Will XRP’s $3 Stance Turn It Into a Digital Leo Tolstoy? 🤔💰

Supporting Cast: $3, $2.7

Supporting Cast: $3, $2.7

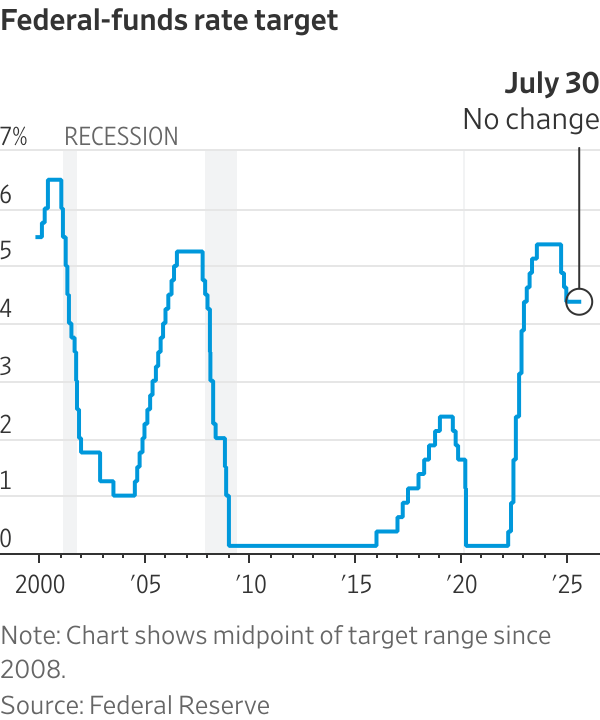

Indeed, it has long been observed (by those who like to watch the tragic comedy) that when the Fed lowers rates, it often prefaces a grand spectacle called recession-a curtain call in the drama of our economy.

Most of the big shots in the top ten on CoinMarketCap are bragging about their daily gains. Bitcoin’s struttin’ past $116,000, Ether’s sneaking past $3,800, and Solana-well, Solana’s doin’ a jig over 5%, like a puppy with a new chew toy in the past 24 hours.

Now, let us meander into the enchanting realm of NFT games, where pixels and profits collide in a dazzling display of digital ownership. Here, players can not only own but also buy, trade, and sell unique digital items-characters, outfits, weapons, cards, or even virtual real estate-each a precious NFT, shimmering with value both inside and outside the game. So, without further ado, let us embark on a whimsical journey through the top P2E NFT games that beckon you to play:

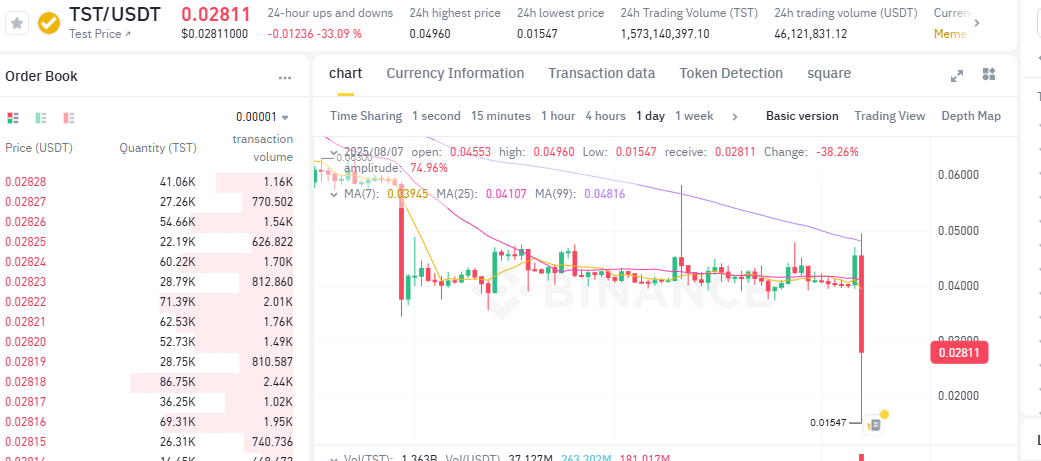

In the domain of cryptocurrency, it appears that even the mightiest may stumble, for TST’s market cap has been reduced from an ostentatious nearly $46 million to a paltry mere $21 million-truly a disgrace! Alas, the good folk at Coinglass have revealed that the open interest for TST did evaporate almost as quickly as a well-prepared soufflé, plummeting by a most alarming thirty-five percent across exchanges. Not to be outdone, Binance-the very bastion of TST trading-suffered an even graver fate with a drop surpassing forty percent, as swift as a flirtation at a country dance. 💃

The cunning plan? To summon a whopping $640 million-yes, with a ‘M’-to conjure a bitcoin treasury that would make even the most seasoned crypto-kings envious. This treasure chest is destined to grow, once the deal’s final curtain falls, according to a press release that’s almost as dramatic as the latest season of a soap opera.

Meanwhile, ETF outflows have surpassed the billion-dollar mark, stretching longer than a queue outside a trendy boutique in April. Traders are whispering of a correction-perhaps a plunge to spice things up. Yet, beneath the supposed calm, signals hint that Bitcoin might be tiptoeing toward a grander spectacle, if it can just stumble past that stubborn resistance hurdle. Think of it as an amateur magician’s act-nothing yet, but possibly something spectacular behind that velvet curtain.

While the big boys (Bitcoin and Ethereum, the serial overachievers) sit quietly on the sidelines, these mid-cap rebels are flexing their muscles, forming fancy patterns like ascending triangles, bullish flags, and trendline breakouts. Basically, they’re trying to make us believe they’re destined for greatness, or at least to escape this inertia. The question remains: are these altcoins about to break out into a victory dance or just fade away into the background noise? Stay tuned, popcorn in hand. 🍿

In a video that might have been titled *The SBR Chronicles: A Tragicomedy in Five Acts*, Mallers, that 30-year-old Don Quixote of crypto, laments the government’s silence with the gravity of a man witnessing the fall of Rome. “They have let us down,” he sighs, as though the Founding Fathers themselves had misplaced their ledgers. The Strategic Bitcoin Reserve, that noble-sounding endeavor, is reduced to a whispered secret, its numbers cloaked in the same mystery as the Ark of the Covenant. “Clearly, this information is sensitive,” Mallers muses, “or else they would disclose it. Or perhaps they fear the world might laugh. A reasonable hypothesis.” 💸

You see, KakaoBank aspires to reign supreme in the glittering realm of digital currency, according to the ever-reliable ZDNet Korea, which, like a prudent first mate, reports that a crack team-comprising top KakaoPay brass-are leading this grand crusade. Because nothing screams stability quite like a tech giant dabbling in crypto, right? 🤹♂️