Trump’s Bitcoin Gambit: Nasdaq Takeover!

This article is from Theminermag, a trade publication for the cryptocurrency mining industry, focusing on the latest news and research on institutional bitcoin mining companies. 🧠💸

This article is from Theminermag, a trade publication for the cryptocurrency mining industry, focusing on the latest news and research on institutional bitcoin mining companies. 🧠💸

Yes, dear reader, while Bitcoin strutted around like a proud peacock, SharpLink snuck behind the curtains—grabbing Ethereum like a bandit—signaling an ominous shift. The so-called “analysts” (ah, those wise fools) whisper that this could be a turning point. Ethereum, once a mere sidekick to Bitcoin’s throne, might soon be the real boss in the corporate treasury game. And why not? DeFi, real-world assets—it’s like Ethereum suddenly woke up looking handsome and useful. Investors eagerly watch this new drama unfold, popcorn in hand.

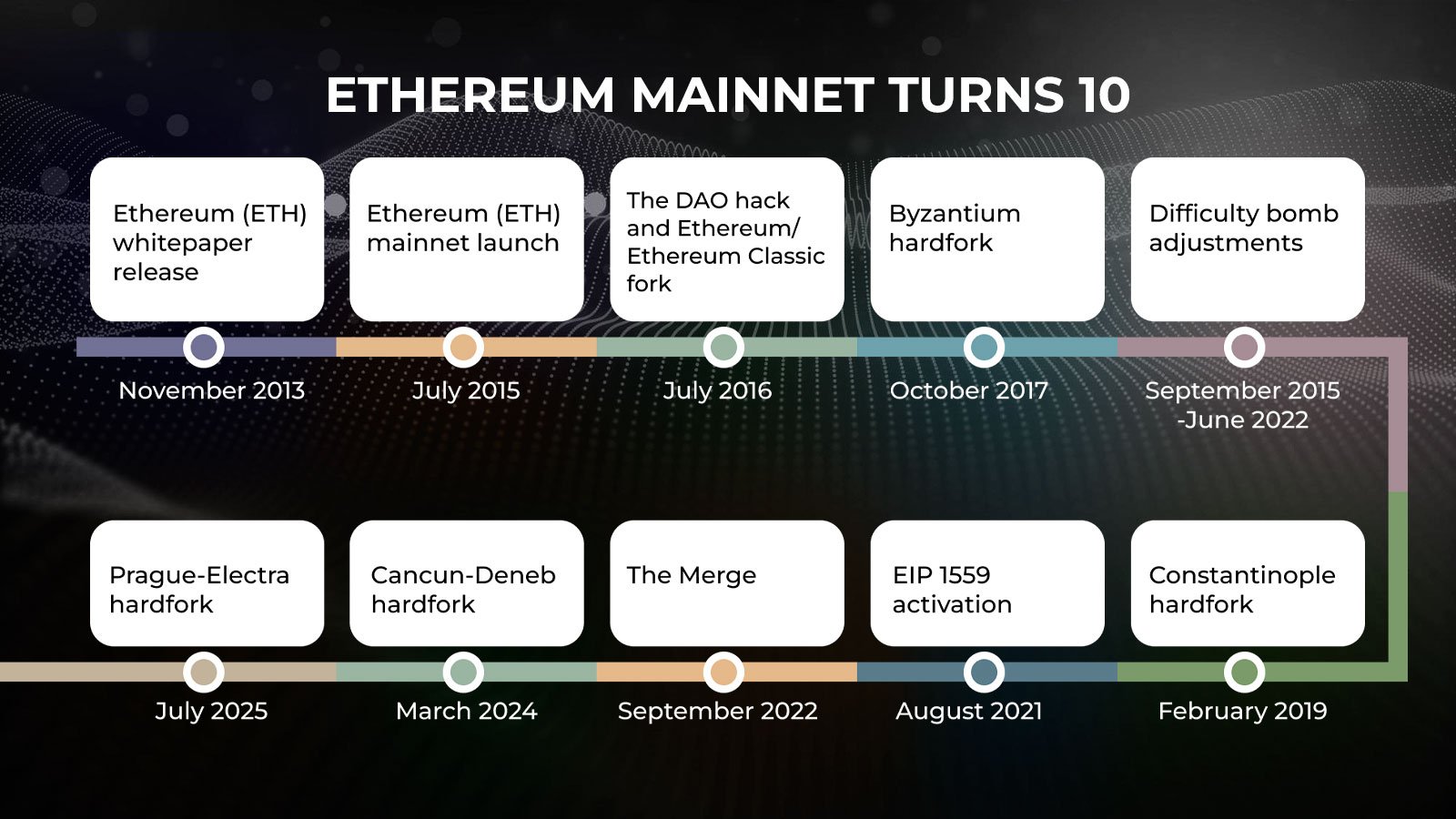

It didn’t just stop at snacks! ETH pioneered smart contracts — those magical digital IOUs that do stuff without a boss watching over your shoulder — and sparked a wildfire of layer-2 chains and Web3 craziness. Think of it as the digital Las Vegas with less gambling and more code, baby! 🎰💻

