Crypto Chaos: Chainlink Crashes While Others Play a Sad Tune 🎢

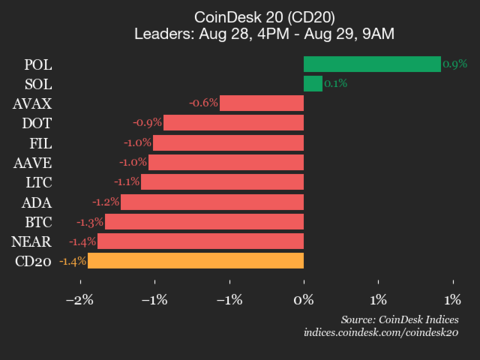

In the grim theater of the CoinDesk 20 Index, where hope flickers like a dying candle in a Siberian winter, the latest report has arrived. Not with triumphant fanfare, but with the quiet resignation of a prisoner waiting for the next roll call.