Lombard’s BARD Sale: Bitcoin’s New Plaything or a Joke?

Lombard, that paragon of innovation, has unveiled a pre-launch Community Sale for its native token, BARD, on Buidlpad-aka the crypto version of a VIP lounge for verified users.

Lombard, that paragon of innovation, has unveiled a pre-launch Community Sale for its native token, BARD, on Buidlpad-aka the crypto version of a VIP lounge for verified users.

Back in the sullen days of dial-up in the 1990s, early startups like RealNetworks poked around with “streaming” media-like trying to watch a movie through a shower curtain-slow and full of holes. Remember when RealPlayer was the big thing? It was exciting until, surprise, it wasn’t, because cords and copyright laws kept crashing the party. Eventually, broadband broadened horizons, and suddenly, Spotify and Netflix weren’t just names-they became lifestyle staples. Funny how changing content delivery also changed the very value of content-who would’ve guessed?

This “asset-light” gambit, as the company so quaintly dubs it, eschews the brutish toil of mining, opting instead for the genteel pursuit of staking. With a war chest of $6.6 billion in ETH, Bitmine now lounges in the lap of Proof-of-Stake luxury, raking in over $200 million annually. One might say they’ve traded their pickaxes for champagne flutes. 🥂

Allianz Life Insurance Company of North America got hit on July 16th. Classic. They figured it out the next day, July 17th, because, you know, hackers are courteous enough to leave a little note saying, “Hey, we were here!”

SharpLink, ever the paragon of transparency, emphasized that the scope of repurchases hinges on market whims, liquidity’s caprices, and trading prices that dance like a drunken waltz. The program, they clarified, is no promise of fixed shares, but a flexible ballet that may adjust or halt should the stars align unfavorably. 🎭

Once, Solana [SOL] was but another wanderer among the crypto countryside. But today, it returned bearing a 13% surge, as if to say, “Yes, I am still alive, and my neighbors should pay attention (at least for twenty-four hours).”

Robert Kiyosaki, the pen behind the world-renowned “Rich Dad Poor Dad,” has once more dipped his quill into the inkwell of financial discourse. For over two decades, his wisdom has flowed through the veins of global commerce, touching the lives of countless souls hungry for the elixir of fiscal prudence.

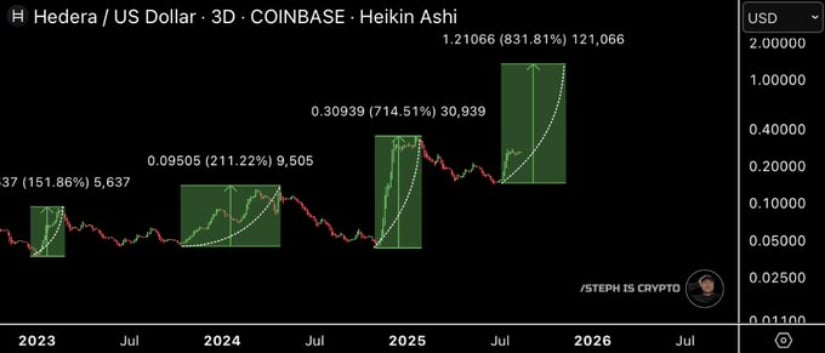

Steph, a wise analyst who roams the digital plains of X, has shared a detailed fractal projection that paints a picture of Hedera’s past-filled with impulsive rallies that follow long, drawn-out periods of sitting still. Using Heikin Ashi candles on a 3-day timeframe, which smooth out the price action to show the true direction of the wind, the analysis reveals cycles of growth that would make any trader’s heart skip a beat: 151%, 211%, and 714%. It’s like watching a small stream turn into a raging river, time after time. 🌊

