Chainlink’s Bold Gambit: Will It Dethrone Ripple in Japan? 💸

Meanwhile, the more anxious holders ponder whether XRP still holds a place in SBI Holdings’ labyrinthine blockchain empire, their minds a veritable circus of doubt. 🧠

Meanwhile, the more anxious holders ponder whether XRP still holds a place in SBI Holdings’ labyrinthine blockchain empire, their minds a veritable circus of doubt. 🧠

Once again, we find ourselves in the delightful intersection of politics, power, and Bitcoin. It’s like a reality show, but with more spreadsheets and fewer roses. Here are the juicy details. 🍷

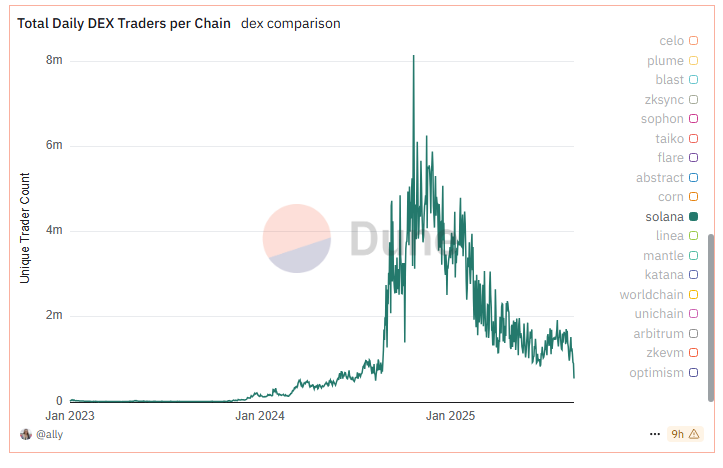

Let’s dive into this tale of numbers, bots, and maybe even a sprinkle of mischief. Some say it’s a mass exodus; others claim it’s just… well, bots being bots. Who’s right? Or is everyone wrong? Let’s find out! 😏

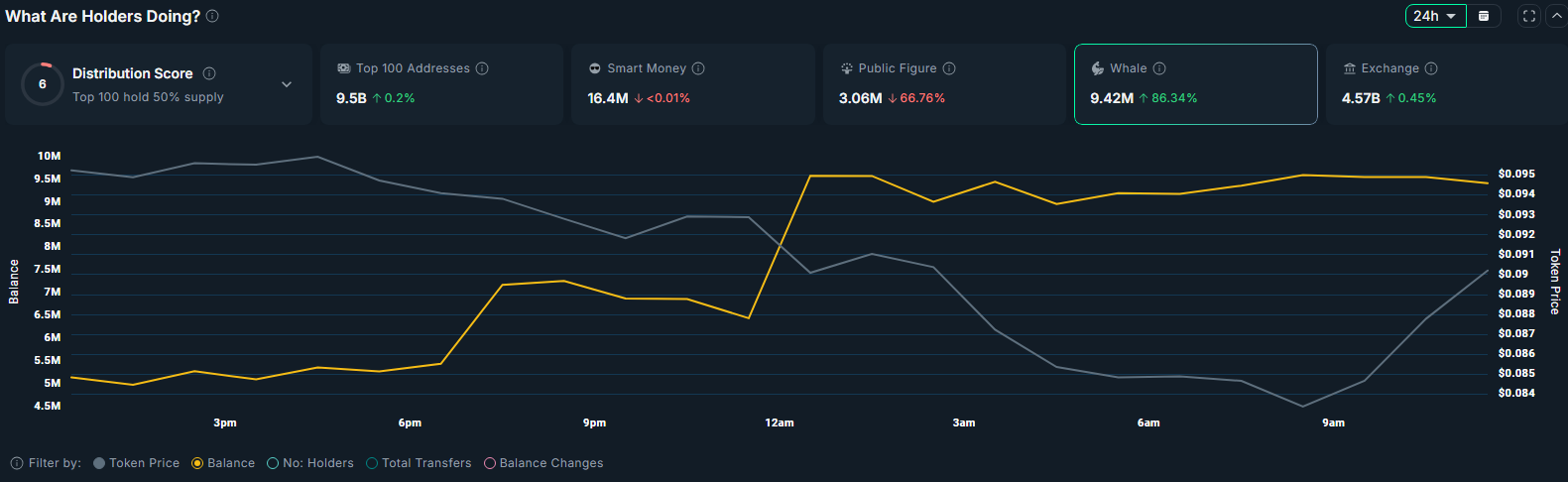

Among the most telling signs are the movements of the great leviathans, known affectionately as whales. Since mid-August, the coterie holding between 10 million and 100 million XRP has swelled by about 250 million tokens.

