Doge’s Latest Move: The Market’s Hidden Wake-Up Call

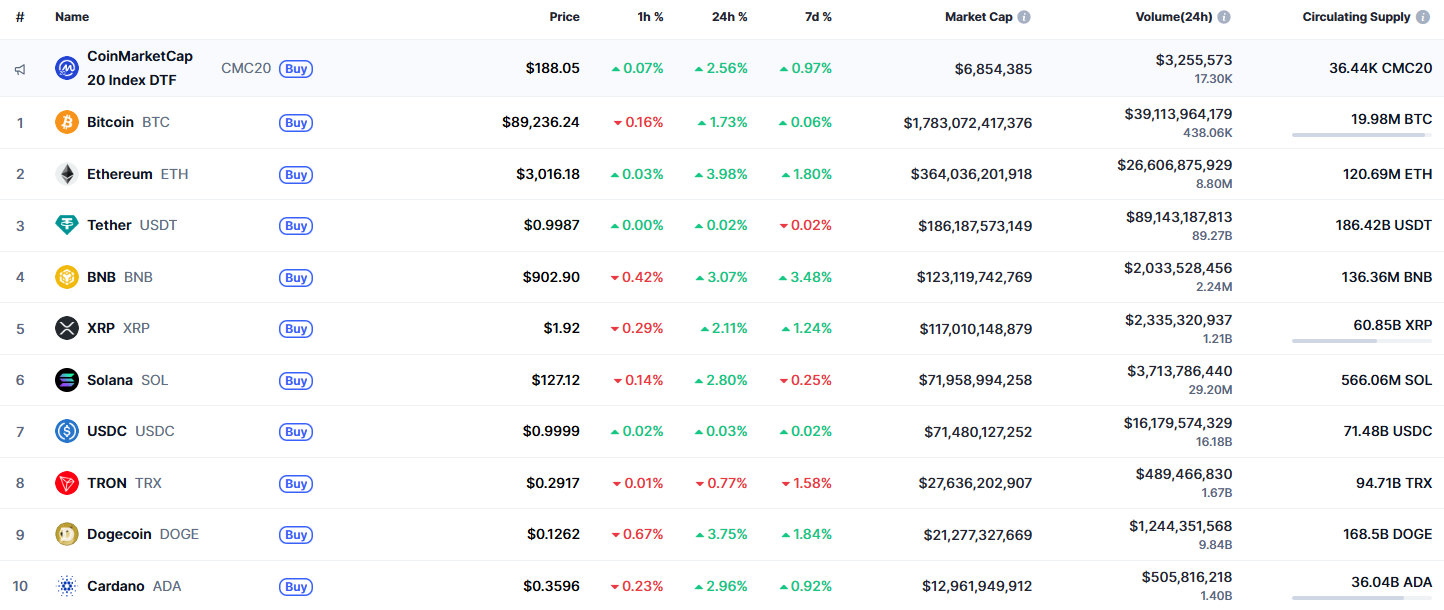

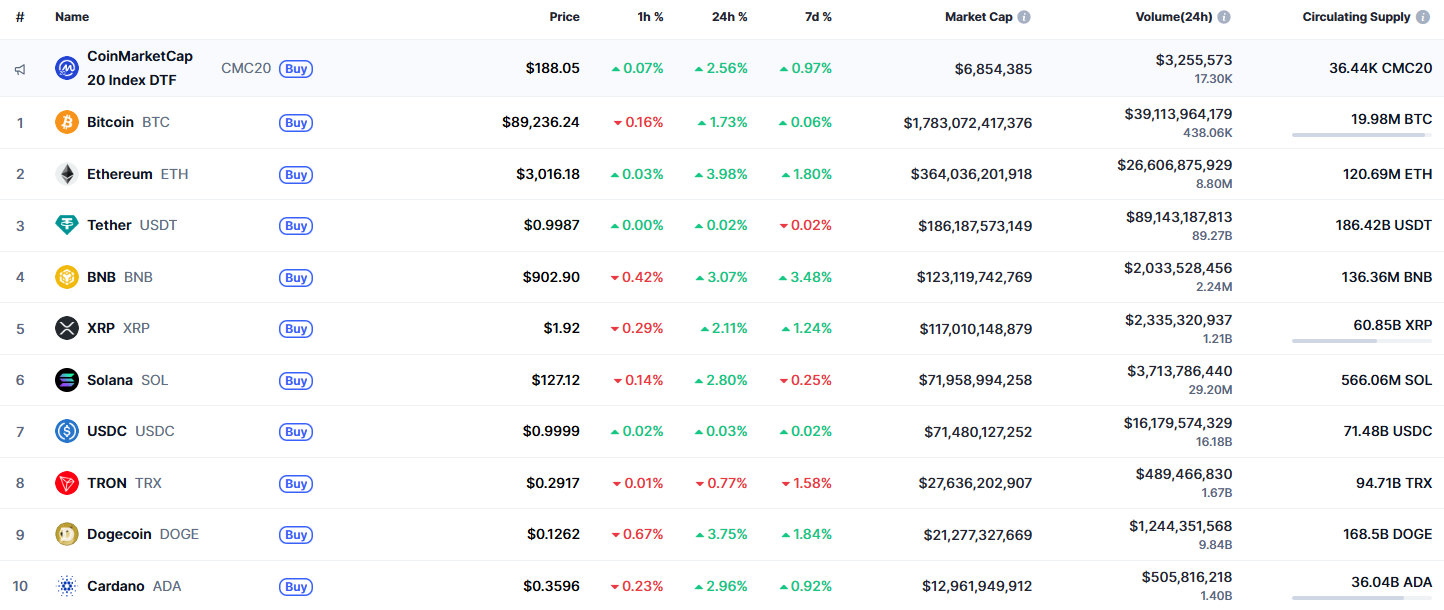

DOGE shows itself among the few gleams-a notable gain of 3.75%-a candle in a dark corridor, barely enough to light the way, and yet somehow enough to tease hope.

DOGE shows itself among the few gleams-a notable gain of 3.75%-a candle in a dark corridor, barely enough to light the way, and yet somehow enough to tease hope.

On the daily stage, Bitcoin continues to languish beneath the 100-day and 200-day moving averages, with the 100-day MA of $94K now posing as the prima donna of resistance. Its recent recovery attempt, alas, was as fleeting as a Coward wit-stalling precisely in this zone, thereby cementing its status as a key supply area rather than a reclaimed throne. While the price remains within the broader rising channel, formed post-sell-off, the structure thus far resembles a corrective curtsy rather than a triumphant reprise. The absence of robust follow-through after each upward thrust betrays a palpable hesitation from higher-timeframe buyers.

Bitcoin moved with a lazy resolve on Wednesday, little changed after yesterday’s gains as the dollar weakened, and ether relinquished some of its strides.

This range-bound behavior, while soothing to the more faint-hearted traders, is, I’m afraid, as stimulating as a lecture on the history of doorknobs. Stability? How utterly pedestrian. Where’s the drama, the flair, the volatility that once made Bitcoin the darling of the financial ball?

While the world shivered under the cold blanket of fear, Solana’s meme coins, those ephemeral creatures of the blockchain, flourished like weeds in a neglected garden. Their resilience, one might say, is as baffling as it is amusing.

