Crypto’s Titanic Sinks as Markets Tango On! 🚀💥💰

Below lies a dissection of this digital dumpster fire, served with a sprinkle of schadenfreude. 🍿

Below lies a dissection of this digital dumpster fire, served with a sprinkle of schadenfreude. 🍿

So, here we are, with December slapping us in the face with a clear bearish bias. Happy holidays, eh?

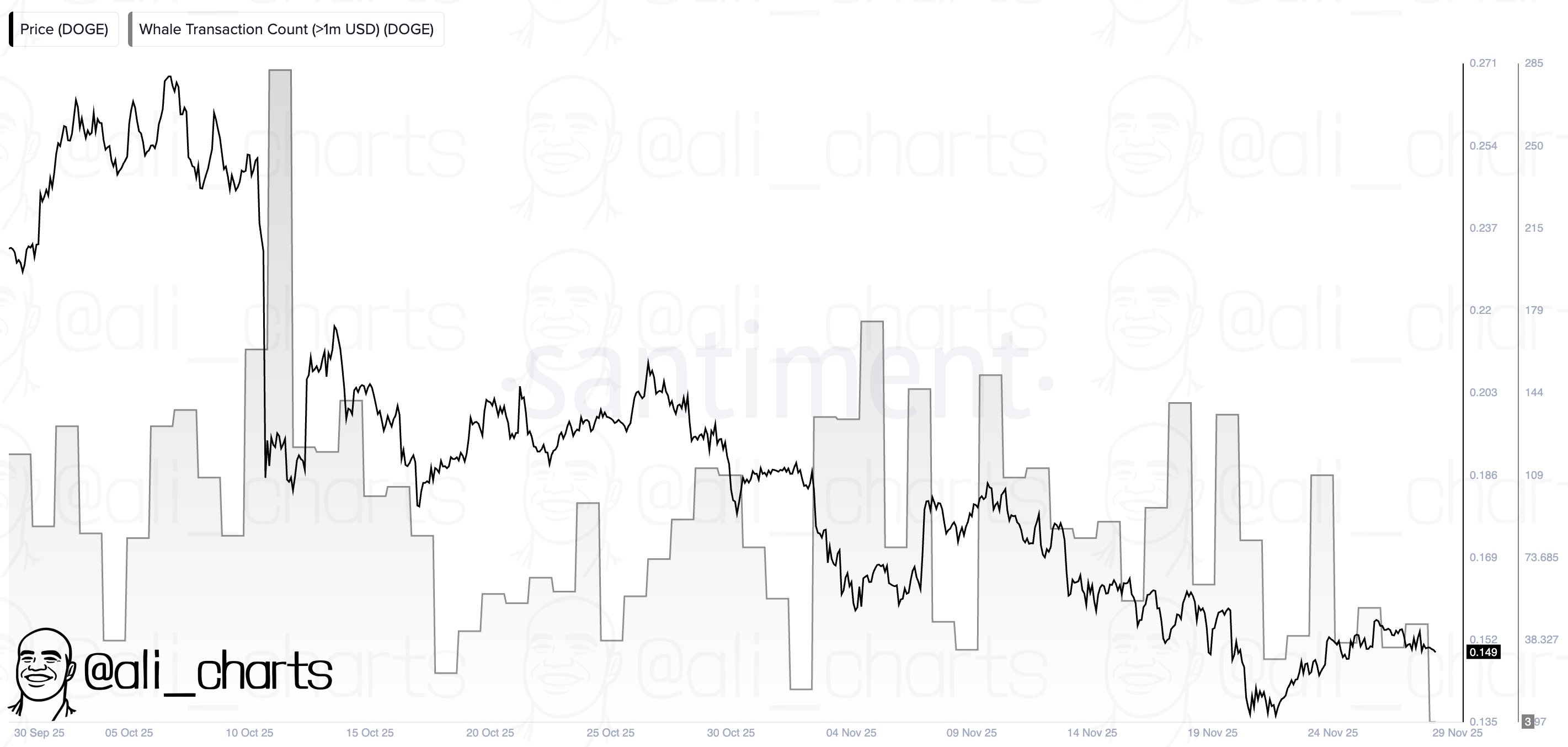

Martinez, with a flourish of his quill (or perhaps a tweet, in this modern age), shared a chart on X, a Santiment masterpiece, which reveals the sad truth: “Whale activity on the Dogecoin network has sunk to its lowest ebb in two moons.” The graph, a tragicomic ballet of price and transaction, shows the once-frequent spikes of high-value transfers in early October 2025, when the price danced near the giddy heights of $0.27. Ah, those were the days! Now, the chart lies flat, as lifeless as a fish out of water.

But don’t just take my word for it. Here’s the lowdown on this privacy-loving coin:

A large wave of liquidations cleared out stop-loss orders between $90,000 and $86,000, allowing the price to fall quickly. With that block now gone, traders are watching how Bitcoin behaves around current levels. Because nothing says “excitement” like a 4% drop and a bunch of confused investors. 😂

But, wait for it, Sacks isn’t having any of it! He’s called the report a “bungled mess” and even a “nothing burger.” Yes, you heard that right-he’s suing the NYT for defamation. Because nothing says “I’m innocent” like a lawsuit, right? 😏

In the frosty heart of Stockholm, where the aurora whispers secrets to the pines, Safello has unleashed a menagerie of digital beasts. XRP, the elusive siren of payments, and BNB, the lion of Binance’s jungle, now rub shoulders with the likes of Tron, Stellar, Polygon, Gala, and Decentraland. Thirty-eight coins in total-a veritable zoo of blockchain curiosities! 🦄🐉

Targeting 30% of Sony’s external sales (read: the Americans), this stablecoin shall coexist with credit cards, though one wonders if the latter will sulk in the corner, muttering about fees. Nikkei, that oracle of Japanese finance, hints at a future where your subscription to Attack on Titan might just be a few keystrokes-and a sigh of relief for card networks everywhere.

Just two weeks ago, the market was split on whether the Fed would act, but recent events and Fed comments have shifted sentiment strongly toward a cut. It’s like a soap opera, but with more spreadsheets and fewer dramatic exits. 📈📉

Ah, the grand ballet of the crypto aristocracy! New data, dripping with the sweat of the proletariat’s toil, reveals a spectacle among XRP’s top 10,000 wallets. These titans of finance, with hands greasier than a factory foreman’s, now clutch over 51.39 billion XRP. On the fateful day of November 29, 78 nouveau riche accounts-fresh from … Read more