Éthereum en déroute : Quand la bourse pleure et le marché pleurniche! 😂📉

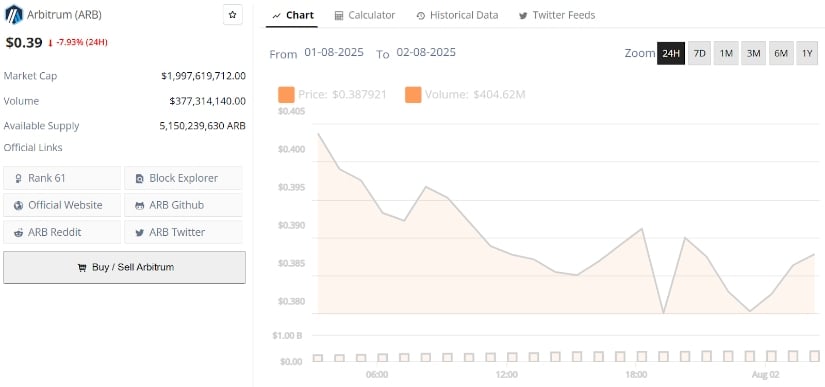

Notre cher Éthereum, qui jadis dansait en haut de la scène avec une hausse de 12%, a soudainement trébuché, comme un arrogant qui a oublié ses chaussons. La demande pour ces fameux ETF, ces fonds qui font tourner la tête des financiers, s’est évaporée plus vite qu’un bon mot de Molière lors d’une soirée mondaine. Selon SoSoValue, ces fonds ont vidé leurs poches de 152 millions de dollars vendredi dernier, clôturant ainsi une longue série d’entrées qui durait depuis le début de juillet. Enfin, tout comme un comédien fatigué, la popularité des ETH en ETF semble s’éteindre, passant de 1,85 milliard à seulement 154 millions cette semaine. Quelle déchéance théâtrale! 🎭