm up to bitcoin 🐍. A marvel of modern finance, isn’t it? 🤯

🇵🇱 President Vetoes Crypto Law: Power Grab or Freedom Fight? 🚀💰

So, the real drama wasn’t about crypto-it was about who gets to be the puppet master: the state, the market, or Brussels. Because, you know, why solve actual problems when you can argue about power? 🤷♂️

Bitcoin’s Meltdown: Is This the End of Strategy’s Crypto Empire? 💥

At press time, Bitcoin’s chilling at $86,900-a 21% discount from its peak. Some experts call this a bear market warm-up. Others say it’s just Bitcoin “taking a nap,” which is either adorable or terrifying, depending on your portfolio. 😴

Vanguard’s Crypto Leap: A Tale of Financial Revolution 🚀💸

Behold, Vanguard has pivoted from its fortress-like resistance to crypto, now allowing clients to trade ETFs and mutual funds on its hallowed brokerage platform. Bloomberg, the scribe of modern finance, reports this as a “landmark shift.” Let’s call it what it is: a truce between tradition and the digital wild west. 🤝

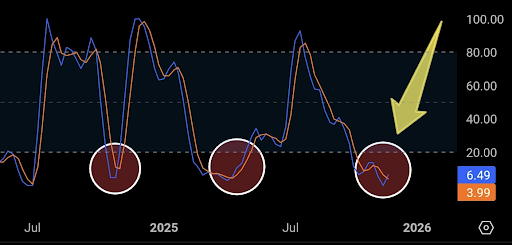

XRP’s Weekly Cross: The Crypto Comeback or Just Market Trolling? 😏🚀

The crypto circus continues: despite the limited momentum, a few shiny new XRP ETFs have graced the scene, sprinkling hope like fairy dust-reminding everyone that even in chaos, some things do sparkle. Ah, the timeless dance of despair and hope. 💃🏻🔮

Goldman Sachs Just Bought a Bunch of Fancy ETF Magic (Spoiler: It’s Bitcoin-y!)

Goldman Sachs, a bank that’s definitely not a vampire squid squid, just bought a company that specializes in Bitcoin-linked ETFs. Innovator Capital, the victim of this corporate affection, brings $28 billion in assets and 159 ETFs to the party. These aren’t your grandma’s ETFs-they’re “defined outcome” strategies, which is finance jargon for “we’ll try to lose your money less badly if the market tanks.”

Chainlink ETF: A Harebrained Gamble or The Next Big Flop? 🐎💸

But lo! After recent altcoin ETFs flopped harder than a wet pancake, investors are scratching their heads: Will LINK finally break its slump, or join the parade of punchless pumpkins? The market’s been in a sulk, and even the most optimistic optimist’s got a frown stuck on their face.

Mark Twain’s take on the crypto crackdown: A tale of banks, bullies, and busted dreams

It seems the investigation, which kicked off in the 118th Congress-about the time folks were still arguing whether to burn or fry their tax returns-discovered that the Biden crew has been employing all sorts of vague rules and dark spells to scare banks away from dealing with digital assets. Like a snake oil salesman at a county fair, they use “informal guidance” and “enforcement actions”-that’s fancy talk for “we’re watching you, buddy,”-to keep crypto from playing in the banks’ backyard. 🕵️♂️