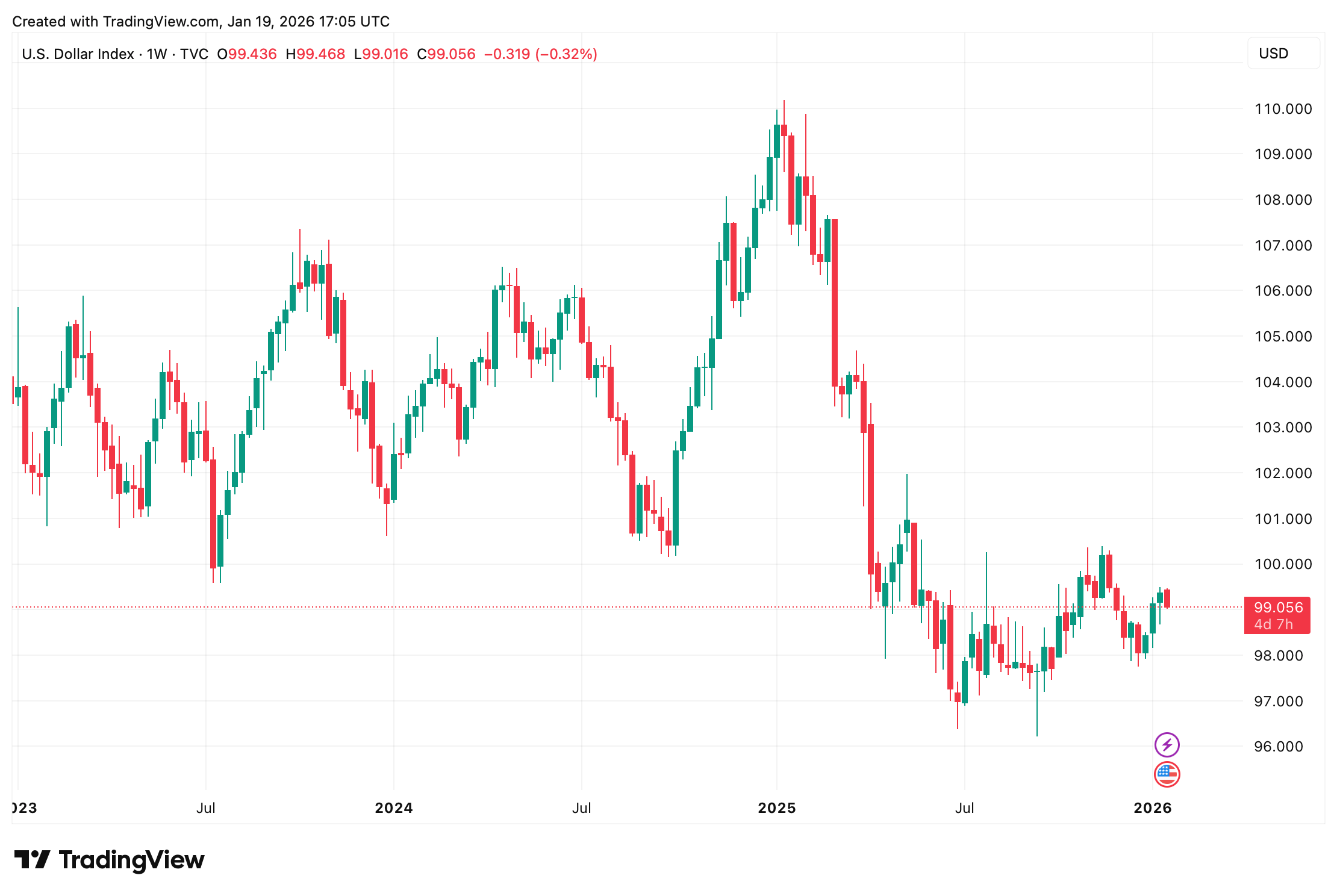

Dollar Dives and Markets Panic: The Great US Shakeup

Oh, and just to keep things interesting, the U.S. markets-those precious things we all pretend to understand-are closed today for Martin Luther King Jr. Day. But fear not! Those open markets are practically twitching with anxiety, like a jittery Chihuahua at a cat convention, just waiting for the real chaos to start when they reopen tomorrow.