Next Crypto to Explode as Tokenized Crypto Market Nears $300B in Crazy Race

Let’s dig deeper into what all this means for the crypto space and which cryptos are primed to explode like a hot potato. Spoiler alert: you might want to keep reading.

Let’s dig deeper into what all this means for the crypto space and which cryptos are primed to explode like a hot potato. Spoiler alert: you might want to keep reading.

So here we are, Ethereum stuck in the $4,330 zone-up 1% in the last 24 hours, which is basically the excitement level of a Monday morning. Over the week, it’s slouched down 2%. Earlier this year ETH ran hot, but now it seems to have gone for a leisurely stroll toward resistance at $4,900, pausing every few minutes to contemplate its life choices. 😴

In this whimsical world, meme coins lead the dance, with Nobody Sausage (NOBODY) leaping 62% in the last seven days. Let’s dive into NOBODY and two other meme coins to watch as we tiptoe towards the end of Q3.

In a tweet that fluttered through the ethers like a mischievous imp, Nick summarized the debut act of crypto’s strange opera: “all about money and infrastructure.” Glorious chaos, fortunes won and lost, and countless JavaScript bugs shackled with chains of blockchain.

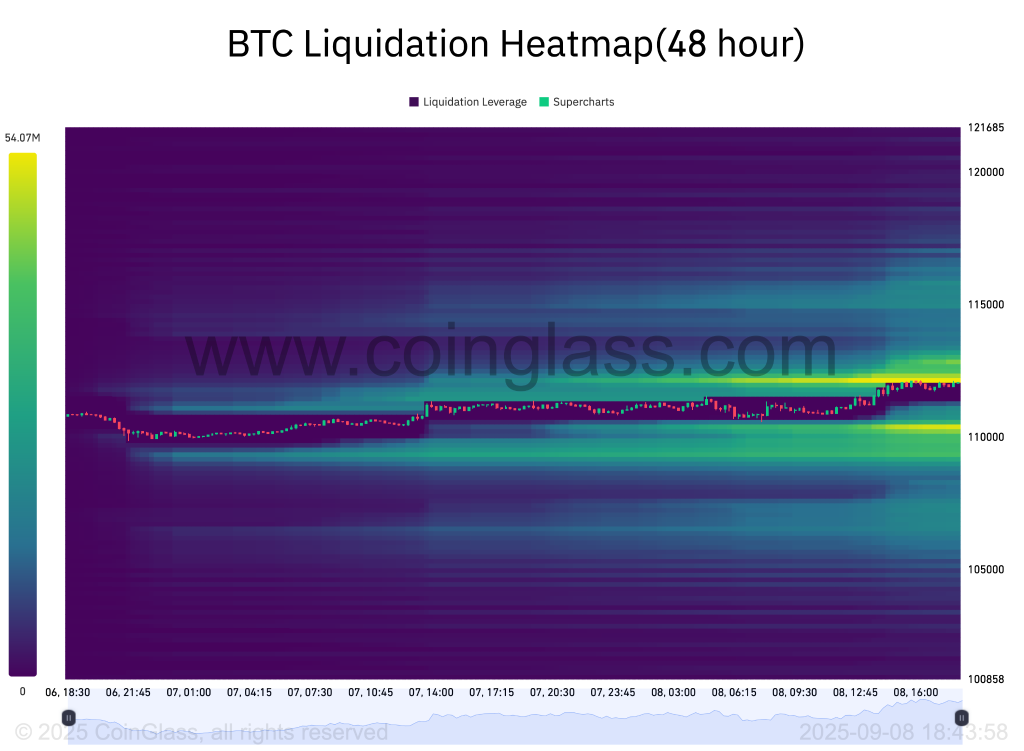

The current price action seems to have compelled investors to create a safe cluster around the range, much like how you’d huddle under a table during a particularly intense game of hide-and-seek. The liquidation heatmap of Bitcoin shows the price trading between the liquidity cluster, which is accumulated between $112,100 and $112,300 and around $110,800. The bulls are failing to break the upper cluster, which is expected to drag the levels lower to squash the sellers. It’s like trying to climb a greased pole while wearing roller skates. 😅

Technical indicators, those modern-day crystal balls of finance, suggest PI may be plotting its grand escape-an upward breakout! But lo and behold, a shadow looms large: 106 million PI tokens are set to flood the market this very month. A veritable deluge of supply threatens to drown even the strongest rally. Can demand rise to meet this challenge, or will PI sink back into obscurity?

Ten-minute block times and gas fees that can spike to $100+ mean it’s great as ‘digital gold,’ but try using it to buy a cup of coffee, and you might as well write a check by hand. 📝☕

For those unfamiliar with the mystical art of Bitcoin mining, let me explain. The “mining difficulty” is essentially how hard it is for miners to solve cryptographic puzzles that validate new blocks. Why do they bother? Because solving these puzzles earns them shiny new BTC coins, which are worth more than your average paperclip. The goal here is to keep the block creation process ticking along at about 10 minutes per block, ensuring the decentralized network remains secure and sustainable. Sounds simple, right?

But wait! All is not lost in this comedic tragedy. Strong fundamentals remain Bitcoin’s trusty sidekick, ever-ready to swoop in and save the scene. Institutional adoption continues its steady march forward, with companies quietly adding BTC to their treasuries as if sneaking dessert from under their spouses’ noses 🍰. Rising inflation concerns? Mais oui! They keep Bitcoin relevant as a hedge, even amidst these market wobbles.

Ah! Attend, good gentles, to the tale most curious-Friday’s dismal U.S. nonfarm tale caused brooding clouds of bearish gloom, yet lo! The morrow dawned and those fears were but smoke and shadows! Thus, coins such as Ethena’s ENA, worldcoin, hyperliquid (HYPE), and that merry fool Dogecoin, did pirouette and soar like jesters on a midsummer’s stage! 🎭