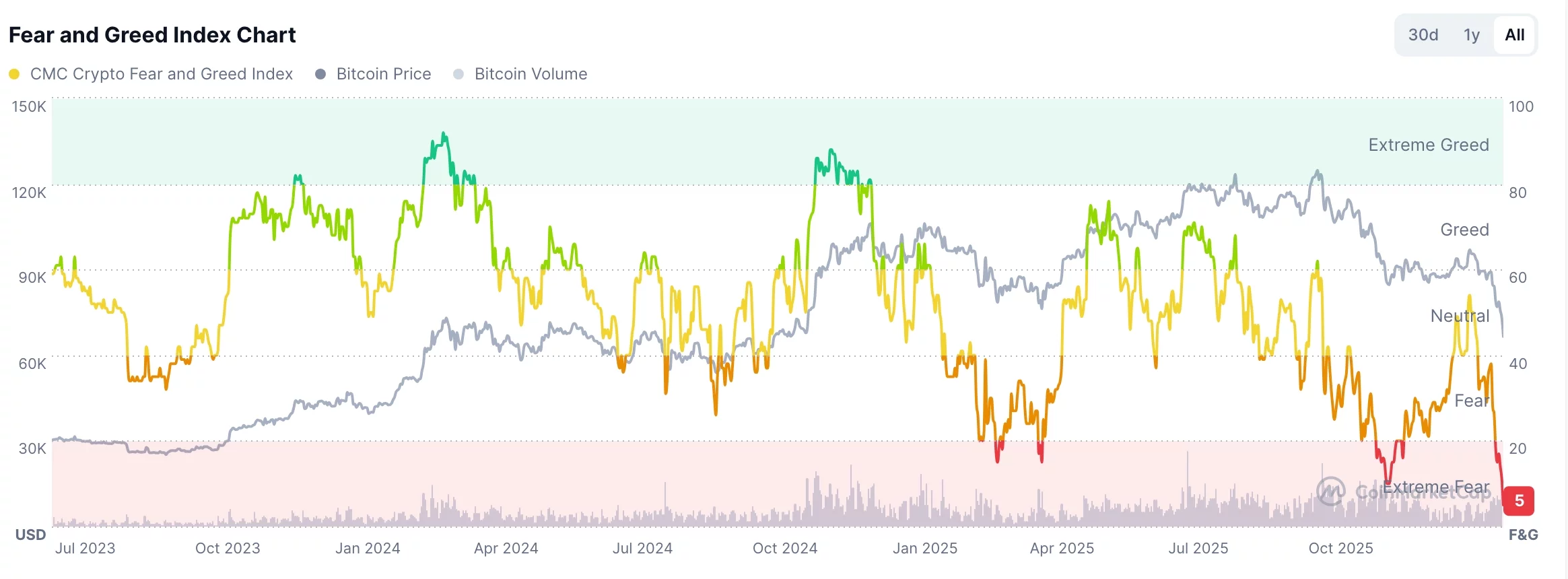

SAFU’s Desperate Gamble: 3,600 BTC Stolen as Market Screams in Despair!

Amid this maelstrom, the Binance SAFU Fund, that modern-day Promethean figure, declared the acquisition of 3,600 BTC, worth $233.37 million. A noble gesture, one might say, if not for the absurdity of purchasing salvation during a financial apocalypse. Such moves, while not guaranteeing resurrection, whisper of strategic accumulation by those who fancy themselves saviors of the digital realm-even as volatility gnaws at their heels.