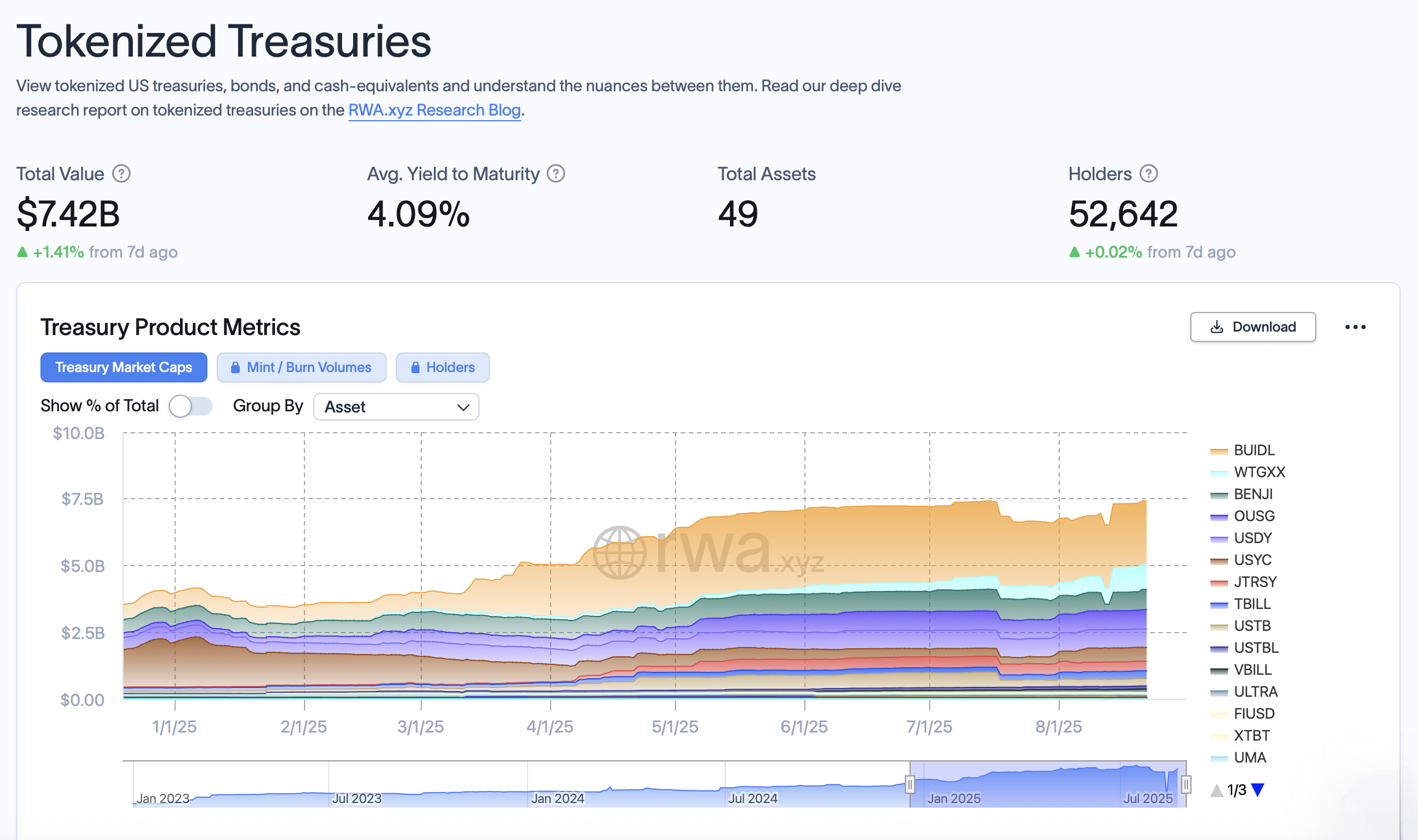

The latest figures from rwa.xyz show growth of 1.41% from a week ago, with tokenized bond products continuing to attract investors seeking onchain exposure to government-backed assets. Currently, the market spans 49 separate assets across multiple issuers and protocols, with an average yield to maturity of 4.09% and more than 52,600 unique holders.

According to our favorite analyst, Jireon (@jireon0x), $WIF has been riding a clear ascending trendline since early 2025, like a kid on a rollercoaster! 🎢 The latest bounce happened around the $0.80-$0.85 zone, which has become a robust demand zone-like a buffet line at a family reunion! With volume spikes during price rebounds and a neutral RSI reading around 49, there’s plenty of room for a bullish push ahead. Just don’t forget to hold onto your hats! 🎩