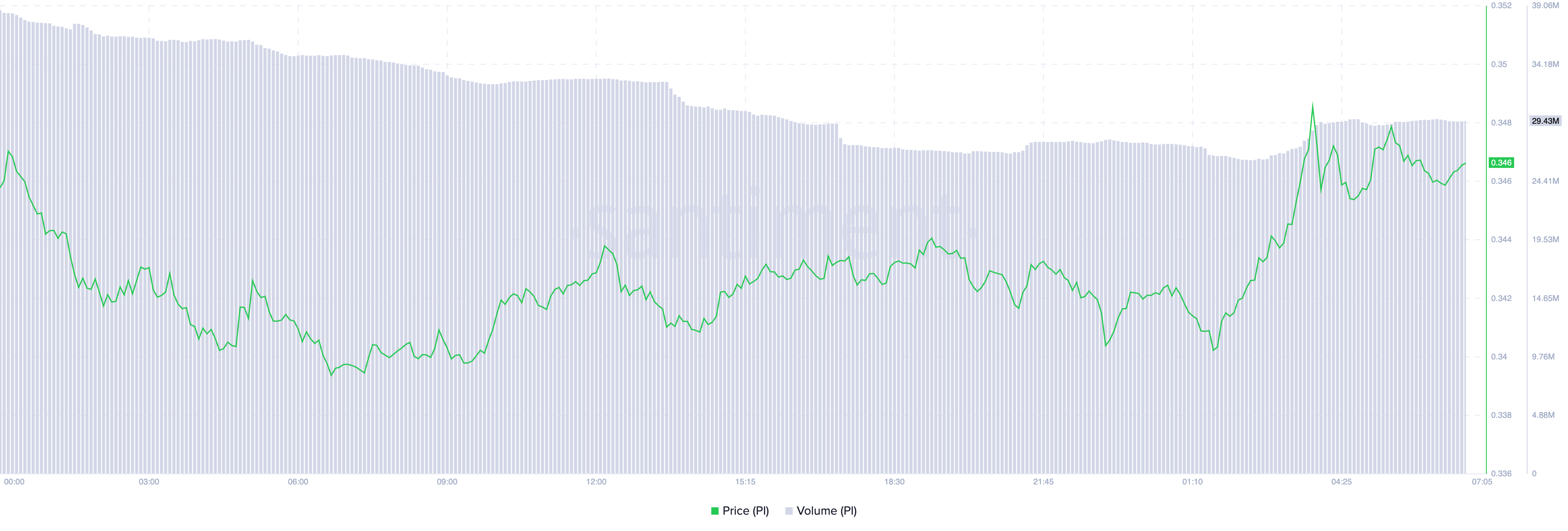

Despite these so-called “advancements,” PI has flatlined like an overworked office printer. It’s been trading sideways with all the enthusiasm of someone stuck in a queue at the DMV. No fireworks, no confetti, no parades. Just… silence. 🎇❌

Sur le fil de la toile – que dis-je, la toile de Santiment – il est révélé, avec une douceur de serpent, que ces géants de la finance numérique ont vu leur nombre s’accroître depuis août. Plus de 13 nouveaux titulaires de baleines Bitcoin, et 48 gros toutous Ethereum, ont rejoint le bal, comme si la fête n’était pas encore assez folle. 🐳🐳🐳

Arthur Hayes, the BitMEX co-founder known for stirring the crypto pot, has published a blog post on August 27, where he floats a bold prediction: Ether.fi (ETHFI) could surge 34-fold, and Ethena (ENA) could skyrocket 51-fold. Why? Because stablecoins, the financial world’s shiny new toys, are poised to take over.

According to the wise sages at crypto.news, Zora (ZORA) took a 14% tumble to an intraday low of $0.083 on the morning of August 28, as the sun rose over Asia. At this price, it remains a staggering 33% below its weekly high, which was fueled by none other than Coinbase CEO Brian Armstrong’s purchase of BALAJIS, a creator coin in the Zora ecosystem. Talk about a rollercoaster ride!

Now, this isn’t just any “Hey, let’s add a token to a market” kind of launch. Oh no. This is the real deal. A properly regulated, super convenient way to access Pi through the magical world of traditional brokerage channels. Yes, that’s right. Europe’s *mainstream* and *institutional* investors-those dashing, blazer-wearing folks who never have time for lunch-can now dip their toes into the crypto pool via the Pi ETP. The catch? A 1.9% management fee. It’s almost like saying, “I’ll hold onto your money for a small fee, don’t worry about it.” And let’s not forget, it’s all priced in Swedish kronor. Because, why not add a sprinkle of Nordic flair to the crypto chaos?

Since August 21, the swelling tide of cash into Ether ETFs has reached a staggering $1.83 billion, whereas Bitcoin funds-those elder statesmen of crypto flair-lassoed only $171 million, according to the ever-reliable CoinGlass (which, let’s face it, sounds like a spy agency disguised as a finance site). On that last thrilling Wednesday, nine Ether (ETH) funds raked in $310.3 million, while 11 Bitcoin (BTC) funds-tortoises in a hare race-raised just $81.1 million. Classic.