QTUM: Moon or Bust? 🚀💰 Analysts Say “HODL Your Horses!”

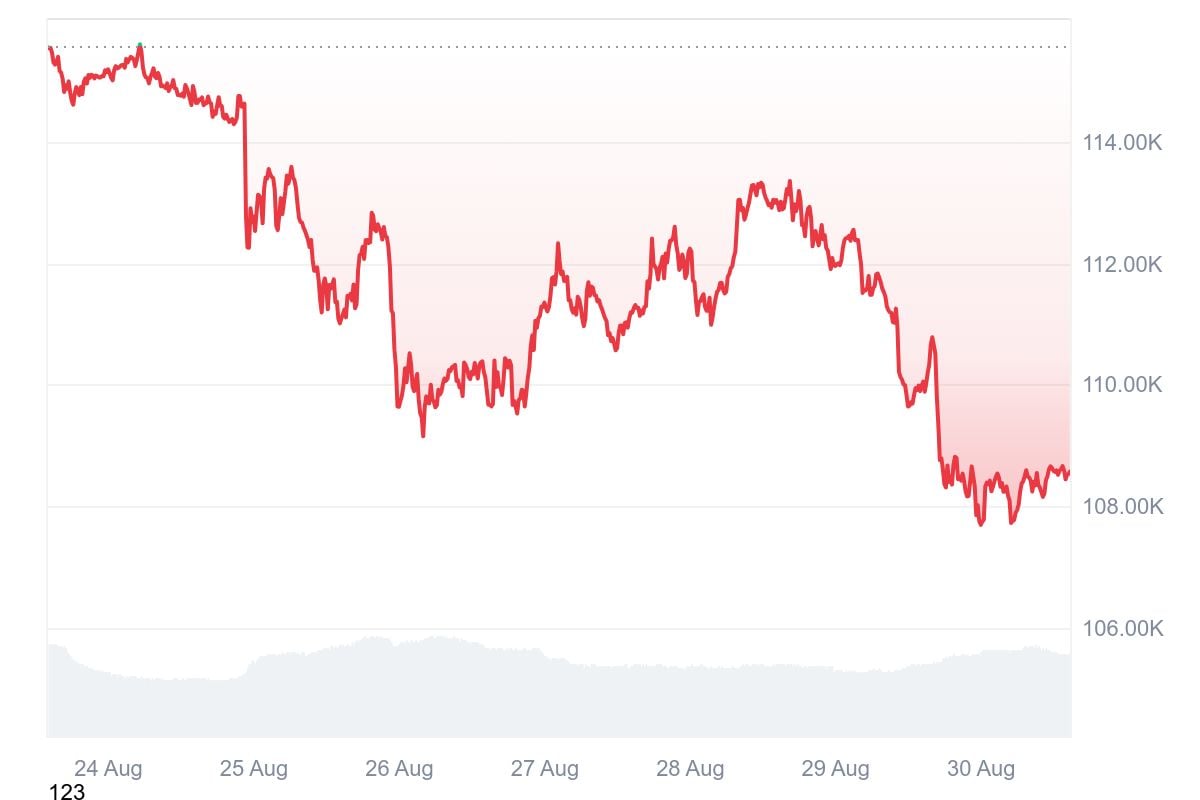

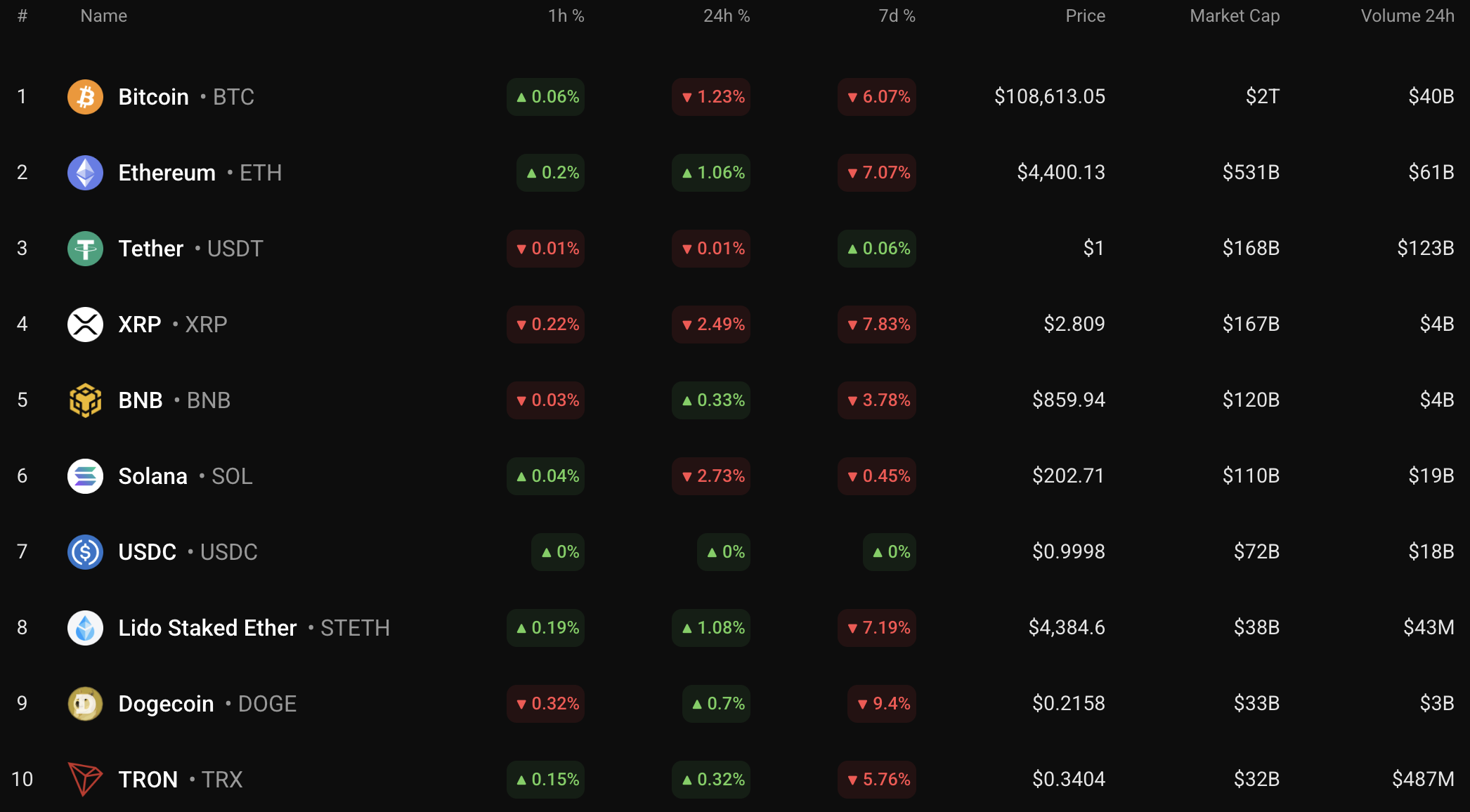

QTUM’s been ridin’ the waves like a salty dog, up 18.94% in the last week and a whopping 38.83% over the month. Its year-over-year performance be a respectable 29.11%, though it’s still 97.16% below its all-time high of $106.88 back in 2018. Ah, the good ol’ days! 🌊