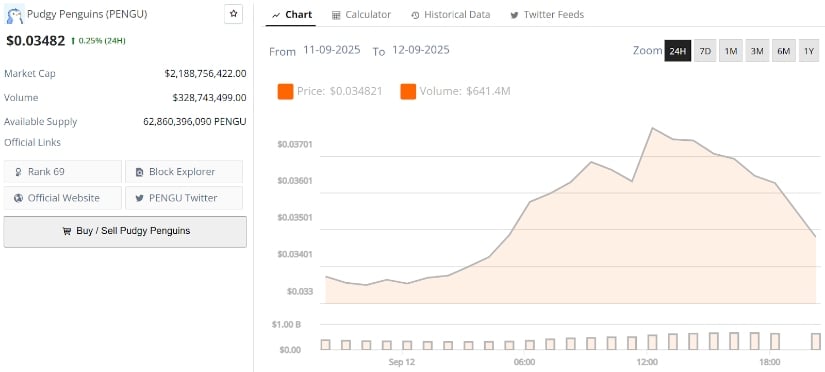

Are PENGU Penguins About to Break Free? $0.10 Could Be on the Horizon!

It is as if the PENGU chart is simply following the age-old rhythm of “expand, retreat, expand”-a sequence as predictable as the tides. Each new sharp expansion is met by a pullback so gentle, you could almost mistake it for a nap. The recent retrace has barely scratched the surface, maintaining the holy grail of higher-lows. Now, if you watch closely, you’ll see the candles closing in on tighter ranges. A bit like an animal preparing to pounce. Ah, the suspense! The markets are poised, waiting for the inevitable breakout. Will it be $0.056 or perhaps a glorious $0.080 in the weeks to come?