GameStop’s Bitcoin Gambit: Will They Win or Lose Big? 💸

GameStop’s bet on Bitcoin [BTC] might just be be paying off. 🎮💸

GameStop’s bet on Bitcoin [BTC] might just be be paying off. 🎮💸

So, the Kyrgyz parliament said, “Let there be crypto regulation,” and lo, there was a bill! 🌟 This bad boy is all about state-backed cryptocurrency mining and enough rules to make a bureaucrat blush. 🎩✨ They’re even launching a state crypto reserve-because why not hoard digital gold? 🏛️💰 Plus, they’ve got a licensing system stricter than a bouncer at a VIP club. 🎟️

Aligned with the likes of Bonk.fun and Raydium, WLFI seeks to entice the masses through the seductive allure of promotional rewards-a digital honeytrap for the intrepid trader keen on USD1 pairs. This endeavor, seemingly more optimistic than foolhardy, promises to bolster stablecoin activity within the bustling realm of Solana.

Ripple, ever the mysterious and elusive creature, has yet to make an official statement on this transfer. Analysts, of course, have already put on their detective hats and speculated that it could be related to some sort of liquidity preparation for exchanges, settlement mechanisms, or possibly the expansion of Ripple’s On-Demand Liquidity (ODL) corridors. I mean, it’s not like the company just enjoys doing things without any reason, right?

Sixty billion tokens-a number so vast it defies comprehension, yet here we are, staring into the abyss of potential sell-offs. Are the whales fleeing, or is this merely the universe mocking our feeble attempts at wealth? The reserves now stand at 85.4 trillion SHIB, a figure that screams, “Behold, the folly of man!”

//s3.cointelegraph.com/uploads/2025-09/01993578-fb01-7ba5-bbae-54cd71673b4f”/>

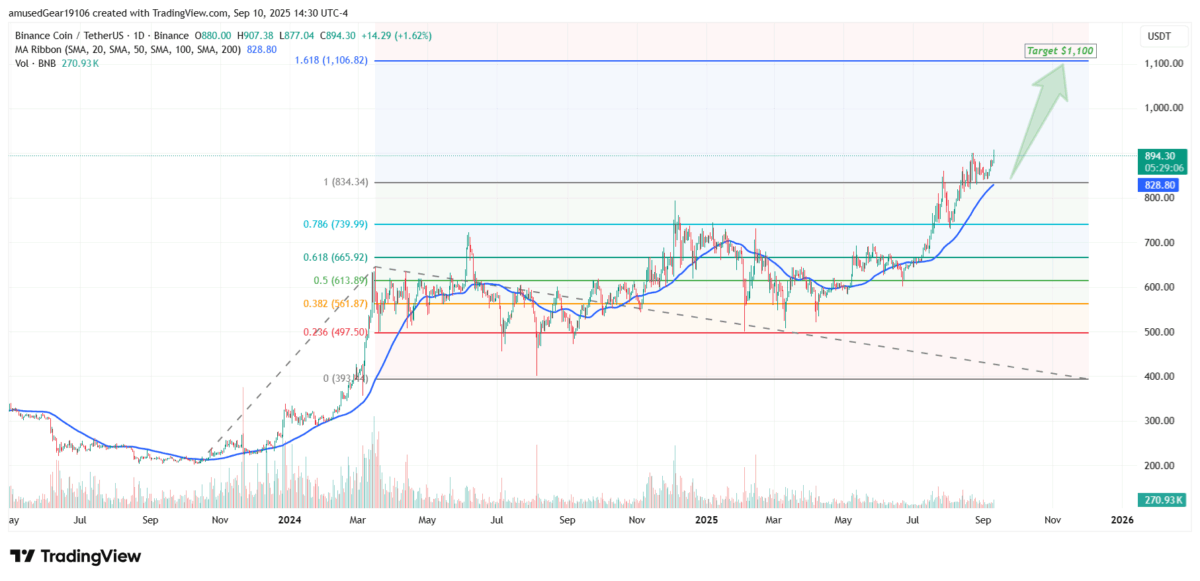

This wasn’t just a twitchy little hop above a threshold; nay, it was more akin to a full-on monthly candle rave party, with multiple daily candles staking their claim and declaring $700 not as an annoying ceiling but a comfy floor. And with all that chart wizardry behind it, BNB is setting its sights on the fanciful $1,100 mark, an elusive Fibonacci extension point rumored to be guarded by mythical creatures and a rigid spreadsheet or two.

The central bank’s concern is that banning crypto altogether wouldn’t exactly close the cryptographic floodgates. People could still trade on decentralized exchanges, those rogue little islands where banks and central authorities are the unwelcome guests at the party. And while the RBI may wish to shut these down, it turns out that a decentralized exchange is about as easy to shut down as a cat in a paper bag.

The numbers, cold and undeniable as a Siberian winter, reveal $205 billion coursing through this land’s digital veins between July 2024 and June 2025. A surge of 52%, they say-though a sober observer might wonder if these figures bring hope or merely a brief respite before the next storm. Asia-Pacific and Latin America hold the lead, but here, where the horizon stretches endlessly, the battle for economic survival wields its own strange weapons.

SHIB has been a trooper, climbing from $0.00001287 to $0.00001312-a 2% rise! That’s like a flea jumping over a skyscraper in the crypto world. 🪰🏢