Orbs, the Layer 3 wizards, have announced that Gryps, a trading protocol that’s faster than a New York minute, has integrated their Perpetual Hub Ultra. This means the Sei Network now has a professional-grade perpetual futures stack that’s so advanced, it probably comes with its own barista. All thanks to Orbs’ Layer 3 tech and Symmio’s smart contracts, which are like the Swiss Army knives of the blockchain world.

This token, a creature of the GENIUS Act (a title that doth protest too much, methinks), is designed to waltz gracefully through the newly minted federal stablecoin framework. How quaint, that Tether, once a fugitive from the prying eyes of regulators, now seeks to embrace the very rules it once fled. The irony is as rich as the reserves they once misrepresented-or so the New York Attorney General would have us believe.

This merry dance coincides with the crypto market’s sudden gentling of convulsions, lifting the total capitalization by a mere 1%-a yawn in the realm of financial hyperbole. Yet here lies the twist: Silver, that glistening, rather unassuming metal, has become the unlikely emperor of Hyperliquid’s ascension.

Once known as merely “John Daghita,” this individual became internet famous, or notorious, after being linked to diverting a whopping $40 million from U.S. government-run cryptocurrency addresses. In a twist seemingly ripped from a Douglas Adams novel, he promptly launched a meme coin, named $LICK, on Pump.fun, conveniently while promoting it in live streams across Telegram. Astoundingly, ledger evidence suggests he keeps 40% of this freshly minted token up his virtual sleeve.

According to the sagacious remarks of Don, the long-term tale told by the Altcoins/BTC chart is a cycle of predictable monotony. Indeed, history whispers twice in our direction. In 2017, just when interest began to wither, Bitcoin’s dominance waned, and altcoins, in their resplendent resurgence, leapt by 500% or more. Such movements emerged during the dullest of months, when traders’ passions had evaporated like morning mist.