Acting Chairman Caroline D. Pham, a woman of decisive action and questionable life choices, announced on August 1st that the Commodity Futures Trading Commission (CFTC) would embark on a “crypto sprint,” a term that sounds suspiciously like a toddler’s tantrum but is, in fact, a plan to follow the President’s Working Group’s report. Speaking from the belly of Washington’s bureaucratic beast, Pham declared the CFTC’s intent to “coordinate” with other agencies to build a “structured foundation” for crypto innovation. Because nothing says “structured foundation” like a committee meeting. 🚨🏛️

Recently, Metaplanet announced the issuance of perpetual preferred shares totaling about 555 billion yen (roughly $3.7 billion), a sum so vast that even Wall Street might trip over its own financial shoelaces. The upcoming Extraordinary General Meeting will determine if shareholders are willing to sanction this audacious plan to swell their Bitcoin reserves—because what’s wealth without a little risk, yes? 🎲

In a universe seemingly governed by inexplicable logic, Conflux [CFX] has decided to spice things up by executing the v3.0.0 hardfork upgrade, which people are whispering about as if it’s the second coming of sliced bread. The deadline for such futuristic sorcery? A quaint little date of the 1st of September. So, mark your calendars, folks!

Robert Kiyosaki, whose words have enriched the minds and wallets of many through his best-selling tome, “Rich Dad Poor Dad,” now turns his gaze to the tumultuous landscape of American finance and the burgeoning realm of cryptocurrencies. This book, a beacon of financial wisdom, has traversed the globe, touching the lives of millions across countless tongues and cultures.

Treasury Secretary Bessent chimed in, proclaiming a “golden age of crypto.” A golden age! One wonders if he’s looked at the charts recently. Perhaps he’s confusing it with the age of alchemists trying to turn lead into gold. Similar success rate, really.

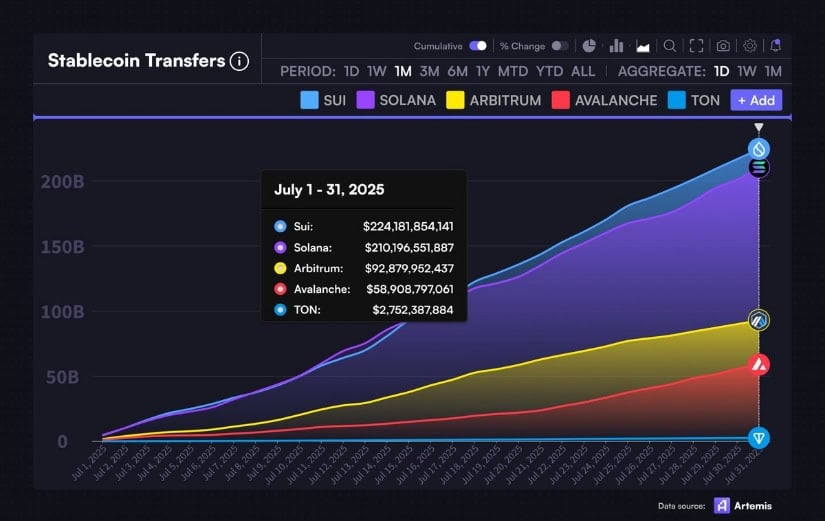

Not so long ago, Solana’s name, whispered in the chambers of market analysis, was proof enough of unassailable vigour. Now? A new upstart prances onto the stage, and Solana finds its fashionable shoes pinching at the sides. Is it the beginning of the end, or merely a pebble in the path of progress? The stablecoin skirmish signals only that the game is changing—though Solana, clutching its medals, might wonder aloud whether the youth of today simply transfer too much.

Arthur Hayes—the self-proclaimed oracle of BitMEX— predicts that Bitcoin, that rebellious phantom, might soon test the $100,000 barrier. All this, while the land of Uncle Sam chokes on its own contradictions—tariffs looming large and a July jobs report so bleak it makes the soul shiver.